Handling Debt Collector Harassment: Know Your Rights

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Receiving a surprise letter from a debt collector can be worrying. After all, nearly half of individuals who deal with debt collection agencies have experienced harassment or aggression1.

Don’t worry; you’re not alone. Every month, more than 170,000 people come to our website for information about their debt problems. We understand your fears and are here to help.

In this guide, we will share:

- What is classed as harassment from debt collectors.

- How to stop nuisance calls when wrongly blamed for owing money.

- How to get help with debt.

- What to do if debt collectors come to your home.

- How to legally write off debt.

Some of our team members have also faced debt collectors, so we know how you might be feeling. We want to share useful information with you so you can figure out your next steps and your options.

Read on to learn more about how to handle debt collector harassment.

What Is Debt Collector Harassment?

Understanding your rights against debt collection is important so you know how to deal with a situation when it presents itself.

But identifying debt collector harassment could be challenging when you’re stressed out.

Debt collector harassment is when you are being harassed to pay off debts, usually by multiple communications and too many calls within a short period.

This may be done by your creditors directly (the people you owe the money to such as a utility bill company or loan company).

But it is more likely to happen through a debt collection agency that works on behalf of your creditors to chase up the debt.

Your Rights With Debt Collectors

We’ve created this quick table to help you better understand your rights when dealing with debt collectors and prevent harassment. If you’d like to learn more, make sure to check out our detailed guide.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

Is Collection Harassment Illegal?

Just like any other form of harassment, debt collector harassment is unlawful.

Recognizing abusive debt collection practices allows you to deal with situations positively.

Nobody deserves to be harassed, no matter how many debts they have or how much they owe. If a debt collector or a creditor is harassing you, they are committing an offence.

Some debt collection groups know they are breaking the law but do it anyway because they think that the debtor is more likely to pay up than submit official complaints.

» TAKE ACTION NOW: Fill out the short debt form

Online harassment by debt collectors

Some debt collection agencies use the internet to harass people. They send excessive emails and text messages both of which would be deemed harassment.

Digital debt collection harassment is more commonplace than you may image.

Moreover, there have been reports of debt collectors using social media to contact people over alleged debts.

If this happens to you, report the debt collector immediately.

Protections Under UK Law

Debt recovery companies are highly regulated which means, they must follow the legal boundaries for debt collectors in UK.

A debt collector can lawfully contact you over an unpaid debt. But there are limits to what they can do. In short, their legal powers are the same as those of an original creditor.

The things a debt recovery company CANNOT do are listed below:

- Pretend they have the power to seize possessions when they do not

- Produce papers that appear to be issued by a court when they are not

- Use confusing legal jargon to put you on a back foot

- Force their way into your home

- Coerce you into taking out a loan to pay what you owe

- Discuss your debt troubles with other people

- Threaten or harass you

- Refuse to leave when you ask them to

Debt collectors that behave in this manner can be reported for breaching the law. You have the right to complain to a debt collector’s head office.

If they don’t reply in a timely fashion or their response is unsatisfactory, we suggest you make a complaint and eventually take the matter to the Financial Ombudsman Service.

What Is Classed as Debt Collector Harassment?

Lots of things can constitute debt collector harassment, such as:

- Phone calls before 8am

- Phone calls after 9pm

- Phone calls at times when you asked them not to call

- Repeated phone calls or text messages throughout the day/week

- Nuisance calls where debt collectors don’t speak when you answer

- Home visits (especially when making false repossession claims)

- Coming to your place of work to collect a debt which contravenes debt privacy rights

- Unlawful debt collection activities

This is not a complete list of what can be classed as debt collector harassment.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What can you do to stop nuisance calls when falsely accused of owing money?

If repeated and nuisance calls are your main concern, you should be able to stop debt collectors from calling too often by providing them with your communication preferences.

You are allowed to inform them of the ways you want to be contacted and at the times of the day you are willing to speak with them.

If after you have provided them with this information, they continue to disregard your preferences, it can be used as further evidence of debt collector harassment.

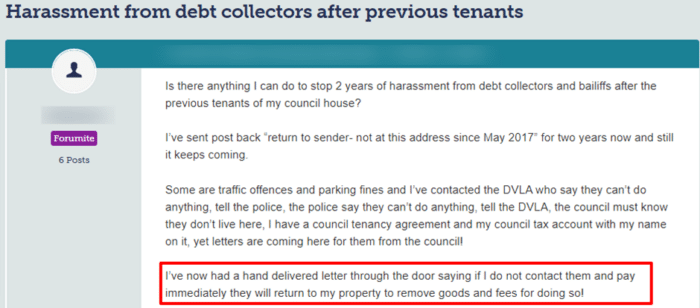

See this message posted on a popular forum about debt collector harassment.

Source: Moneysavingexpert

What Can I Do if Debt Collectors Come to My Home?

Our financial expert, Janine, says: ‘I understand that having a debt collector at your door can be scary, especially when you are already under huge financial stress. It’s crucial that you stay calm and know your rights. They have no power to enter your home or take any of your possessions.’

There is only one type of debt recovery worker who is allowed to request entry to your property or threaten the repossession of your items.

This worker is a law enforcement officer (bailiff) and they only do this once the debt has been judged in court and made payable.

No debt collection agency or creditor has the right to enter your home. Plus, they are not allowed to say or give the impression that they can take your items. It is illegal.

If you keep getting home visits from field workers who are not law enforcement officers, you can simply ask them to leave and ignore them.

You might want to record them as evidence of debt collector harassment. Your approach to dealing with debt collectors at home must be positive.

The Impact of Debt and Harassment on Mental Health

Being in debt is bad enough on your mental well-being. But being harassed by a debt collector compounds things.

Mental health impact of debt collector harassment can be extreme and seeking help and support is a must.

You could start experiencing sleepless nights which in turn, affects your ability to work. Moreover, you could suffer from:

- Bouts of anxiety and stress

- Mood swings and feeling low

The disastrous effects of being harassed when in debt could even lead to suicidal thoughts.

If you’re feeling low and feel you’re being harassed, we suggest you seek help as soon as you can.

Debt counselling could be invaluable at a time you need it most. Plus, a counsellor could help you report the harassment to the right bodies.

Can They Tell My Family?

Debt collection agencies are not allowed to disclose your debts to other people.

That means they cannot call a household phone and tell another person that you have a debt. They also cannot tell your employer that you are in debt.

These are serious industry breaches and warrant complaints to the FCA and Ombudsman.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can My Debt be Wiped Because of Debt Collector Harassment?

Unfortunately, debt cancellation due to collector harassment will not happen.

If the debt collection agency is found guilty on a number of occasions, they could be forced out of business for breaking industry rules.

Moreover, there is a small chance the debt would not need to be repaid straight away (this is not the same as written off!).

In an event like this, your debt would likely be sold to another debt collection agency that is still operational.

How to Fight Back

Reporting debt collector harassment is something you may be worried about doing. But you won’t be alone if you do.

The process of making a debt collector harassment complaint can be split into three stages:

- Gather evidence of harassment

- Make a complaint to the creditor/debt collection company

- Make a complaint to governing bodies and others

Step One: First you must gather as much evidence as possible to prove that you have been subject to debt collector harassment.

To do this, you will need to download call logs showing that creditors have frequently called you (maybe at times you asked them not to). And gather witness statements, photos or video evidence that they have been frequently coming to your home.

Step Two: Send copies (don’t send your original and only evidence) to the debt collection agency showing them why they are guilty of debt collector harassment.

Ask them to stop and make specific requests of how you wish to be contacted in the future.

At this stage, it is hoped that any debt collector harassment will stop. But if it doesn’t you should proceed to step three as detailed below.

Complain to the Financial Ombudsman Service

Step Three: If they don’t react to your direct complaint within a reasonable timeframe, you are allowed to complain about the debt collector’s harassment to the Financial Ombudsman Service. You can also file a complaint with the FOS if you think that the debt collector’s response to your complaint was unsatisfactory.

The ombudsman may choose to investigate the matter further and apply fines.

You should also report them to any governing trade bodies that the company belongs to and the Financial Conduct Authority (FCA).

The FCA may be able to stop the debt collection agency from operating unlawfully.

The official complaints procedures for each can be found on their website. It is crucial to keep original and backup debt collector harassment evidence in case you need to complain to these groups.

Possible Outcome when Complaining to the Financial Ombudsman Service

The Financial Ombudsman Service has the power to award financial compensation to you if they rule in your favour against a debt collector.

If the FOS finds that a debt collector has not abided by the rules and laws by harassing you, they can instruct them to resolve the complaint.

In short, the FOS would ‘put you back to the position’ you were in if the issue hadn’t arisen. You could be awarded compensation for the distress you were caused.

It’s worth noting that FOS complaint outcomes can vary from case to case.

Checking for Other Debt Collectors

There are a lot of ways to get into debt. In fact, it’s not uncommon to owe money to several companies at once.

Perhaps you have a mortgage, a car loan, a couple credit cards and an item or two you bought on buy-now-pay-later schemes. It’s easy to lose track.

That’s why it’s important to regularly check your credit report and bank statements to make sure you haven’t missed anything.

If a debt collector has purchased your debt, it appears on your credit report.

Some of the debt collectors you’re most likely to come across are PRA Group, Lowell and Cabot Financial.