Arrow Global Debt – Should You Really Have To Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Dealing with unplanned debt can be tough, especially when you receive a sudden letter from a debt collector like Arrow Global. If you’re wondering about the debt, whether you should pay it, or if it’s real, don’t worry. We’re here to help.

Over 170,000 people come to our website each month for advice on debt issues, so you’re not alone. We understand your worry and confusion about this debt, as research shows 64% of UK adults find interactions with current debt collectors stressful1.

In this article, we’ll explore:

- Who Arrow Global Debt Collection is and why they might be on your credit report.

- How to respond to Arrow Global Debt letters.

- What to do if Arrow Global proves your debt or takes you to court.

- Possible ways to write off some Arrow Global debt.

- Debt solutions you can use, such as Individual Voluntary Arrangement (IVA), Trust Deed, Debt Relief Order (DRO), Debt Management Plan (DMP), Bankruptcy, and Sequestration.

With our expertise, we hope to bring clarity to your situation and help you make informed decisions. We’ve walked many others through similar situations, and we’re ready to do the same for you.

Who Are They?

The average unsecured debt amount has increased by 27% year-on-year (to £16,174)2, so payment plans like the one mentioned above have become more and more common over the years.

Why are they on my credit report?

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How should I reply to the letters?

I always recommend responding to debt collectors – even just to question the debt’s validity. Remember, you have the right to request proof of the debt. They have to prove it or they can’t charge you.

» TAKE ACTION NOW: Fill out the short debt form

What Should I Do If My Debt Was Proven?

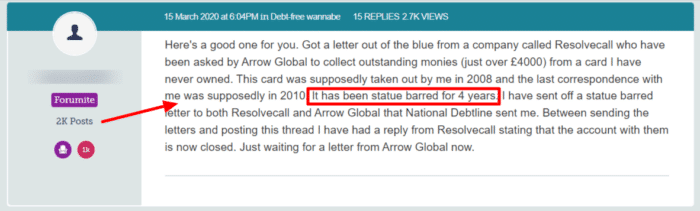

This is why you should always make a debt collection agency prove your debt – Arrow Global debt collection practices can quite often make mistakes!

Being up to date on your rights as a debtor is also a good idea.

Because this person knew their rights, they kept calm because they knew that there was nothing enforceable about the alleged debt.

Here’s a quick table summarizing debt collectors’ rights to help you have an edge over the situation.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

They Are Taking Me to Court – What Do I Do?

Can I Use a Debt Solution?

If you are struggling with your debts, a debt solution can help you get back in control of your finances. There are lots of debt relief options in the UK so take the time to make sure you find the best solution for you.

Individual Voluntary Arrangement (IVA)

An IVA is a legally binding agreement between you and your creditors. You will pay an agreed sum for a set period of time – usually 5 years – and at the end of your IVA, any remaining debts are written off.

One of the major advantages of an IVA is that you don’t deal with your creditors – your Insolvency Practitioner (IP) does it on your behalf. Your creditors are unable to contact you in any way during your IVA, including court action!

Keep in mind that an IVA does not cover all types of debt. Secured debts can’t be included in your agreement and any debts due to court fines, child support, and student loans will not be covered.

You also need to owe a substantial amount of debt to more than one creditor to qualify for an IVA. Your monthly payment is also based on your income so, if you have very little disposable income, a different debt solution might be more appropriate.

Trust Deed

A Trust Deed is basically the Scottish equivalent of an IVA. IVAs are unavailable to you after 1 year of living in Scotland – you need to opt for a Trust Deed now.

Other than geography, the other key differences between a Trust Deed and an IVA are the amount of debt required to qualify and the duration of the agreement.

An IVA will last around 5 years, but a Trust Deed typically lasts for 4 years. You need to owe more than £5,000 to more than one creditor in unsecured debts for a Trust Deed, but most IPs will only consider opening an IVA if you owe more than £6,000.

Debt Relief Order (DRO)

A DRO is a debt solution for those with very little disposable income and few valuable assets.

A DRO stops your creditors from contacting you or taking further legal action for 12 months once it is approved. After the year, your finances are looked at again and if there is no improvement any remaining debt is written off.

To qualify, you need to demonstrate that your monthly disposable income is less than £75 for England and Wales and £50 if you live in Northern Ireland. A DRO is not available if you live in Scotland.

Debt Management Plan (DMP)

A DMP is an informal debt solution. As part of a DMP, you will negotiate with your creditors to freeze or reduce your interest and agree to a repayment plan.

This solution is for non-priority debts and can be set up by a debt charity. Keep in mind that it is not legally binding to your or your creditors, but any missed payments can make your situation worse.

Bankruptcy

Bankruptcy is many people’s final option when they are struggling with debt. It can be your only option if you owe significant debts with no real way of paying them off.

While there are some negative attitudes towards bankruptcy, it can be the best option for some people.

Keep in mind that bankruptcy is a serious financial situation and should not be taken lightly. However, at the end of the process, many of your debts may be written off. This allows many people to financially go back to square one for a fresh start.

Sequestration

Sequestration is the Scottish version of bankruptcy.

To qualify, you must owe more than £3,000. Anything less than £3,000 may qualify you for a MAP bankruptcy which is a solution for people with few assets.

With so many options available, it is a good idea to get some advice. There are several charities and organisations in the UK that offer specialist advice and can walk you through different debt options.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What Can the FCA Do?

The Financial Conduct Authority (FCA) regulate those providing financial services, including debt collection agencies.

This means that there is a strict code of conduct that all companies regulated by the FCA have to follow – including Arrow Global. If you think that Arrow Global has not followed these rules and has not done anything when you raised your concerns with them, you can make a complaint.

Your complaint needs to be made to the Financial Ombudsman Service (FOS) which can investigate and issue fines or compensation as appropriate.

Arrow Global Debt Contact Details

Other Debt Collectors

You should check for more outstanding debts that you may have with other companies or debt collectors. Here are four steps you could take:

- Check your credit report for other defaults

- Check your email and post for reminders or overdue notices

- Check the court records for CCJs against you

- Check your bank statements for the names of other debt collectors

There are hundreds of debt collectors in the UK and each works with different companies to collect debts.

For example, Cabot Financial have been known to collect for the DVLA while Lowell Financial and PRA Group buy debts from various credit card companies like Barclaycard.

If you see a name on your bank statement that you don’t recognise then you can search MoneyNerd to see if they’re a debt collector.