Wilson & Roe High Court Enforcement – Should you Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a surprise letter from Wilson & Roe High Court Enforcement saying you owe them money? You might be feeling confused, worried, or unsure of what to do.

Don’t worry, we’re here to help. Every month, over 170,000 people visit our website for guidance on debt matters.

In this article, we’ll help you:

- Understand who Wilson & Roe High Court Enforcement are.

- Learn how to check if the debt they claim you owe is really yours.

- Find out what happens if you don’t pay.

- Explore ways to handle the debt if you can’t afford to pay.

- Discover how to stay on top of your debts in the future.

We know how scary it can be when you’re being chased for debt, especially since research shows that nearly half of individuals who deal with debt collection agencies have experienced harassment or aggression1.

Some of our team have been in your shoes. With our expertise, we’ll help you learn more about the different ways you can deal with Wilson & Roe High Court Enforcement.

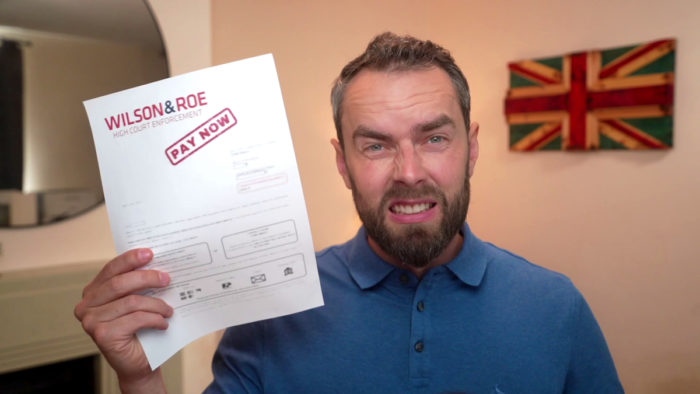

Have you received a Wilson & Roe High Court Enforcement letter?

Wilson & Roe High Court Enforcement will send you a letter notifying you that they are coming to recover the debt on behalf of the high court.

The letter is known as a Notice of Enforcement and will provide you with an opportunity to pay or expect a visit from their high court enforcement officers. You pay a fee of £75 for receiving a Notice of Enforcement.

You should have already lost the case in the high court for the high court enforcement officers to send this letter. If the letter is in someone else’s name, you should speak to Wilson & Roe High Court Enforcement and let them know they have made a mistake.

Should you pay?

» TAKE ACTION NOW: Fill out the short debt form

You should pay the debt if Wilson & Roe High Court Enforcement have sent you a letter requesting payment. This means the debt case has already been to the high court, and you have previously been ordered to pay.

If the matter has not been to the high court or you are not aware of it, you should query the letter with the company and make sure it’s not a scam.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens if you don’t pay them?

If you don’t pay Wilson & Roe High Court Enforcement the money owed, their high court enforcement officers will come to your property.

When they arrive, they will request full payment or attempt to take possession of your goods. These goods will be kept in storage – which you may need to pay for – and you’ll be given a further period with the opportunity to clear the debt.

If you fail to clear the debt during this time, the goods will be sold at an auction to raise money. The money is then used to pay off your high court debt, with any remaining money or assets returned to you.

If the HCEO process gets to this stage, further fees and charges will be added to your total debt.

Differences Between Debt Collectors and Bailiffs

It’s important to note that debt collectors are not allowed to do the same as high court enforcement officers or bailiffs. I recently spoke to the Mirror about them. While a bailiff may be permitted to take your possessions, a debt collector never can. All they are allowed to do is ask for a payment.

Here’s a table that explains the main differences between bailiffs and debt collectors. If you want more information about your rights, please read our complete guide.

| Category | Debt Collectors | Bailiffs |

|---|---|---|

| Bank Account Access | Access your bank account – but only after a CCJ has been secured and not complied with. |

After the creditor has taken you to court over missed payments, bailiffs/creditors can apply for a third-party debt order to freeze and take control of a bank account. |

| Leniency | Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | If you tell them immediately that you are a vulnerable person, they must treat you with greater consideration and give you more time to respond to any contact. |

| Re-Selling Debt | Sell your debt if they are unable to collect payment from you. | Call and visit multiple times – there isn’t a set limit on how often they may contact you. If they can’t take any goods to sell or enter your property, they might return with a warrant and force entry to your property. |

| Visiting Your Home | Conduct home visits (on rare occasions) and knock on your door. | Conduct home visits and can enter without your permission as long as all of the correct legal steps have been taken. |

| Contact Hours | Contact you by phone or mail. They’re allowed to call whenever they see reasonable without constituting harassment, usually between 8 am and 9 pm. | Can visit your home anytime between 6 am and 9 pm (unless they have a court order that states otherwise). |

| Permission To Take Belongings | They cannot take anything from your home. They may only ask you to make a payment. | Take goods from inside and outside of your home once all legal steps have been taken. However, they cannot take essential items for domestic living or work purposes. |

| Court Actions | Threaten to take you to court by suing you for payment on a debt. | Can apply to the court to get permission to use ‘reasonable force’ to enter a home, which could mean breaking in. They have to give details to the court about how they will secure the property afterwards. |

What if you can’t afford to pay?

If you want to pay Wilson & Roe High Court Enforcement but cannot due to low income or financial insecurity, you might be able to agree on a payment plan with an upfront lump sum. This can be arranged after receiving the Notice of Enforcement to avoid further HCEO charges.

Wilson & Roe High Court Enforcement may accept a payment plan when they visit your property, but they are not obligated to do so.

Staying On Top Of Your Debts

One of the hardest parts about being in debt is that the industry isn’t at all transparent.

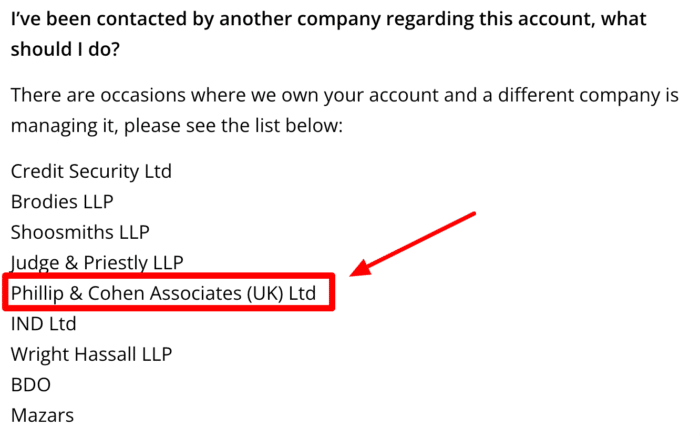

One common tactic used by Debt Collectors is contacting you under multiple names and addresses.

Sometimes, it’s for practical reasons, but even then it can be confusing and intimidating. So it’s important to try to keep a level head and research what’s going on.

Some of the biggest debt collectors in the UK operate under multiple names.

- Robinson Way will sometimes contact you under the name Hoist Finance.

- Cabot Financial Group recently bought Wescot Credit Services

- Credit Style communicate as both Credit Style and CST Law.

- Lowell Financial also owns Overdales and collects debts under both names.

In fact, in the case of PRA Group, they’ve been known to use multiple company names. As you can see in the image below.

If you’ve been contacted by a debt collector recently, it’s worth going through your post and emails to check that you haven’t missed anything, just in case they’ve started writing to you under a different name.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Wilson & Roe High Court Enforcement Contact Details

| Website: | https://www.wilsonandroe.com/ |

| Address: |

Salford Head Office 26 Missouri Avenue, Salford, Manchester, M50 2NP T: 0161 925 1800 E: [email protected] London Office 5th Floor, 38 Chancery Lane, London, WC2A 1EN T: 0208 161 9670 E: [email protected] Bristol Office 10 Victoria Street, Bristol, BS1 6BN T: 0782 542 6308 E: [email protected] |