Sheriff Court Decree in Scotland – What You Need To Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you anxious about a Sheriff Court Decree in Scotland? Do you feel stressed about a bailiff knocking on your door or your possessions being taken away? Well, don’t worry. You’re in the right place to get clear and simple answers.

Each month, over 170,000 people like you come to our website for advice on debt issues. We understand your worries, and we’re here to help.

In this easy-to-understand article, we will:

- Explain what a Sheriff Court Decree is and why you might have been sent one.

- Talk about what happens if you do not act on a decree.

- Discuss the ‘Time to Pay Order’.

- Share what items a bailiff can’t take from you.

- Give advice on how to stop a decree from being issued.

Our team knows how tough it can be to deal with bailiffs and debt issues. We’ve been in your shoes, so we’re here to offer expert advice and help you figure out your next steps in this tough time. Let’s start learning about Sheriff Court Decrees and make your worries a thing of the past.

Why have I been sent a decree?

A creditor may apply for a decree against you if they think you haven’t and won’t repay money you owe them.

If the courts agree with the creditor, they’ll issue the decree and tell you to pay the money back. No further action will be taken against you as long as you stick to the terms and pay on time. If you are unable to keep to the amount you have agreed to pay, you can apply to have the amount varied.

Here’s some of the action you could take:

- Pay back the full amount straight away

- Ask to pay later or in instalments

- Dispute the claim or amount owed (if you think the creditor’s claim is incorrect)

- Claim against the creditor (if you think the creditor owes you money, e.g. for breaching a contract).

What happens if I ignore a decree?

If you ignore a Sheriff’s Court decree or don’t meet its terms, the court may take more serious action. This type of enforcement is called ‘diligence.’

Per the simple procedure, creditors have to wait at least 4 weeks after the decree is granted to enforce it against you. However, if the Sheriff’s Office has granted an open decree, enforcement can start immediately.

Your creditor can also apply for diligence if you have missed any payments or have not stuck to the terms of the decree.

Diligence can mean different things. Usually, it will involve one of the following:

- Taking money from your earnings

- Freezing money in your bank account

- A ban on the sale of your property, namely your house

- An attachment of property outside your home

- An attachment of property inside your home.

If you are worried about any of these possible enforcement measures, I recommend contacting a debt charity. I have linked several charities that offer free advisory services at the bottom of this page.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What is a Time to Pay Order?

Once diligence against you has begun, you can request that the court grants you a Time to Pay Order. These orders give you the chance to pay off your debts yourself.

If your Time to Pay Order is accepted, all diligence against you is frozen and any future enforcement is blocked.

That said, you can’t use a Time to Pay Order if:

- Your debt is more than £25,000

- Your debt is an award in connection with your divorce proceedings

- Your debt is for maintenance

- Your debt is for income tax, car tax, or VAT.

You will need to explain to the Sheriff on your application form why you can’t pay off the debt in one go but that you could manage instalments.

Providing that your creditor doesn’t disagree with your payment offers, the Time to Pay Order will be granted after 2 weeks. This will freeze any diligence that is in action or pending against you.

If your creditor doesn’t agree with your offers to pay the debt, you will be invited to a hearing. At this hearing, either your advisor or you will speak to the Sheriff and explain your circumstances. The Sheriff will then work out a repayment plan for you to stick to. Generally, these plans last for 2 years.

» TAKE ACTION NOW: Fill out the short debt form

What can’t they take?

There are strict rules on what a Sheriff’s Officer can’t remove from your property. These items include:

- Anything that belongs to someone else – this includes things that belong to your children

- Pets or service animals

- Vehicles, tools, or equipment that you need for your job or to study up to £1,350

- A mobility vehicle or any vehicle with a valid Blue Badgewh

- Anything permanently fitted to your home – kitchen units, etc.

A Sheriff’s Officer also can’t take things that you need to live. These items can be anything that you use for your ‘basic domestic needs.’ They can take some of these things, but must leave you with:

- A table with enough chairs for everyone in your home

- Beds and bedding for everyone in your home

- A phone or mobile phone

- Any medicine or medical equipment that you need to care for someone

- A washing machine

- A cooker or microwave, and a fridge.

If you think that they have taken something that they shouldn’t, you need to complain immediately. I go through the complaints process below.

You can also contact a debt charity for some advice. I have listed several charities that offer free advice at the bottom of this page.

What can I do to prevent a decree from being issued?

If you’ve got unpaid debt and you’re receiving threats of legal action from creditors, you should try to take action to prevent a decree (or CCJ) from being issued against you.

These steps could include:

- Pay what you owe

- Consider a debt solution

- Check if it’s a Statute barred

- Look into writing off your debt

The obvious solution is to pay the money you owe, but this isn’t always easy if you’re experiencing any financial difficulty.

Debt Solutions

There are several different debt solutions available in the UK, so I recommend speaking to a debt charity as soon as possible. Their advisors will be able to look at your finances in detail and help you work out which debt solution will work best for you.

I have linked a few charities that offer these advisory services for free below.

Trust Deed

A Trust Deed is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you or pursue legal action against you for the duration of this agreement.

Trust Deeds will typically last several years and any outstanding debts are wiped off at the end.

Keep in mind that Trust Deeds are not suitable for everyone. You need to owe several thousand pounds to more than one creditor just to be eligible. You also need to demonstrate to your trustee that you have disposable income to pay for it.

Sequestration

Sequestration is the Scottish term for bankruptcy.

While it has a negative image, it might be your only way of getting a fresh financial start and is most suited to those who have no realistic possibility of ever paying off their debts.

That said, it is a serious financial situation that should not be taken lightly.

Minimal Asset Process

A Minimal Asset Process (MAP) is a quicker, cheaper, and more straightforward version of sequestration.

It is intended for those who have little income and few valuable assets, with debts that would otherwise be impossible to pay.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Statute Barred Debt

If it has been 5 years since you last paid anything towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 window will be enforceable for the duration of the CCJ.

If your debt is statute-barred, you can use my free letter template to write to the debt collectors or Sheriff’s Office and explain the situation.

If you are unsure about the status of your debt, you can contact a debt charity for some advice. Their advisors will be able to look at the debt in question, determine its status, and advise you on your next steps.

How long does a decree stay on my record?

A decree stays on your financial records for six years, after this all details are removed from your file even if the debt is still unpaid.

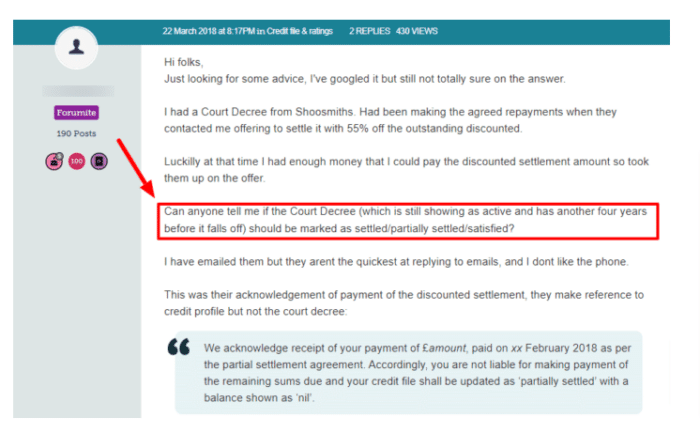

Here, this Money Saving Expert forum user has settled their outstanding debt offered with a discount. A letter from the court shows it as ‘partially settled’. Decrees don’t expire and will show on your credit file for six years from the judgement date.

Details of the following stay on your credit file for six years from the date they were recorded:

- Debts you’ve paid off or ‘settled’ in full

- Defaults on accounts

- ‘Partial settlements’ where a creditor has agreed to accept a reduced amount and write off the remainder of a debt

- Any debt solution that you start.

Are sheriff court decisions binding?

Decisions made by the Sheriff Appeal Court in civil appeals are binding on all sheriffs throughout Scotland, and decisions are also binding on the Sheriff Appeal Court itself.

The decree will stay on your record for six years and may affect your credit rating. It’s best to try to take earlier steps to try to prevent being issued with a decree. Being in debt is scary, but you can seek advice and take steps to solve or write off your debt in a way that you find affordable.

If you are dealing with a debt collection company or just struggling to manage your money, I recommend speaking to a debt charity.

There are several charities and organisations in the UK that offer free debt counselling services and free financial advice. Thei/r advisors will be able to walk you through your options and find the best solution for you.