Can Debt Collectors Call or Come to Your Work?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Receiving a surprise letter from a debt collector can make anyone nervous. But don’t worry, you are not alone. Each month, over 170,000 people find help on our website for problems just like this. We understand your fears and questions. Can debt collectors come to your workplace? How can you stop their calls? Is the debt even yours? We cover all these topics and more.

In this guide, we will explain:

- How to check if the debt is really yours.

- The rules about debt collectors calling or visiting your work.

- Steps to stop debt collectors from calling you.

- Tips to write off some of your debt.

- What to do if a debt collector is bothering you too much.

Our team has faced debt collectors too. We know it’s hard. But with the right information, you can handle this.

Can Debt Collectors Come to Your Work?

Can Debt Collectors Call You at Work?

» TAKE ACTION NOW: Fill out the short debt form

How to Stop Them From Calling?

Can They Call at Any Time?

How About Old Debts?

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window will be enforceable for the duration of the CCJ.

If your debt is statute-barred, you can use my free letter template to write to your debt collectors and explain the situation.

If you are unsure about the status of your debt, you can contact a debt charity for some advice. Their advisors will be able to look at the debt in question, determine its status, and advise you on your next steps.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How Do I Verify Debt Collectors?

If you have received debt letters from a debt collector but aren’t sure if they’re legit, what do you do?

From my experience, the best thing to do is ask for proof that the debt is yours. I have a free ‘prove it’ letter template that you can use to help you write to the debt collector and request evidence that you are liable for the debt that they are chasing.

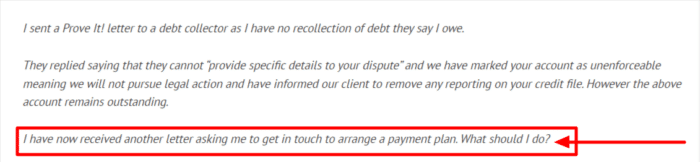

You are under no obligation to pay for a debt that can’t be proven to be yours. Take a look at this example.

You don’t have to pay off a debt that can’t be proven to be yours, no matter how your debt collectors respond. This forum user can ignore the rest of the letters that they get from this company but could have grounds for a complaint of harassment if this continues.

It is crucial that you respond to legitimate debt collectors quickly. Responding quickly will help you avoid any extra charges or fees. Not ignoring debt collectors also means that you are less likely to face legal action, such as a CCJ.

What to Do If a Debt Collector Is Harassing You

What If They Still Harass You?

If you think that your debt collector has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to the debt collector’s company or agency so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, the debt collector’s company or agency may be fined. You could even be owed compensation.

The Difference Between Debt Agencies and Enforcement Agents

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Staying On Top Of Your Debts

One of the hardest parts about being in debt is that the industry isn’t at all transparent.

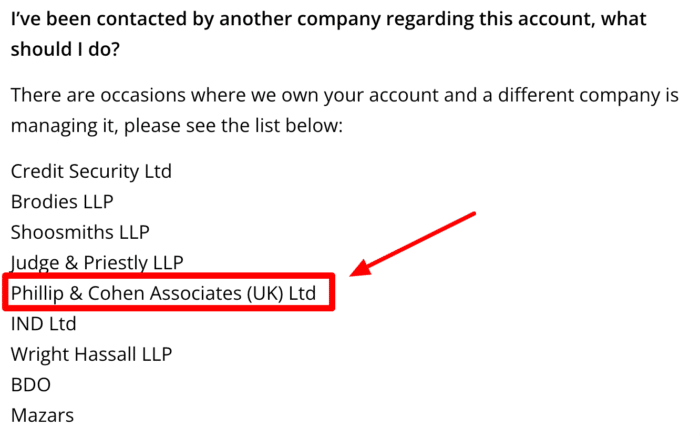

One common tactic used by Debt Collectors is contacting you under multiple names and addresses.

Sometimes, it’s for practical reasons, but even then it can be confusing and intimidating. So it’s important to try to keep a level head and research what’s going on.

Some of the biggest debt collectors in the UK operate under multiple names.

- Robinson Way will sometimes contact you under the name Hoist Finance.

- Cabot Financial Group recently bought Wescot Credit Services

- Credit Style communicate as both Credit Style and CST Law.

- Lowell Financial also owns Overdales and collects debts under both names.

In fact, in the case of PRA Group, they’ve been known to use multiple company names. As you can see in the image below.

If you’ve been contacted by a debt collector recently, it’s worth going through your post and emails to check that you haven’t missed anything, just in case they’ve started writing to you under a different name.

Know Your Rights When Dealing with Debt Collectors

If you are dealing with a debt collection company or just struggling to manage your money, I recommend speaking to a debt charity.

There are several charities and organisations in the UK that offer free debt counselling services and free financial advice. Their advisors will be able to walk you through your options and find the best solution for you.