Quick Primer on the Breathing Space Scheme

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about debt? Do you need to know if the Breathing Space Scheme could help? You’re in the right place. Each month, over 170,000 people look to us for guidance on ways to handle their debts.

In this article, we’ll explain:

- What the Breathing Space Scheme is and how it can help you.

- Who qualifies for this scheme.

- How to apply for it.

- How it may affect your credit score.

- What to do when your Breathing Space ends.

Debt can be a big worry, but you’re not alone. Our team knows what it’s like to face debt. We understand your fears, and we’re here to help. The Breathing Space Scheme can offer a pause on debt payments, giving you a chance to plan your next steps. Whether you’re in England, Wales, or Scotland, this scheme could provide the help you need.

Let’s learn more about how the Breathing Space Scheme might be able to assist you with your debts.

Is there a breathing space scheme?

There are breathing space schemes for debtors who live in England, Wales or Scotland.

These schemes are primarily designed to stop creditors from pursuing further action to recover the debt while you get debt advice and choose a suitable strategy to get out of debt.

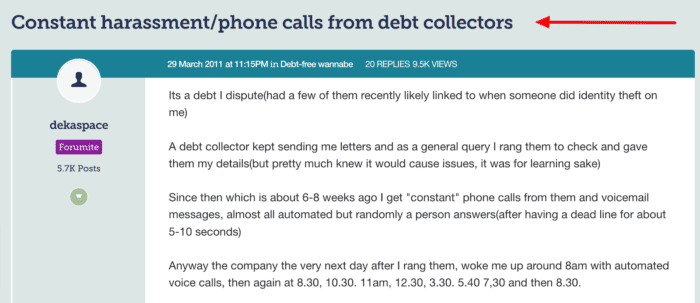

When you have debt, things can get worse quickly and you might be subject to constant communications and legal threats, as this forum user experienced:

But with a breathing space scheme, you can temporarily end the possibility of further action, and take the time to get on top of the situation.

For debtors who live in England or Wales, there are two possible breathing space schemes:

- The Debt Respite Scheme, also known as the standard breathing space scheme

- The Mental Health Crisis Breathing Space Scheme

Debt Respite Scheme (standard breathing space scheme)

The Debt Respite Scheme is a government scheme launched in May 2021 to help debtors take the time needed to get on top of their debt without their situation getting worse.

It’s not the only one; you can learn more about government schemes to help debtors with MoneyNerd.

During the Debt Respite Scheme, applicable creditors cannot add interest, add late fees or take further action to recover the money, such as applying for a court order.

The breathing space period will last for 60 days, which is enough time to get debt advice and implement a debt solution. There will be a review of the use of the scheme between 25 and 35 days in.

Mental Health Crisis Breathing Space

The Mental health Crisis Breathing Space Scheme is for people who are suffering from a mental illness and are receiving treatment. It provides this type of debtor with breathing space lasting the entirety of their treatment plus an additional 30 days.

» TAKE ACTION NOW: Fill out the short debt form

Breathing space scheme eligibility

The eligibility to use the Debt Respite Scheme or the Mental Health Crisis Breathing Space Scheme are very different. We have explained the eligibility criteria for both schemes below.

Who qualifies for the Debt Respite Scheme?

To qualify to use the government’s Debt Respite Scheme you must live in either England or Wales and wish to use it to get breathing space on a qualifying debt. Not all debts qualify for use of this breathing space scheme.

You cannot use the Debt Respite Scheme if you have used the scheme in the last year or if you already use a Debt Relief Order (DRO), an Individual Voluntary Arrangement (IVA) or are an undischarged bankrupt.

Who qualifies for the Mental Health Crisis Breathing Space Scheme?

To qualify for the Mental Health Crisis Breathing Space Scheme it’s not enough to be suffering from a mental illness, such as depression.

You need to have been detained – also known as sectioned – under the Mental Health Act and relocated to a place of safety. And you need to be receiving treatment from an Approved Mental Health Practitioner (AMHP).

Consequently, the Mental Health Crisis Breathing Space Scheme is only suitable for a small percentage of debtors. It’s more likely that you’ll have to apply for the Debt Respite Scheme, commonly called the breathing space scheme.

Is breathing space a payment holiday?

No, this is a common misconception. Breathing space prevents creditors from taking further action but you should keep paying monthly payments when possible.

What debts are covered by breathing space?

The majority of personal debts (including joint debts) qualify for use of the Debt Respite Scheme, such as:

- Personal loans

- Credit cards

- Overdrafts

- Store cards

- Mortgage arrears

- Council tax arrears

- Car finance

- Most debts to the government

Guarantor loan debts also qualify but breathing space is only granted to the debtor and not the guarantor on the credit agreement.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What debts don’t qualify for breathing space?

But there are some debts that don’t qualify for breathing space under a breathing space scheme. The most common examples are:

- Court fines

- Child maintenance

- Debts occurring from fraud

- Student loans

- Universal Credit

- Social fund loans

- Damages resulting from injury or death of another person

How do you set up a breathing space?

As you might expect, the way of setting up the Debt Respite Scheme or the Mental Health Breathing Space Scheme is very different. We explain both processes below.

How to apply for the Debt Respite Scheme

To apply for the Debt Respite Scheme you must get a professional debt adviser to do this on your behalf. You can use a debt advice charity to do this for you. You won’t need to pay for the application.

You might see commercial businesses offering to set up a breathing space scheme for you in return for a fee. There is a good chance that these companies are a scam. All you need to do is talk to a debt advice charity for personalised and free support.

How to apply for Mental Health Crisis Breathing Space

You can only apply for Mental Health Crisis Breathing Space through your AMHP. They will submit evidence and a form to a debt advisor who will then apply for the scheme on your behalf. You should speak with your AMHP to discuss this option.

Does the breathing space scheme affect your credit score?

The use of a breathing space scheme doesn’t get recorded on your credit file and therefore the scheme alone doesn’t affect your credit score.

But if you miss a payment or don’t make a full payment during the breathing space scheme, your credit score will be negatively affected.

Does it provide high court enforcement breathing space?

Yes, with a breathing space scheme all further action to collect a debt must stop, which means that these schemes also provide bailiff breathing space if your debt situation has already escalated to enforcement.

Is there a breathing space scheme in Scotland?

Yes, there are two breathing space schemes in Scotland.

You might qualify to use an informal breathing space scheme called creditor forbearance, or you might have to apply for a formal breathing space period known as a moratorium period as part of a debt solution application.

How does creditor forbearance work?

Creditor forbearance is an informal agreement with creditors for them to stop contacting you or pursuing a debt while you receive debt advice from a debt charity or commercial debt management company.

Because the breathing space period is informally agreed upon, the timeframe you’re given can differ but most people are given 30 days. Some creditors might also freeze interest and charges during the breathing space.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How to ask for forbearance

To ask for forbearance you should call or write to your creditor and let them know you’re seeking debt advice and would like some breathing space.

They might ask for proof that you’ve started receiving advice, which you could supply through phone records or a transaction of online chats and emails.

If they reject forbearance you could make a complaint.

How does a moratorium period work?

A moratorium period stops creditors from taking further action against you for six months and stops you from having to make debt repayments. It’s a formal agreement and a legal requirement when you use certain debt solutions in Scotland.

If you’re applying to use Sequestration, a MAP, DPP or Protected Trust Deed, then you will qualify for a six-month moratorium period during the application process.

Interestingly, a moratorium period is also available in England when a debtor uses a Debt Relier Order. The moratorium period lasts 12 months and then all debt is written off at the end of the year if the debtor’s finances haven’t improved.

Is there a breathing space scheme in Northern Ireland?

At the time of publication, there is no breathing space scheme in Northern Ireland.

There are calls for this to change and give Northern Ireland debtors the chance to take control of their debts without the threat of more charges and further action.

What is a breathing space order?

A “breathing space order” is just a colloquial name for the standard government breathing space scheme, namely the Debt Respite Scheme.

What happens when your breathing space scheme ends?

Once the Debt Respite Scheme ends after 60 days, your creditors can start charging interest and fees again – if applicable. Creditors can also pursue debt recovery by taking legal action, such as applying for a County Court Judgment (CCJ).

This is why it’s so important to engage with your debt advisor during the breathing pace scheme and decide on the best way to get out of debt. This usually means deciding which debt solution you’re going to use.