Capital Recoveries Debt – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

So, you’ve received a letter from Capital Recoveries, and you’re not sure what to do. You’re not alone. Over 170,000 people come to our website each month for help with issues just like this.

We understand that you might be worried or confused about this debt. Maybe you’re not even sure where it came from. But don’t worry; we’re here to help.

In this article, we’ll cover:

- Who Capital Recoveries are and what they do.

- How you can make sure the debt is really yours.

- What steps you can take if you can’t afford to pay.

- If Capital Recoveries can act as bailiffs.

- Ways you might be able to write off some of the debt.

Our team knows what it’s like to be chased by debt collectors. We’ve been there, and we understand how you’re feeling. That’s why we’re here to help you figure out your next steps.

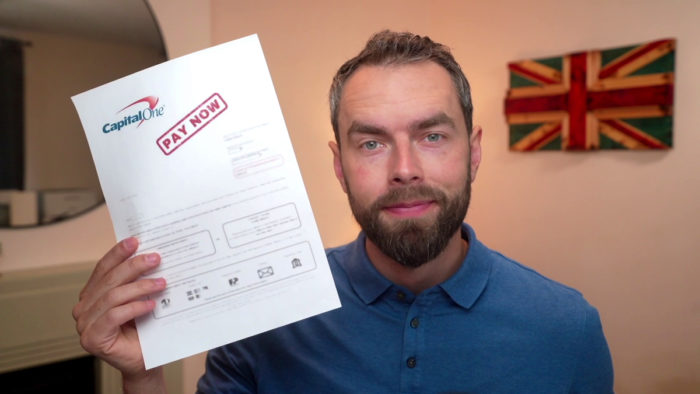

Capital Recoveries debt letters

Your first contact with Capital Recoveries Debt Collection is likely to be a letter. The collection agency will inform you of the debt they’re trying to collect on behalf of the other company and ask you to pay. They’ll listen to your offers of a payment plan if the debt is large or you have financial difficulty.

These letters are likely to threaten legal action if you don’t pay or make contact. Sometimes these can be empty threats, but if the debt is large then it’s very possible that you could be taken to court if you ignore the letter.

Should I pay Capital Recoveries?

You may end up having to pay Capital Recoveries or ask them to agree on a payment plan. But there are some things you can do before you reach for your bank card.

You should check to see if your debt is still legally enforceable. Some debts become too old to be recovered, which basically means that the company cannot take you to court.

Therefore, you’ll never be forced to pay by a judge and won’t have to pay. Most debts become too old to be collected after six years, but the rules are different for mortgage shortfall. As Capital Recoveries often chase mortgage shortfall, we discuss the specifics of this a little later.

You should ask Capital Recoveries to prove that you owe the debt. They must supply you with evidence, which often needs to be a copy of the signed credit agreement or signed contract. If they ignore your request and you’re eventually taken to court, you could tell the judge that you were ignored when asking for proof of the debt.

FREE prove the debt letter

When you ask for proof of the debt, you can use our free letter template. This includes key information and prompts when creating your letter, so you can send a professional prove-it letter without spending hours making it. Download it for free now!

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

I think they have the wrong person…

If you’re convinced that Capital Recoveries Debt Collection is chasing the wrong person, you should also ask them to prove the debt. This is better than just telling them they’ve made a mistake. But you could do both.

Once they realise that they can’t prove you owe them money, they should realise that there has been a mistake in tracing the correct debtor.

Are Capital Recoveries bailiffs?

» TAKE ACTION NOW: Fill out the short debt form

Capital Recoveries is not an enforcement agent company, commonly known as bailiffs. They’re simply a tracing and administration company that other businesses use to search for debtors and ask them to pay using the correct processes. They have no right to come to your home or demand to enter.

Capital Recoveries reviews

There are very few online reviews and forum posts discussing Capital recoveries with little additional information than what we already know. Some posters claim to have received final settlement offers from the company, which is when you pay a smaller lump sum at once to clear all the debt. Some have complained that they changed the payment plan amount without good reason.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Capital Recoveries Contact Information

| Address: | SWAN COURT, LAMPORT, NORTHAMPTONSHIRE, NN6 9EZ |

| Phone: | 01604 686052 9 AM – 5 PM |

| Website: | https://www.capitalrecoveries.co.uk/ |