Robinson Way Debt Collectors – Do You Really Need to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Update 03/05/2023:

Robinson Way was acquired by Hoist Finance. Hoist Finance has now been acquired by Lowell Financial. Debts under the Hoist name will now be collected by Lowell, and you can check how this affects you here.

Update 12/09/2022:

Robinson Way has been acquired by Hoist Finance. In an article from Credit Connect it reports that: “The name Robinson Way, one of the oldest in the UK Collections industry, is to disappear eight years after the business was acquired by Hoist Finance. The company will become Hoist Finance UK.”

Are you worried about a letter from Robinson Way Debt Collectors? You may have lots of questions. Where did this debt come from? Should you pay it? Is this company real? We understand your worries, and we’re here to help.

Around 170,000 people come to our website each month for advice on debt issues, so you’re not the only one facing this.

In this article, we will share:

- What Robinson Way Debt Collectors do and if they are a real company.

- How to find out if you really owe the money.

- What might happen if you ignore them.

- Your options for dealing with your debt.

- If you can pay less or even nothing.

Many of us have had letters like yours, so we know how you feel. We’ve learned a lot about debt collectors, and we will share our knowledge with you. Let’s find out more about Robinson Way Debt Collectors and how you can deal with them.

Why Did Robinson Way Limited Send Me a Debt Letter?

If Robinson Way Debt Collectors has sent you a letter, the chances are that they are requesting payment for a debt in your name or threatening legal action.

But how on Earth can you owe a company money you have never heard of? Well, if Robinson Way bought the debt you owe to a bank or loan company, then you now owe the money to them.

Don’t get caught out and think it is a scam. You might really owe Robinson Way the money!

Check if you really owe the money

Has Robinson Way Limited made a Mistake?

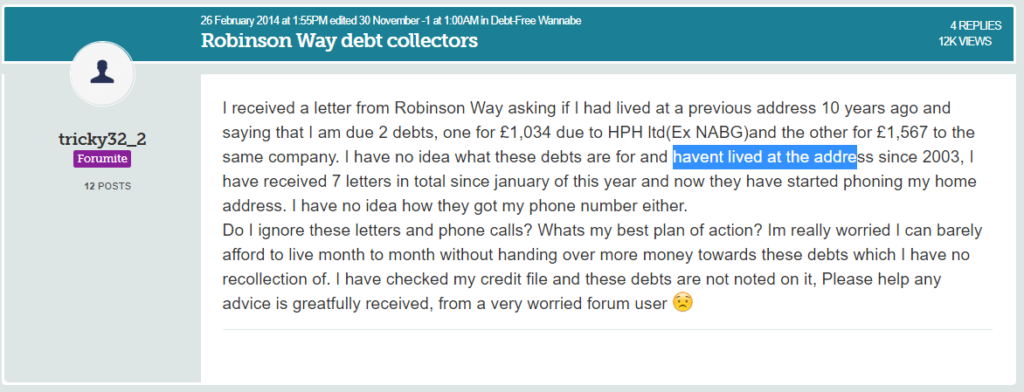

There is still a chance that they could have made a mistake and that you don’t owe Robinson Way.

Sometimes, the debt collection agency will send letters to addresses rather than people because that is the last known address of the real debtor. And thus, you received the letter instead of the person who really owes the money.

But you can fight back against these mistakes with a letter to prove you owe the debt, because Robinson Way might have the wrong contact details, and might be mistaking you for someone who lived there previously.

In fact, you should be asking for proof of the debt even if you know you owe the outstanding debt.

This is because debt cannot be enforced without proof you owe the money. And even if they do eventually prove the debt, you can win some thinking time to plan how you’re going to pay off your total debt.

You have lots of options here, and I’ll outline them below.

You can ask for proof easily by using our prove-it debt letter. Fill in your details but never sign this letter as your signature could be used to counterfeit evidence you owe the debt.

And keep a record of this letter just in case they ignore you and take legal action. You can show a judge that you requested proof, and they ignored you, which could get you off the hook.

After you print and mail the letter, Robinson Way may respond by saying, “we have tracked the debt to you”, and offer you a deadline to respond.

You can ignore this because they still need to show proof of the debt, which should be the original credit agreement signed by you.

This is why you should not sign the letter, as it will give them a copy of your signature, which they can use to recreate the original document.

» TAKE ACTION NOW: Fill out the short debt form

How Can I Pay Robinson Way Limited?

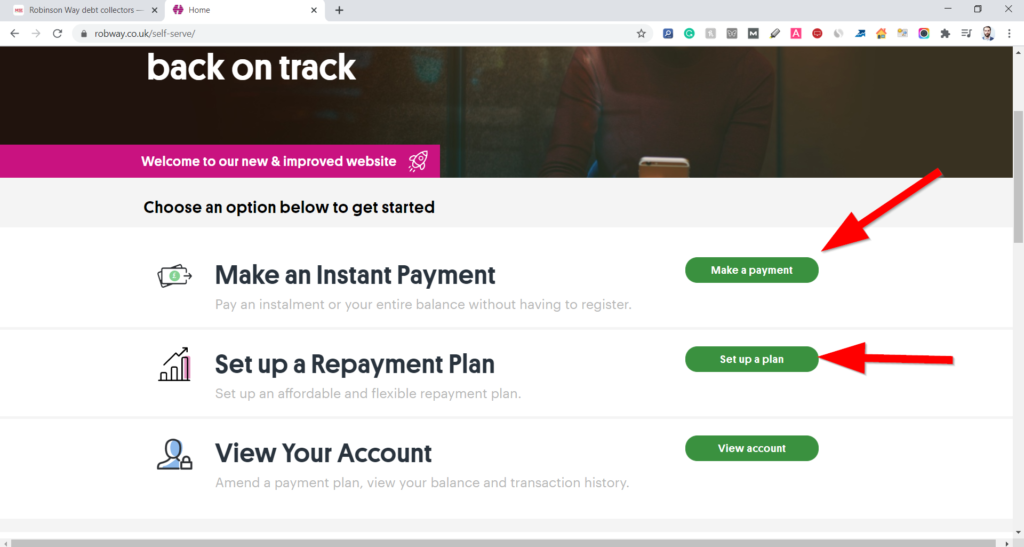

Not surprisingly, they’ve made making a payment from your account very easy. You can pay in a number of ways. The best thing to do is to visit their website. They give you two options here:

- Make an instant payment – this will be using a debit or credit card

- Set up an account repayment plan – this is a recurring payment from your bank account, for example, weekly or monthly, which will have you paying down the debt over time

There is also an option to log in to your account and see the status and balance of your debt.

You will need your reference number/file number to do this, which is usually found on any letters they send you.

Why Is Hoist Finance UK Taking Robinson Way Payments?

If you have been making regular payments from your bank account, you might be surprised to see that your bank statements show the payment is now going to a company called Hoist Finance (or Lowell) – a debt restructuring partner – instead of Robinson Way.

Don’t be alarmed, this is now the same company. The terms of your repayments with Robinson Way will remain the same when paying Hoist instead.

What Other Ways Can I Pay My Robinson Way Debts?

It might feel convenient to agree on a repayment schedule directly with Robinson Way. But there are many ways to get out of debt, such as:

- Debt Management Plan

- Debt Relief Order

- Individual Voluntary Agreement

- Trust Deed

- Settlement Offer

- Bankruptcy

The right option to choose will depend on your personal circumstances and if you have other debts.

Some of the solutions above are provided through an insolvency practitioner and debt management businesses for collection fees.

However, the solutions can save you thousands of pounds, and even paying the fees will make paying off your debt cheaper.

For example, an IVA is for people who have more than one debt and owe a significant amount of money that they cannot get on top of.

It consolidates all your debt repayments into one payment for six years. After six years is up, all unpaid debts are wiped.

People who choose this option can wipe thousands of pounds off their debt and never have to pay it back.

For a full breakdown of the best ways to escape your debt, take a look at our easy-to-read debt solutions page!

This page links to all the popular debt solutions with complete explanations and no confusing jargon.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Am I Able to Write Off My Robinson Way Debt?

An IVA is one of the best ways to write off a lot of your debt. There are some other options.

A Debt Relief Order is for people on a low income, and it stops all debt collection agencies from contacting them for a full year.

If their finances do not improve during this time, they can wipe out all the debt.

You might be able to wipe off 10-20% of the debt by making a settlement offer to pay off what you can.

But the golden nugget of writing off debt is using the statute barred law. Essentially, it is a law that says some debts are too old to be collected.

You don’t technically write off the debt, but Robinson Way will not be allowed to take you to court, thus, not able to recover the money.

Robinson Way will never voluntarily wipe the debt as they can make a big profit by getting you to pay.

How to Negotiate With Robinson Way Debt Collectors

- Verify the debt: Ensure the debt is accurate and legitimate by requesting written proof of the debt, including details of the original creditor and the amount owed.

- Set a budget: Assess your financial situation and determine what you can realistically afford to pay each month toward the debt.

- Communicate: Contact the debt collector promptly to discuss your situation. Be polite and honest about your financial difficulties. Use MoneyNerd’s free sample letters to help you communicate more effectively with debt collectors.

- Offer a payment plan: Propose a repayment plan based on your budget. It should be reasonable and affordable. Debt collectors may be willing to accept smaller, regular payments.

- Negotiate interest and fees: Request a reduction or waiver of interest and additional fees, if possible. Some debt collectors may be willing to negotiate on these terms.

When Can I Complain About Robinson Way?

You might be wondering when you can contact their complaints department.

Here are the four things that Robinson Way could do that might win you compensation!

1. Aggression

Aggressive behaviours are rife within debt collection companies. Their workers will talk at you without empathy and try to force you to make a payment.

The reason for this is that the call centre staff in many debt collection businesses are given monetary incentives.

The staff could earn bonuses if they get so many debtors to agree to a repayment plan each month, and they may even receive a commission if they secure a full debt payment. With money on the line, they can easily become more forceful.

2. Harassment

Harassment is another common complaint among people being chased for debts in the UK. One of the most problematic behaviours is frequent calling.

Some people receive a call from a debt collector every hour, which causes all sorts of mental health problems like anxiety.

Modern collection tactics incorporate automated calling into their efforts. This is when a computer will make a call to your phone at set times to keep the pressure and get you to give in.

Unending calls can significantly elevate your stress levels, leading to anxiety, depression, and other mental health issues.

But all of this is a criminal offence and should be punished!

As a debtor, you have the right to:

- Specify how and when debt collectors can contact you, and you request for the communication to stop under certain conditions

- Treated fairly and not misled or pressured into making payments

- Dispute a debt and seek verification

- report Unlawful practices such as debt collectors falsely representing themselves or threatening with legal action which they don’t intend to take

- Right to privacy

3. Privacy Breaches

If you have a debt, you are the only person that the debt collection company can speak to about it. Some companies may call house phones or work numbers to speak to you.

However, if they divulge that they are calling about debt to someone else who picks up, they have broken serious privacy laws.

These instances should be reported to the Ombudsman immediately. Robinson Way could be hit with a heavy fine, and you could be due compensation!

4. Lies and Empty Threats

Another big issue to watch out for is lying and making empty threats. Robinson Way Debt Collectors cannot lie to you and say they have the right to do things they do not.

The best example is saying they can come to your home and take your car or personal items.

Only a registered bailiff can do this, and they cannot be used until after court action has taken place (you will be notified if they are taking you to court).

When a bailiff comes to your door, it can be an extremely intimidating experience. They will almost certainly add collection fees for each visit they make to your home.

Remember, debt collectors will report your unpaid debt to credit bureaus, which results in a negative mark on your credit report.

Additionally, even if you settle the debt, the collection account can remain on your report for several years, further affecting your creditworthiness.

5. How can I complain about Robinson Way?

You can complain about Robinson Way through their parent company, Hoist Finance (or Lowell), through their complaints process.

If, after this process, you’re still dissatisfied, the Credit Services Association will deal with complaints in relation to the CSA code of practice for debt collection agencies.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.