Can a Court Bailiff Arrest You? Know Your Rights

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about dealing with a County Court Bailiff? Have you been asked to pay a debt? This article is just right to help you. Many people, over 4,600 each month, come to us for guidance on court matters and debts.

In this easy-to-understand guide, we’ll talk about:

- Who County Court Bailiffs are.

- What to do if they contact you.

- The jobs these bailiffs have to do.

- How you might lower your debt.

- What steps to take if a bailiff visits you.

We understand this is a hard time for you. Some of us have dealt with debts and court things too, so we know how you’re feeling and are here to help you.

Let’s get started and discuss your options.

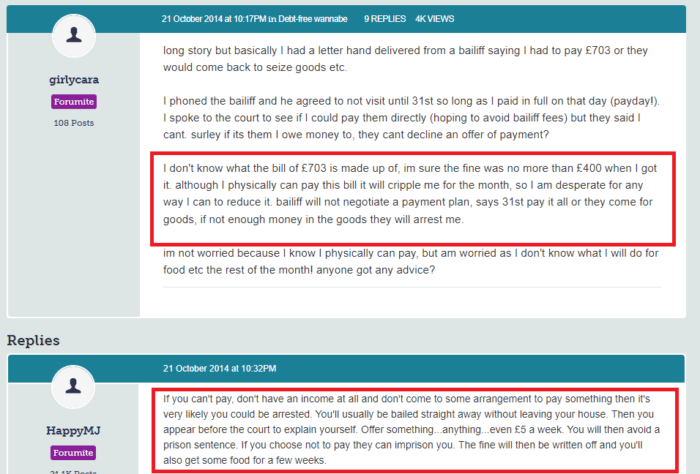

Can a County Court Bailiff Arrest You?

The answer to this question depends on the type of debt the bailiff is trying to get you to pay. It also depends on how much of the debt can be offset by taking goods from your home.

It is only official debts such as criminal fines or maintenance payments that you can be arrested for by a bailiff. And even then, there is a timeline that will be followed before you are arrested, as defined below.

- The bailiff will visit, and ask you to pay the debt.

- If you cannot pay the debt, the bailiff will confiscate goods from your home, to sell off and pay the debt.

- If there is not enough value in the goods to clear off the debt, the bailiff may then arrest you if they see no other option.

What usually happens, is you are arrested on the spot and bailed straight away without even having to visit a courtroom. A court hearing will then be scheduled, and you can plead your case for paying the debt off in instalments. If you cannot pay at all, you might be sent to prison for a short time, but the debt would be written off once your prison sentence is over.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can a County Court Bailiff Enter Your Property?

In general, a county court bailiff cannot enter your home without your permission. Unless they can find an unlocked door to enter through. Furthermore, these other restrictions are in place and it’s important to make sure that any notice you receive previous to the arrest is legitimate and not a scare tactic (such as a fake NN1 2TX letter).

- A bailiff cannot push past you to gain entrance.

- They cannot enter your home at all if there is nobody over the age of 16 is at home.

- If only a disabled or sick person is home, they cannot enter.

- A bailiff cannot visit your home between 9pm and 6am.

- A bailiff can only enter through a door. Not a window, for example.

However, there is an exception to a bailiff not being allowed to enter your home by force. In certain circumstances, they can force entry (but not harm you or threaten you). As follows:

- If they are serving a warrant for possession to evict you.

- If they are seeking to confiscate goods to pay a magistrates court fine.

- If they are serving a warrant to arrest you.

In cases such as these, a bailiff may use an acceptable level of force to break into your property and carry out their duties. You cannot try to physically stop them from doing this, as the law is on their side at this point.

» TAKE ACTION NOW: Fill out the short debt form

What Do County Court Bailiffs Do?

County court bailiffs fulfil a very special role within the justice system. They are the representatives of the county court that deal with the sharp end of the business. The long arm of the court in many ways. Below, we have listed some of the main duties a county court bailiff carries out.

- Collecting payments against a debt such as a loan, that a judgment has been made on.

- Confiscating goods to be sold off against a debt.

- Repossessing goods, such as a car.

- Serving official court documents such as a summons or warrant.

- Evicting tenants.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

County Court Bailiff Conduct and Complaints

A county court bailiff has to act within the law at all times. They cannot harm or threaten you physically. They must also identify themselves when asked. The warrant they are serving must also be 100% correct. Therefore, if a bailiff visits, you should ask them for the following:

- An ID badge or card to prove identity.

- A contact telephone number for their controller.

- Details of the reason they are visiting.

- To view and check the warrant that they are serving.

If you are in any doubt as to the authenticity of any of these, you are within your rights to turn the bailiff away. If a bailiff acts in an inappropriate manner, or does something that they do not have the legal power to do, you can report them to the local county court. If the bailiff has acted poorly, they might even lose their license and be struck off the bailiff register.