Bailiffs Turning up for Previous Tenants – What To Do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about a bailiff who has come for a previous tenant? You’ve come to the right place. Each month, over 170,000 people visit our website to learn about how to tackle debt issues, so you’re not alone.

This guide will help you understand:

- What bailiffs are and why they might visit your home.

- Steps to take if a bailiff visits to collect from a previous tenant.

- The powers that bailiffs have.

- How to make a complaint against a bailiff.

Shelter found that no-fault evictions have increased by 143% in recent years, often involving bailiffs in the eviction process.1 We understand this can be worrying, but we’re here to help.

Here’s how to handle the situation in the best way.

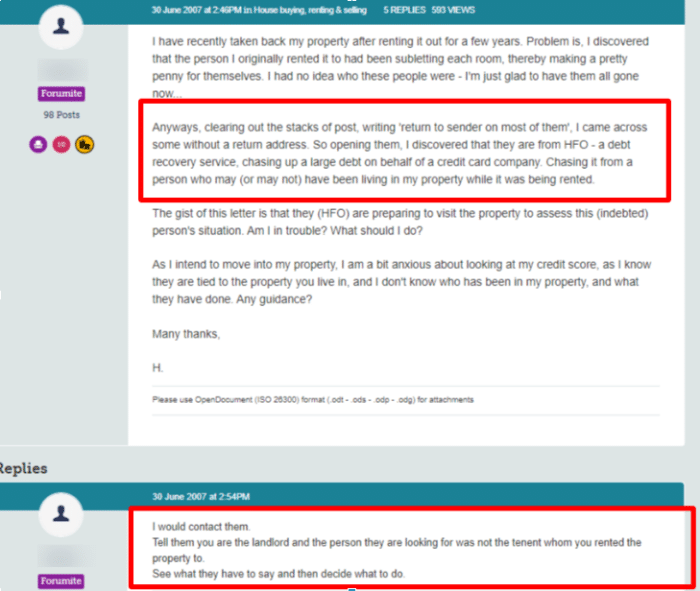

What To Do if Bailiffs Visit To Collect From a Previous Tenant

It’s important to learn how to prove you don’t owe a debt, and that a previous tenant is responsible.

Please note, a bailiff is not legally allowed to confiscate any goods from a home, that is not the property of the debtor.

Therefore, as long as you can prove you are not that person, your possessions will be safe.

Here are some ways to do just that.

- Show the bailiff some ID such as your passport or driving licence to prove your identity.

- If you have your tenancy agreement to hand, show this to the bailiff to prove you are the current tenant.

- You may have unopened letters for the previous tenant, show these to the bailiff.

- If there is a car parked on your driveway or in your garage, show the bailiff your logbook and other documents to prove you own the car, and they cannot take it.

» TAKE ACTION NOW: Fill out the short debt form

Once you have dealt with the bailiffs knocking at the door, you should contact the creditor and inform them that the person who owes the debt no longer lives at the address.

The bailiff will be able to give you details of who the debt is owed to.

Your Rights With Bailiffs

I shared with The Mirror2 how important it is to know your rights when faced with bailiffs at your front door.

You see, bailiffs often resort to intimidation, but it’s important to remember they can’t legally make threats or seize items from someone else who doesn’t owe any debt.

Here’s a quick explanation of what bailiffs can and can’t do. If you’d like to learn more about your rights, don’t forget to read our detailed guide.

| Bailiffs Can | But They Can’t |

|---|---|

| Call and visit your home multiple times, any day of the week. | Visit your workplace (if you are not self-employed) |

| Take items from your home. These items have to be considered ‘luxury’. | Take essential items from your home. This includes beds, clothing, and work equipment. |

| Use ANPR technology and DVLA information to locate your car and take it. | Enter your home without permission unless they have a warrant to force entry for a CCJ. |

| Peacefully enter your property. | Harass or threaten you. |

| Issue notices to those who owe a debt. | Take items that belong to someone else. However, they may be able to seize jointly owned property. |

| Offer to conduct a Virtual Controlled Goods Agreement (rather than in-person). This will typically be offered to vulnerable people. | Sell goods they have seized at auction until seven clear days have passed. |

Do You Need to Keep Records?

I always recommend that you keep records of your dealings with bailiffs — documentation is very important!

Having relevant evidence or copies of previous correspondence with bailiffs will help prevent any future misunderstandings.

It will also make it much more difficult for the bailiffs to argue with you because you’ll have the evidence in front of you, ready to go.

Documentation and record keeping are one of the reasons why I suggest writing letters or even emailing bailiffs, rather than relying on phone calls. With letters and emails, you have a permanent record of what you said and their response that no one can argue with!

You can use any of my free letter templates – including the ‘prove it’ and ‘not liable for the debt’ letter templates – to write to the bailiff company and explain the situation.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How To Make a Complaint Against a Bailiff

StepChange found that 90% of people who have been visited by a bailiff in the last 2 years identify as vulnerable. With over 50% reporting depression and more reporting stress and anxiety. 3

So, if you’re in the same situation and feel stressed because you took actions such as those explained in the previous section, and the bailiff is still insisting they must come into your home and take goods, don’t worry.

They are acting unlawfully.

It is fully within your rights to make a complaint about a bailiff when they overstep the limitations placed on them.

Below, are some reasons why you should report a bailiff.

- If a bailiff forces their way into your home.

- Goods that don’t belong to the debtor are taken.

- A bailiff continually harasses you to pay a debt even though you don’t owe it.

- If a bailiff acts in a threatening or aggressive manner.

- When a bailiff uses offensive language.

If you are in any doubt whether the bailiff is acting ethically, you should make a note of their name and if possible, take a photograph of their ID so that you can report them later.

To make a complaint, the first thing you need to do is follow the complaint process of the bailiff’s company.

You should be able to find this on their website.

If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, the bailiff or their company may be fined.

You could even be owed compensation.

You can also make a secondary complaint to the Civil Enforcement Authority (CIVEA) if you think that the bailiff has broken any of their guidelines.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What Powers Do Bailiffs Have?

First things first. Unless a bailiff is serving a criminal warrant, they have very few powers and must work within certain restrictions.

Knowing what these limits are could be useful if you have a bailiff at your door looking to settle e debt from a previous tenant.

So, I have listed them below.

- A bailiff cannot push past you to get into your home, and they cannot force entry in any way.

- A bailiff can only enter your home if you invite them inside. Or if they can find a door that you have left unlocked. They can’t force a lock and they can’t enter through an open window.

- If the only people at home when the bailiff calls are disabled people, or children under 16 years of age, the bailiff must leave.

- Between the hours of 9pm and 6am, a bailiff is barred from making house calls. However, do note that they work weekends so could visit on a Saturday or Sunday.