Walker Love Debt Collectors – Do You Have to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a letter from Walker Love Debt Collectors? Are you confused about where this debt has come from? Or are you concerned because you can’t afford to pay?

Don’t worry; you’re in the right place. Each month, over 170,000 people visit our website looking for guidance on debt issues, just like this one.

In this article, we’ll explain:

- How to check if the debt is really yours. If it isn’t, you don’t have to pay!

- What Walker Love Debt Collectors can and can’t do.

- How to stop Walker Love from bothering you so much.

- Ways to set up a payment plan or even write off your debt.

- What happens if you can’t pay.

We understand your worries; some of us have had debt collectors chasing us too. It can be very scary, but we’ve found ways to deal with it. In this guide, we’ll share these with you.

Why are they Calling Me?

If you have received a phone call or letter from Walker Love, you likely have outstanding debt.

But there’s no reason to panic, as this procedure is quite normal for debt collection.

For example, if you are behind with your Business Rates payments, the local authority will apply for a summary warrant from the Sheriff’s Court.

It is, in effect, a court order detailing your outstanding debt and legally forces you to settle the debt.

Receiving these court orders can be stressful for consumers but it’s important to never simply ignore it.

However, if you’ve been served with a summary warrant, or a phone call, from the firm of Walker Love, there are specific steps that you may consider to prevent additional legal action.

Verifying their Request

Before doing anything, I suggest you find out more about the source of the debt.

Confirming legitimacy of Walker Love’s debt collection request should put your mind at ease.

Ask the creditor for details on the debt Walker Love is chasing you for. When the information matches, you know things are legitimate.

In short, always ask for proof and confirmation that the debt is yours and that the debt collection agency is not a scam but legitimate.

Is the Debt Too Old?

First, start by establishing what specifically the debt is for, and if you are in debt with the creditor.

Sometimes, the debt might have expired and this is referred to as ‘statute barred’.

It means that under the Limitations Act the debt can no longer be collected. However, the debt may be visible on your credit profile for up to six years after the default date.

There’s a specified period in which creditors can collect outstanding debts and in Scotland, for example, it’s a five years limit from either:

- the date on which a previous payment (if any) was made

- the date you’ve last has written contact

- the date an order was issued for payment

In Wales and England, this limit is six years and is governed by the Limitations Act.

If the debt is in more than one person’s name, the criteria for statute barred applies to all parties.

» TAKE ACTION NOW: Fill out the short debt form

What criteria makes a debt statute barred?

It is important to note that for the above to apply, there are specific requirements for the five- or six-year period.

The statute of limitations on debt collection are:

- The debtor has not acknowledged the debt

- No decrees exit for the outstanding amount

- The creditor hasn’t yet contacted the debtor

If the debt is considered too old, Walker Love won’t be able to pursue this further.

Council Tax Collection

If you are behind with Council Tax bills, the council may send you a reminder to settle your overdue bill.

When you get a reminder, you will be given seven days to pay or make an arrangement to pay off the debt in instalments.

If you fail to do this, you’ll receive another reminder with 14 days to settle.

However, in this case you will need to settle the amount in full and won’t have the option of paying in instalments.

If, after two reminders, you still haven’t settled your Council Tax bill, the council may apply for a summary warrant, or court order from the Sheriff’s Court to force you to settle the debt.

If this warrant is then granted against you, the local council will submit your details to debt collectors like Walker Love.

Walker Love’s role in Council Tax recovery take over from this point. They can then, in turn, serve you the summary warrant for payment.

It’s important to note that besides the Council Tax that you need to pay, you will be liable for an additional 10% penalty as a charge for your summary warrant.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Business Rates Collection

As with your unpaid Council Tax, your local authority can also apply for a summary warrant from the Sheriff’s Court for unpaid Business Rates.

Walker Love and Business Rates collection take over at this stage of the recovery process.

Walker Love will have the same rights against you as they do when collecting unpaid Council Tax. Plus, you will be given the same options to apply for a debt repayment arrangement.

If you owe more than £3,000 and Walker Love is unable to get payment from you, they may apply to declare you bankrupt.

Payment Arrangements

If you want to avoid further legal action, you may apply to obtain a specific time to pay action.

Negotiating debt repayment with Walker Love is advised and should be done as soon as possible.

It will offer you the opportunity to make an arrangement to repay your debt in monthly or weekly instalments.

If granted, no further action by Walker Love can be taken.

It also means they cannot execute an attachment for the property outside of your home, nor arrest your bank account or wages.

However, when there is a direction granted, debt collectors like Walker Love could still request an inhibition which stops you from selling your home.

What Happens If I Am Unable To Pay?

The consequences of non-payment to Walker Love can be far-reaching and best avoided.

If you cannot pay your debt, Walker Love can use enforcement action and the creditor may give them permission to collect the outstanding money with:

- Earnings arrestment

- Bank arrestment

- Application for an EAO

- Sequestration/bankruptcy

- Attachment of property outside your home

- Inhibition

Earning Deductions

This refers to when your employer will be instructed to deduct money from your salary to meet the repayment obligations for your debt.

An earnings arrestment will be in place until the debt is repaid.

Walker Love may keep on deducting money from your earnings after tax, until you have paid your debt in full.

You will additionally be responsible for charges for fees, which will form part of these deductions.

Bank Arrestments

Where bank arrestments are issued, debt collectors like Walker Love will apply for the freezing of funds in your account. It remains until you give them permission to take the total sum for your outstanding debt.

If you do give permission, any standing orders or direct debits will stop, and the funds will be released 14 weeks later.

However, this means that you may fall behind on other debts during the time that the funds in your account are unavailable.

Only your available funds on the date that the bank arrestment was applied will be frozen.

However, you might not get a notification of the bank arrestment. It could leave you with no cash available to service your other bills or debt.

Walker Love or your local council must send you a debt advice information pack 12 weeks before serving you with an earnings arrestment.

You need to study this information pack carefully as it will tell you how to avoid having money taken from your earnings.

One example is to apply for a time for pay order, and if it’s granted, it will prevent the earnings arrestment.

What are Attachment Orders?

An exceptional order for attachment (EAO) refers to the ability of the Sheriff Officers from Walker Love to seize property that is in your home.

The creditor to whom you owe the debt will apply for a court order, forcing you to pay your outstanding debt.

This normally happens when the creditor has sent you a reminder to pay, and you’ve failed to do so – or make a payment arrangement – within 14 days.

An EAO will only be granted for the goods inside your home when the creditor can prove that they’ve taken all reasonable steps to find out about your position to pay.

The creditor must take reasonable steps such as using a bank arrestment or using an earnings arrestment.

Sequestration / Bankruptcy

If you are unable to pay your debts where you owe more than £3,000 to a creditor, the creditor may seek to sequestrate (bankrupt) you.

Sequestration will stop any debt collector like Walker Love from taking further action against you.

However, bankruptcy could have dire consequences for your personal credit history and may influence your employment and risk losing your assets.

When you are declared bankrupt, a trustee will control your finances.

They will control all your belongings and assets, to pay as much as possible to your creditors.

Attachment of My Property Not In My Home

When the court orders a specific attachment for property not in your home, it means that the Sheriff Officer may seize property that belongs to you.

Your property could be auctioned off to cover your debt. It gives Sheriff Officers the ability to enter garages, business premises or outside buildings, even when locked.

However, they cannot get access to your house under these orders.

Before this order is served, you need to be shown the warrant by the Sheriff and you must be given the chance to settle your outstanding debt before they can take your property.

What’s an Inhibition?

With inhibition, a court order is issued that prevents you to sell your house, business premises, or property.

It means you cannot go ahead and sell any major asset without first paying your outstanding debt.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Consequences of Ignoring Them

It’s not a good idea to ignore Walker Love. The problem won’t go away.

The impact of not responding to Walker Love will make settling a debt much harder. Plus, the experience will get more stressful.

For instance, you could face court action. You could get a County Court Judgement (CCJ) which harms your credit score.

Plus, the debt may get harder to settle if there are additional court fees and charges to pay.

How Can I Lodge a Report or Complaint?

Filing a complaint against Walker Love is possible, and they can be contacted directly:

| Address: | Walker Love, c/o Complaints Manager, 16 Royal Exchange, Glasgow, G1 3AB |

| Website: | walkerlove.com |

| Telephone: | 0141 212 6120 08:30 – 17:00 Monday to Friday |

| SMS: | 07984 435859 08:30 – 16:30 Monday to Friday |

| Email: | [email protected] |

Should you not be happy with the complaint’s outcome, you can choose to also contact the CSA, FCA or SMASO (The Society of Messengers-at-Arms and Sheriff Officers)

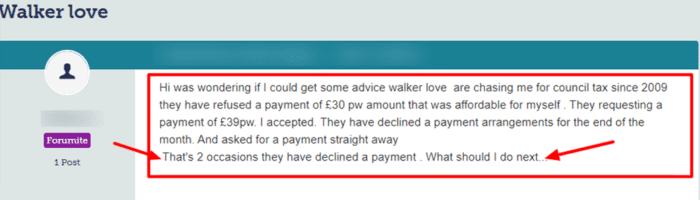

Case study

See this message posted by a concerned Walker Love customer about payment refusals.

Source: Moneysavingexpert

How They Handle Vulnerable Debtors

According to Walker Love, all individuals should be treated as ‘individuals’. In short, ‘one size does not fit all’.

Walker Love’s approach to vulnerable debtors is to abide by the FCA rules which state that a vulnerable person is:

- A person who is more susceptible to detriment from a firm that does not act with appropriate care

- That a company follows the advice found in a paper published in association with the Money Advice Trust which stipulates that all vulnerable clients must be treated fairly

- That risk factors should be identified and solutions found to mitigate further risks arising

Other Debt Collectors

You should check for more outstanding debts that you may have with other companies or debt collectors. Here are four steps you could take:

- Check your credit report for other defaults

- Check your email and post for reminders or overdue notices

- Check the court records for CCJs against you

- Check your bank statements for the names of other debt collectors

There are hundreds of debt collectors in the UK and each works with different companies to collect debts.

For example, Cabot Financial have been known to collect for the DVLA while Lowell Financial and PRA Group buy debts from various credit card companies like Barclaycard.

If you see a name on your bank statement that you don’t recognise then you can search MoneyNerd to see if they’re a debt collector.