Credit Solutions Ltd Debt Collectors (CSL) – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Facing a debt collector like Credit Solutions Ltd (CSL) can be worrying. You might be asking yourself, “Should I pay? Where did this debt come from? Can I afford to pay?” These are normal concerns.

More than 170,000 people turn to our website each month looking for advice on their debts, and research shows 64% of UK adults find interactions with current debt collectors stressful1. You’re not alone in this. We’re here to help.

In this easy-to-understand guide, we’ll explain:

- Who Credit Solutions Ltd are

- Why they might be contacting you

- How to know if the debt is really yours

- What the law says about debt collectors

- If they can take you to court

By the end of this article, you’ll have a better understanding of your situation. And you’ll know how to handle debt collectors and stay on top of your finances.

Remember, there’s always help available for dealing with debt. Let’s start exploring your options together.

Why do they keep contacting you?

Debt is a major problem and although this is great for debt collectors, as they get plenty of business. It is not good for those who suffer from debt problems.

There are all kinds of debt collectors. They may operate together with the creditor you have the debt with, or they may work completely independently. They are not the ones you have the original debt with, they work on behalf of the credit company.

Debt collectors can get a really good deal here, as they snap up the debt at a low cost, and they make money as soon as that cost is covers.

In many cases, debt collection agencies buy billions of debt annually at rock bottom prices – at an average of 10p to £1!2

Now, this will explain why they can be quite aggressive in their attempts to recover the debt. If they don’t get payments they lose money, but if they do, then they make a decent profit.

This has, unfortunately, led many debt collectors down the wrong path and to the point where they can become quite abusive towards debtors. They act this way as they are determined to get the debt paid, and it seems that this behaviour is quite widespread.

How do you know if this is really your debt?

Make sure you get them to prove the debt! If Credit Solutions Ltd have just suddenly contacted you from out of nowhere and you have never even heard of them before, you may be wondering it this is all legitimate.

Remember, you don’t have the debt with Credit Solutions Ltd, so there is every chance that you don’t recognise them. The debt will also be higher than you remember, if you do recall it, as there will be additional charges and interest on it.

The best thing to do in this situation is to write to Credit Solutions Ltd with a request for a copy of the credit agreement. You should not make any attempts to pay the debt, until you receive this from them.

You should write to Credit Solutions Ltd Debt Collectors and demand a copy of your original credit agreement. If they are unable to provide this you have no obligation to make any payment to them.

Follow my ‘prove it’ guide with letter templates and get them to prove that you owe the money.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Will they make you pay?

Not exactly. Credit Solutions Ltd can’t exactly force you into paying, and they shouldn’t try to do this, but if they sent you the credit agreement, and it is your debt, you should make an attempt to pay it.

You don’t need to pay it all straight away, although that would be the ideal outcome, but you can set up a repayment plan with them to pay it at a rate that suits you. There is the possibility of clearing your debt with a partial payment. Credit Solutions Ltd will usually agree to this if they will still make a profit.

Additionally, Janine, our financial expert, explained that while debt collectors can visit your home for payments, they cannot come to your workplace, act threateningly, force payment, or discuss your finances with others. If they violate these rules, you can complain.

Can they take court action against you?

Potentially. However, Credit Solutions Ltd Debt Collectors may say that they are a bailiff and they have every intention of taking you to court because of the debt you owe. You should not listen to this as it’s a lie. They are debt collectors, not bailiffs and they don’t have this power. If they are threatening you like this, they are in breach of the regulations.

To better understand the differences between bailiffs and debt collectors and what rights each one has, please check out the table below.

| Category | Debt Collectors | Bailiffs |

|---|---|---|

| Bank Account Access | Access your bank account – but only after a CCJ has been secured and not complied with. |

After the creditor has taken you to court over missed payments, bailiffs/creditors can apply for a third-party debt order to freeze and take control of a bank account. |

| Leniency | Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | If you tell them immediately that you are a vulnerable person, they must treat you with greater consideration and give you more time to respond to any contact. |

| Re-Selling Debt | Sell your debt if they are unable to collect payment from you. | Call and visit multiple times – there isn’t a set limit on how often they may contact you. If they can’t take any goods to sell or enter your property, they might return with a warrant and force entry to your property. |

| Visiting Your Home | Conduct home visits (on rare occasions) and knock on your door. | Conduct home visits and can enter without your permission as long as all of the correct legal steps have been taken. |

| Contact Hours | Contact you by phone or mail. They’re allowed to call whenever they see reasonable without constituting harassment, usually between 8 am and 9 pm. | Can visit your home anytime between 6 am and 9 pm (unless they have a court order that states otherwise). |

| Permission To Take Belongings | They cannot take anything from your home. They may only ask you to make a payment. | Take goods from inside and outside of your home once all legal steps have been taken. However, they cannot take essential items for domestic living or work purposes. |

| Court Actions | Threaten to take you to court by suing you for payment on a debt. | Can apply to the court to get permission to use ‘reasonable force’ to enter a home, which could mean breaking in. They have to give details to the court about how they will secure the property afterwards. |

Do not allow them to visit your home, as they don’t have any rights. In fact, they won’t have any powers even if they do turn up! If you are vulnerable and feel concerned about any visits from them, make sure you give the police a call.

» TAKE ACTION NOW: Fill out the short debt form

What the law tells us

The Office for Fair Trading (OFT, 2012) felt that the time had come for them to put in some guidelines for the sake of offering protection to borrowers. According to these, debt collectors such as Credit Solutions Ltd Debt Collectors have a responsibility to:

If Credit Solutions Ltd Debt Collectors are not following these guidelines, and are treating you unfairly, you would be able to report them for this behaviour to the OFT. In some cases, the OFT will even take away their license, if they deem it to be necessary.

You should be aware of some the typical lies that you might hear from Credit Solutions Ltd Debt Collectors. They may say that they are bailiffs or that they will take court action against you. Deceit is not permitted according to the regulations, and you would have a strong case for reporting them for this.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Have you considered an IVA?

If you have a lot of debt with numerous creditors, you may want to consider entering into an Individual Voluntary Agreement. This is pretty popular as with an IVA, you combine all your debt together and only make one monthly payment to everything. This not only saves you dealing with several creditors simultaneously, but you may also be able to write off a chunk of the debt.

Staying On Top Of Your Debts

One of the hardest parts about being in debt is that the industry isn’t at all transparent.

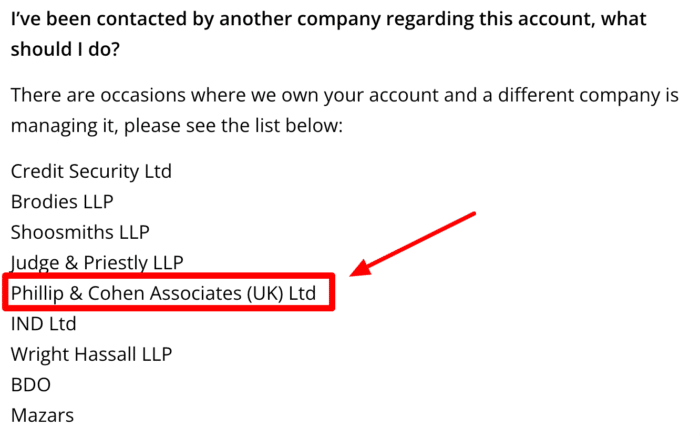

One common tactic used by Debt Collectors is contacting you under multiple names and addresses.

Sometimes, it’s for practical reasons, but even then it can be confusing and intimidating. So it’s important to try to keep a level head and research what’s going on.

Some of the biggest debt collectors in the UK operate under multiple names.

- Robinson Way will sometimes contact you under the name Hoist Finance.

- Cabot Financial Group recently bought Wescot Credit Services

- Credit Style communicate as both Credit Style and CST Law.

- Lowell Financial also owns Overdales and collects debts under both names.

In fact, in the case of PRA Group, they’ve been known to use multiple company names. As you can see in the image below.

If you’ve been contacted by a debt collector recently, it’s worth going through your post and emails to check that you haven’t missed anything, just in case they’ve started writing to you under a different name.