Controlaccount (Control Account Plc) Debt Recovery – Pay FedEx, DHL, etc?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a surprising letter from Controlaccount Debt Recovery? Are you confused and worried about where this debt has come from and if you should pay it?

You’ve found the right place for answers. Every month, over 170,000 people visit our website for guidance on debt matters, just like this one.

In this easy-to-understand guide, we will cover:

- Steps to verify if the debt they claim is indeed yours.

- Ways to handle Controlaccount debts, including payment plans or writing off the debt.

- How to stop Controlaccount from chasing you.

- Your rights and options if you can’t afford to pay.

Nearly half of people chased by debt collection agencies report experiencing harassment or aggression1, and even our team knows what it feels like.

Don’t worry; we’re here to help you navigate this situation and find a solution that works for you.

How to Approach These Controlaccount FedEx or DHL Debts

If you have received a debt letter from Controlaccount concerning FedEx, you will not be able to pay this to FedEx themselves.

You must now engage with Controlaccount Debt Recovery.

» TAKE ACTION NOW: Fill out the short debt form

What About Other Controlaccount Debts?

If you have received a letter from Controlaccount about a different type of debt, maybe one that’s more substantial than a late payment on a delivered item, this could be a real debt that you owe.

Whether you owe the money or not, everyone usually has to take the same first step at this stage.

First of all, check to see if Controlaccount Debt Recovery has provided you with proof that you owe the debt.

Examples of proof that are relevant to Controlaccount may be:

- An unpaid healthcare bill addressed to you

- Signed agreements and contracts

- Student loan agreements

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Send a Prove the Debt Letter

So, how do you ask for proof? You simply have to ask them in a letter.

These letters are known as prove the debt letters. You can write to them and let them know you received their letter and would like them to prove the debt they are referring to.

Some people feel comfortable writing these letters themselves, but if you do not, you can use our free letter template to help.

Use these detailed templates and swap some of the words for your details to make an effective prove the debt letter in minutes.

Getting proof that you owe the debt will, at the very least, help avoid unnecessary confusion!

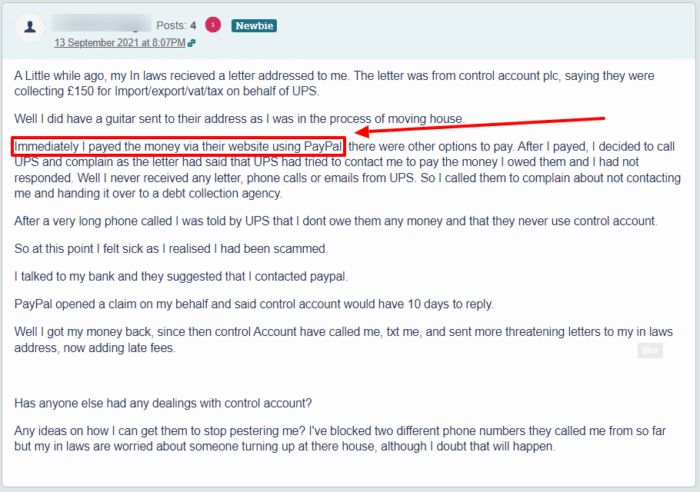

Take this example:

This whole situation could have been avoided if this person had asked for proof of the debt from Controlaccount before they paid!

Did They Prove Your Debt?

If Controlaccount has proved that you owe the debt, here are some key facts you need to know, including what rights you have.

- Controlaccount should only contact you at sociable times and cannot pester you with multiple calls

- They must not discuss the debt with your employer, spouse or anyone else without permission

- They must not apply pressure or use terms that you do not understand without simple and accurate explanations

- They must provide reasonable time for you to assess your debt solution options

Working Out a Payment Plan with Controlaccount Debt Recovery

One of the most straightforward ways of clearing your debt with Controlaccount is by agreeing on a payment plan with the agency.

This is one way to make sure the debt never escalates into court proceedings or repossession of your items.

The reassuring news is that Controlaccount expects you to try and arrange a payment plan if the debt is significant. These plans may or may not be available for all debts, but for greater debts, they are not expecting you to pay off the debt in one payment.

They will be willing to work out a plan that meets their client’s needs and keeps you financially stable going forward.

Sometimes they may even be willing to write off some of your debt if you prove that you’re unlikely ever to be able to afford it.

You can download our “write off my debt” template letter here.

If you need support to come up with a payment plan and to understand your situation, there are a number of fantastic charities and groups offering debt support in the UK.

Your Rights With Debt Collectors

It’s important to understand your rights when dealing with Controlaccount to prevent unfair treatment.

Here’s a quick table that explains what debt collectors can and can’t do. If you’d like to learn more, make sure to check out our detailed guide.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

Can They Repossess Your Home?

Absolutely not!

But Controlaccount field agents are allowed to attempt to visit you at your home. What you need to know is that these people are not bailiffs.

Our financial expert, Janine, says: ‘I understand that having a debt collector at your door can be scary, especially when you are already under huge financial stress. It’s crucial that you stay calm and know your rights. They have no power to enter your home or take any of your possessions.’

The only way an outstanding debt can end up in having your possessions and home repossessed is if they took you to court and won a possession order.

Only then could a team of law enforcement officers carry out repossession orders – not Controlaccount PLC.

Remember, Controlaccount is an agency trying to recover debts on behalf of FedEx, DHL, UPS, TNT and other companies. They have the same legal powers as these companies.

Are Your Controlaccount Debts Statute-barred?

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable.

It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window it will be enforceable for the duration of the CCJ.

If you think that your debt is statute-barred, you can use our free letter template to write to Controlaccount and explain. This won’t reset the 5 or 6 year timer!

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Is the Debt Not Statute Barred?

If your debt is not statute-barred, then the best plan is to try and pay off the debt.

The simplest method to do so would be to agree on a payment plan with Controlaccount – but this is not your only option.

In fact, the best option will depend on your circumstances, not what is the simplest solution.

The aforementioned debt charities will be able to guide you through the different options specific to your income and debts.

Can You Get a Debt Solution?

If you have unsecured Controlaccount debts that you are struggling to manage, you may benefit from a debt solution.

There are several options in the UK, so we recommend speaking to a debt charity for some free advice. These organisations will be able to take a detailed look at your finances and work out which solution will work best for you.

We have linked some charities that offer these services for free at the bottom of this page.

Debt Management Plan (DMP)

A DMP is an informal debt solution that lets you pay off your debts via a single monthly payment.

Because it is informal, it is not legally binding so you are not tied into a DMP for a minimum number of payments.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

How Do You Complain About Controlaccount?

If you think that Controlaccount has been unreasonable, behaved inappropriately, or harassed you, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Fortunately, the Controlaccount complaints procedure is quite straightforward.

Make your first complaint to Controlaccount so that they have the chance to sort out the issue themselves.

If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, Controlaccountmay be fined. You could even be owed compensation.

Will They Give Up Chasing?

After all that you might be wondering whether you can just wait it out and hope they stop chasing you.

Sadly, that’s probably not going to happen. Most debt collectors are persistent.

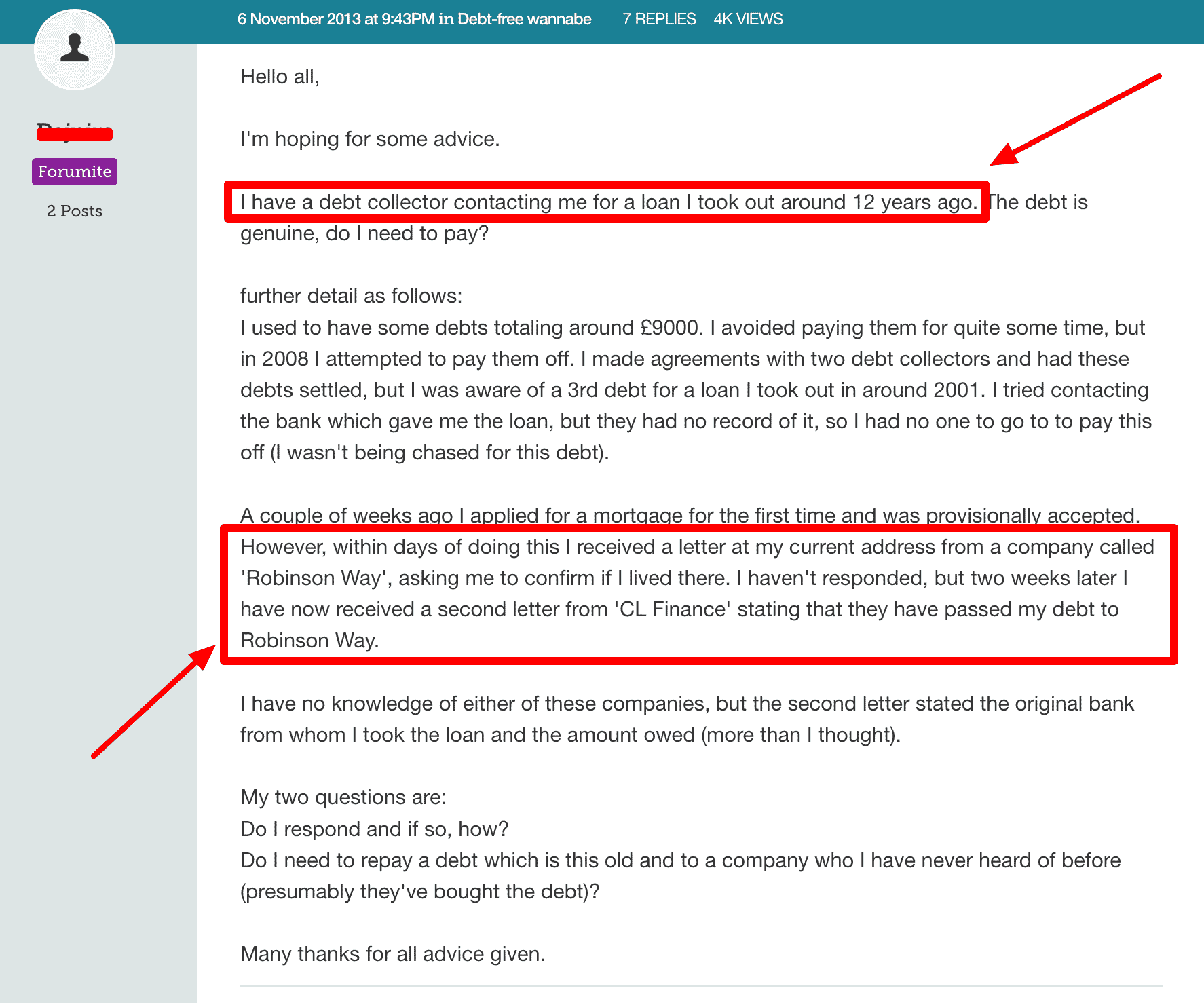

Source: Moneysavingexpert

As you can see Robinson Way starting to chase a debtor mere days after their mortgage application and a full 12 years after the debt was originally chased.

Other agencies like Lowell Group, Portfolio Recovery and Cabot Financial are constantly being accused of buying Statute Barred debts and then chasing people for payment.

Controlaccount (Control Account Plc) Contact Information

| Telephone: | +44 (0) 1527 386 606 |

| Website: | https://www.controlaccount.com/manage-account/faqs |

| Address: | Controlaccount plc, Compass House, Waterside Hanbury Road, Bromsgrove, B60 4FD |