County Court Judgement for Rent Arrears

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about falling behind on your rent and facing a County Court Judgement (CCJ)? You’re not alone.

Each month, over 170,000 people visit our site for advice on debt solutions. We know it’s hard to deal with debt, but money matters can be sorted out.

In this guide, we’ll discuss:

- What a County Court Judgement (CCJ) is and what it means for you.

- Understanding what rent arrears are and how to deal with them.

- The stages of eviction due to rent arrears.

- How to handle not being able to pay your rent.

- The ways you can possibly write off some of your debt.

Understanding your debt and knowing how to clear it are important steps. We’re here to help you.

What Happens if I Have Rent Arrears?

In today’s economy, it can be difficult to keep up with rent payments. From unstable income streams to unexpected bills and payments, finding yourself in arrears can easily happen. If you have rent arrears, make sure you contact your landlord immediately to discuss how you can pay. It might help if you tell them why you can’t pay in full straight away. Your landlord has the right to begin the eviction process, but you might be able to avoid this if you can give them a reasonable offer.

How Do You Deal With Rent Arrears?

If you are dealing with a large amount of rent arrears, you should look at your budget and figure out how much you afford for rent. Create a new payment arrangement that you can afford, and show your landlord. Make sure you are realistic with your budget. If you and your landlord reach an agreement, you will want to stick to this arrangement.

Even if your landlord rejects your repayment offer, or ignores your request, make sure you continue making the payments anyway.

» TAKE ACTION NOW: Fill out the short debt form

Can You Get Kicked Out for Rent Arrears?

A landlord can take steps to evict a tenant for rent arrears if they have a fixed-term agreement. However, it is often a long, drawn-out process. You might not even have to leave at all. It can be difficult getting to grips with your rights as a tenant, and your rights can differ depending on your tenancy type and where you live. However, if you are frightened about getting kicked out, get in touch with Shelter. If you live in Northern Ireland, you can contact Housing Rights.

Specialist Housing Advice Contact Details

| Housing Advice for England | Shelter | 0808 800 4444 |

| Housing Advice for Scotland | Shelter Scotland | 0808 800 4444 |

| Housing Advice for Wales | Shelter Cymru | 0345 075 5005 |

| Housing Advice for Northern Ireland | Housing Rights | 028 9024 5640 |

If you are facing homelessness due to eviction, contact your Local Authority for advice. They can advise you on emergency accommodation and how to apply for social housing.

Rent Arrears Eviction Stages

Before a tenant is evicted, a landlord has to follow the correct processes.

Section 8 Notice to Seek Possession

First, a landlord needs to give you a section 8 notice to seek possession. This notice will detail a date to leave, and a threat of legal action if you don’t vacate the property. At this point, you might be able to avoid eviction if you come to a repayment agreement with your landlord.

Legal Action

Whether you leave the property or not, if you have rent arrears the landlord is still in their right to pursue legal action. If they wish to do so, you will receive a claim form and a defence form. The defence form should be completed and returned within 2 weeks of the dates you got it. You will then receive a notice of review with a review date. If there is a court hearing, the judge could issue a possession order to permit the landlord to evict you.

- Outright possession order — you will be given a date to leave the property

- Postponed possession order — you can stay at the property under certain terms

- Suspended possession order — you can stay at the property under certain terms

If you break the terms of a postponed or suspended possession order, you will be ordered to leave the property.

Warrant of Possession

If you do not leave when ordered to do so, the landlord can apply for a Warrant of Possession. Once this has been granted, they can evict you with the help of a County Court bailiff.

Notice of Eviction

This is the final step in the eviction process. You will be served a notice of eviction. This notice will let you know when the bailiffs will repossess the property. As well as your rent arrears, the landlord can ask you to pay bailiffs’ costs and any legal fees incurred.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Rent Arrears Eviction Stages for Social Housing Tenants

The eviction process is similar for tenants in social housing. However, a social landlord has to follow a Pre-Action Protocol for rent arrears.

Notice to Pay and Possession Proceedings

If you live in social housing, the process of eviction begins once you’ve missed 8 weeks of rent. The process begins with them serving you a notice to pay. If you don’t pay or don’t reach an agreement, they can then apply for a possession order. At this point, the court will send you papers which need to be completed. You are not obliged to leave the property at this stage.

Possession Hearing

The next stage is the possession hearing. You could be issued one of the following by the judge:

- A suspended possession order — where you will need to meet certain terms if you want to continue to live as per the current housing tenancy

- An outright possession order — you must leave the housing tenancy when told to do so

Enforcement Action

If you break the terms of either of the two orders, the landlord can apply for a Warrant of Possession and your local authority could remove you from the premises with the help of bailiffs. You will also be issued a notice of eviction which will detail the date County Court bailiffs will arrive to repossess the property.

If you are kicked out, you will still need to pay rent arrears, as well as other costs incurred during the process.

Rent Arrears and Bankruptcy

Whether you are renting from a private landlord, a local authority or a housing association, you can usually stay in your home if you are up to date with rent payments and are declared bankrupt. Any rent arrears you may have been included in your bankruptcy, and court action can not be taken to recover the money you owe. However, you can still be evicted from the property. This is more likely to happen with a private landlord. Furthermore, it can be more difficult to find a private tenancy after declaring yourself bankrupt.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can You Get a CCJ for Rent Arrears?

Yes, but it is an uncommon occurrence because the process is lengthy and expensive. Many landlords prefer to simply evict the tenant and move on. When a landlord applies for a possession order on the property, they can apply for a CCJ against the tenant too. If you have been issued a postponed order or a suspended order, the CCJ will often be postponed or suspended too. Therefore, you don’t have to leave your home unless you fail to pay rent or break the terms in the possession order.

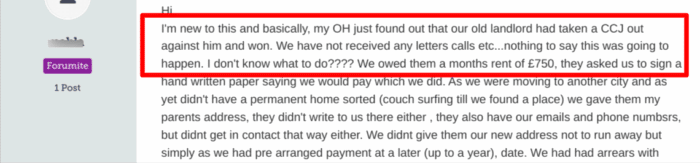

If you’re unsure if your landlord will apply for a CCJ without your knowledge, make sure you check your credit report regularly. The last thing you want is to be caught by surprise, like the Money Saving Expert forum user below.

What Happens if I Don’t Pay a CCJ for Rent Arrears?

If you don’t pay a County Court Judgement for rent arrears, your landlord can pursue enforcement to recover the debt. This can be costly for both parties. If the landlord knows you don’t have any assets, they may not deem it to be worthwhile.

Warrant of Control

By applying for a Warrant of Control, the local authority may allow CCJ bailiffs to seize assets from your address and sell them at auction. All proceedings will go towards your rent arrears. If the landlord goes down this route, the maximum amount they can recover from your tenancy is £5,000.

Attachment of Earnings Order

This order might be pursued if your landlord is certain you are employed. If an Attachment of Earnings Order is granted by the court, the landlord will receive repayments directly from your wages until they have retrieved the debt. Alternatively, you will be given the choice to pay what you owe in full.

Charging Order

If you own your own property, the landlord may apply for a Charging Order against you. This enables them to put a ‘charge’ on your home. In other words, if you sell your property, the proceeds of the sale will go towards the CCJ first.

How Far Back Can Rent Arrears be Claimed?

A CCJ can stay on your record for 6 years, and it begins from the first date you missed rent. If a CCJ is issued against you by the County Court, they can try to chase you for up to 6 years worth of rent arrears. Although it is possible to write off debts that are over 6 years old, the landlord will likely enforce the debt using several methods, such as sending bailiffs’ to your home to seize property.