Credit G Debt – Should You Pay Them?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

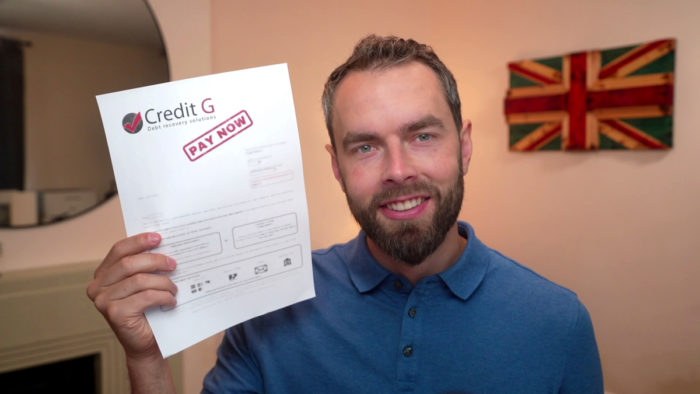

Have you just received a surprising letter from Credit G Debt Recovery? Don’t worry; you’re at the right place to find answers. Each month, over 170,000 people come to us for advice on dealing with debt issues.

In this article, you’ll learn:

- Who Credit G Debt Recovery are and what they do.

- How to respond if you receive a letter from them.

- What to do if you can’t afford to pay.

- How to check if your debt can go to court.

- Ways to manage or even write off some of your debt.

We know how confusing and worrying it can be to get a debt letter out of the blue. You might be wondering if you really owe this money or if you can ignore it. Our team has dealt with debt collectors too, so we understand your concerns.

We’re here to help you understand your options and make the best choice for your situation.

Here’s how you can deal with Credit G Debt Recovery.

Have you received a letter?

The most important communication you’ll receive when being chased by Credit G is their debt letter, officially a Letter Before Action (LBA). LBAs are letters that must be sent before a company is allowed to press ahead with legal action against you. They ask you to pay but warn that legal action will be taken if you don’t.

Sometimes these legal threats are real. Other times there isn’t a real chance of being taken to court (by their client!). But there is no way of knowing, so you should never ignore these letters!

What can you do instead of paying?

Instead of reading their letter and anxiously reaching for your bank card, you can ask Credit G Debt Recovery to prove you owe the debt. They can’t just say you owe it; they have to prove it with an agreement or contract you signed.

Until they send this you’re not obligated to pay. And if they ignore your request, you can inform a judge that they ignored you if ever taken to court. Keep a copy of your request!

To request this information use our free letter template. This template is all you need to create a structured and formal request for proof. It’s professionally written and 100% free for you to download.

Check to see if your debt can even go to court!

Before you ask for proof, you might want to check to see if you can even be taken to court over your debt. Some debts become too old to go to court to prevent the courts from having time-consuming backlogs.

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window will be enforceable for the duration of the CCJ.

If your debt is statute-barred, you can use my free letter template to write to Credit G and explain the situation.

If you are unsure about the status of your debt, you can contact a debt charity for some advice. Their advisors will be able to look at the debt in question, determine its status, and advise you on your next steps.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What if they prove I owe the money

If Credit G Debt Recovery replies with proof that you owe the money, it’s a good idea to pay the debt.

Remember that you can speak to them about personalised repayment plans if needed. The reason you may opt to pay is that they could take you to court. This could add further expense to the debt. You’ll then be subject to a court order to pay and have to pay anyway.

It’s a risk to continue to ignore their calls and letters in the hope they don’t take you to court.

Are they bailiffs?

Credit G is not a company of bailiffs. They can only chase you for the debt by calling you and sending you letters. Bailiffs would only get involved if you were taken to court and still refused to pay. This sort of situation should be avoided and usually can be.

The only thing Credit G Debt Recovery can do is ask you to pay and threaten legal action. They cannot come to your home and definitely cannot take any of your possessions.

Will it affect my credit score?

Yes, debt collectors like Credit G can affect your credit score, but not in the way that many people think.

Once you have missed a few payments or defaulted on an account – which negatively impacts your credit score, too – your debt might be sold to these collectors, it will appear as a second collection account on your credit file, and the original entry may be marked as ‘sold’ which doesn’t look good!

If they don’t add a second entry to your credit file, the entry for your original debt can be changed to add the debt collection company’s information.

While it is unlikely that they will do this for smaller debts, they have the legal right to.

These collection accounts will negatively impact your credit. They are visible for 6 years and will impact your ability to get credit or use some credit products during this time.

This is because companies use your credit file to see if you are a ‘high-risk’ customer – someone who might have difficulty paying their bills on time. If you continue not paying until you have a CCJ against you, you have had such trouble paying back your debt that someone had to go to court about it.

Understandably, companies are going to be reluctant to give you credit!

After 6 years, it is no longer visible on your credit report, and you should find it easier to get credit again.

You also need to be aware that any debt solutions that you use will also be visible on your credit file for 6 years, and your credit score may be affected. However, once these 6 years are over, your debt solution will no longer be visible, and you may find it easier to get credit again.

What if I can’t afford to pay?

So, Credit G have proved that you owe the debt and that it’s not statute-barred. But you can’t afford to pay. What do you do?

From my experience, now is an ideal time to consider a debt solution to help you avoid potential court action or financial hardship.

There are several different debt solutions available in the UK, so I recommend speaking to a debt charity as soon as possible. Their advisors will be able to look at your finances in detail and help you work out which debt solution will work best for you.

I have linked a few charities that offer these advisory services for free below.

Debt Management Plan (DMP)

A DMP is an informal debt solution that lets you pay off your debts via a single monthly payment.

Because it is informal, it is not legally binding so you are not tied into a DMP for a minimum number of payments.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.

If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How do I make a complaint?

If you think that Credit G Debt Recovery has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to Credit G so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, Credit G may be fined. You could even be owed compensation.

Other Debt Collectors to look for on your Credit Report

There are hundreds of debt collectors in the UK and they each collect for different companies.

It’s surprisingly easy to not notice that you’re in a debt collector’s crosshairs.

I’d suggest you spend time checking your credit report. If a debt collector purchases any of your debt, it will appear on your credit report.

Some of the biggest to look out for include Cabot, PRA Group, and Lowell.

So if you see anything relating to their names, then you’ll need to investigate further.

Credit G Contact Information

| Address: | Credit G Ltd., PO Box 3158, South Croydon, Surrey, CR2 6WY |

| Phone: | 0203 637 8408 |

| Website: | https://www.creditg.com/ |