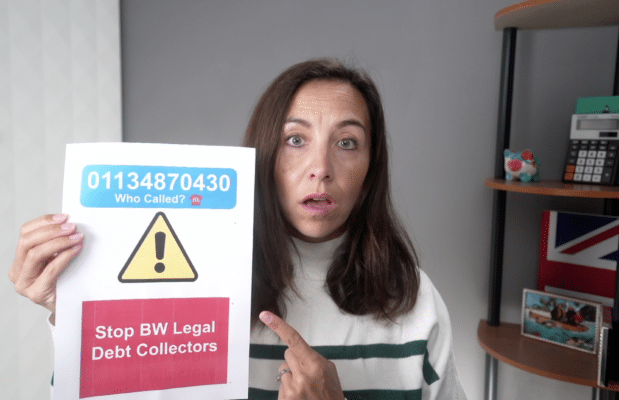

01134870430 – Who Called? Stop BW Legal Debt Collectors

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you just received a call from 01134870430, or a letter from BW Legal Debt Collectors? You might be feeling worried or confused. We’re here to help you understand what’s happening.

Every month, over 170,000 people visit our website seeking advice on debt problems. You’re not alone; we’re here to help.

In this article, we’ll explain:

- Who is calling you from 01134870430.

- How to stop BW Legal Debt Collectors from calling.

- Who BW Legal Debt Collectors are.

- What will happen if you don’t answer when 01134870430 calls.

- Can BW Legal Debt Collector take you to court.

We understand that receiving a call or letter from BW Legal Debt Collectors can feel scary, especially since research shows that nearly half of individuals who deal with debt collection agencies have experienced harassment or aggression1.

But don’t worry; we’re here to help you!

Who Called You From 01134870430?

First of all, we need to explain why these calls are so frequent. The collection agent is using a computerised system to call the number automatically. No live person is involved in the dialling process, and you will only be put through to a live agent if you pick the phone up.

In the case of 01134870430, it is BW Legal that is calling you. If you have some form of voicemail service, BW Legal will have left you a message after each call, so you would already know who has been calling.

Typical Debt Collection Process

It’s common for debt collection agencies to call or send letters, as it’s part of the first stage of the debt collection process.

I’ve put together this table that explains the debt collector timeline. If you’d like to learn more about the actions involved in each stage, be sure to check out our specialized guide.

| Stage | Actions | What you should do: |

|---|---|---|

| Missing one or two small payments | Calls and letters from the debt collector asking for payment. They may enquire about reasons for missing payments. | Contact the debt collector and offer to pay what you can. If you are struggling to pay the debt, get in touch with us to explore your options. |

| Missing large or multiple payments | Their contact will become more frequent, urgent, and threatening. | Contact the debt collection agency and offer to pay what you can. You may also make a complaint if you think the letters are a form of harassment. |

| Debt collector visit | After a few months, if the debt is significant (£200+) you will receive notice of a debt collector visit. They have to notify you before arriving. Debt collectors cannot take anything from your home – they may only ask for payment. | If a debt collector shows up at your home, ask them to show proof of the debt and their ID through a window. Do not open your door or let them in. You can arrange a payment plan with the debt collector, but make sure to get a receipt of this. |

| Court | If you still do not pay your debts to the original lender/debt collector agency, they will take you to court and either attempt to: – File a CCJ against you. – File an attachment of earnings order. – File a lawsuit against you. |

You must show up to your court date. From here, you can either dispute the debt, or the judge will likely suggest a manageable repayment plan for you. |

Remember that the easiest way to keep BW Legal Debt Collectors from calling or sending letters is by contacting them and offering to pay what you can. Avoid ignoring them.

I always recommend responding to debt collectors – even just to question the debt’s validity. Remember, you have the right to request proof of the debt. They have to prove it or they can’t charge you.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Happens if You Never Answer When 01134870430 Calls?

BW Legal will be contacting you to try and organise repayment of the debt. Either in full, or by setting up a monthly repayment plan.

However, there is a very good reason why the company is desperate to get hold of you. And this has to do with how debt write-off works. To have a debt written off, you must go 6 years without:

- Acknowledging the debt.

- Having any written communication with BW Legal.

- Making any payments against the debt.

If you can make it to the 6-year stage without doing any of these things, it will become a statute-barred debt, and can no longer be collected. Unfortunately, this sounds much easier to do than it actually is. And the chances of BW Legal not taking legal action against you before the 6 years is up, is very slim.

» TAKE ACTION NOW: Fill out the short debt form

Stopping 01134870430 From Calling You

Now that you know who is calling you from 01134870430, and why, it’s time to look at how to go about stopping these phone calls.

Initially, you need to find out who the original creditor was that set BW Legal on you. Once you know this, you have to start gathering evidence of harassment. As we explain, below.

- Don’t throw away any letters you have been sent by BW Legal. Keep them as evidence.

- Make a list of all the dates and times that 01134870430 has called you.

- Ask neighbours or other people living in the house to give a witness statement.

Once you have this proof, it is time to take action. You are going to need to write to the original creditor. You need to make sure you keep a copy of the letter and then send the original using recorded delivery post.

In this letter, you should point out that harassment is illegal in the UK. And that you want these phone calls to stop or you will take matters further.

Explain to the creditor what you would deem an acceptable way to contact you in the future. The creditor must give you an informal response within three business days, and they must tell the FCA that a complaint has been made.