DWF Solicitors Debt Recovery – Do I Have to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Getting a surprise letter from DWF Solicitors Debt Recovery can be a bit scary. You might wonder where the debt has come from or if you really have to pay it.

You’re not alone. More than 170,000 people come to our site each month to get information about their debt problems.

In this article, we will talk about:

- How to figure out if the debt is really yours.

- What to do if DWF are not being fair.

- Ways to stop DWF from bothering you too much.

- How to set up a plan to pay back the debt.

- And even how you might not have to pay all of the debt.

We understand how confusing and scary it can be to get a debt collection letter. After all, nearly half of the people who are chased by debt collection agencies have experienced harassment or aggression1.

Don’t worry; we’re here to help you understand how to deal with DWF Solicitors Debt Recovery.

What if you don’t believe you owe the money?

DWF (and every other debt collection agency) needs to be able to prove that the debt they say is yours really is yours.

Under the Consumer Credit Act, you have the right to ask a creditor for a copy of your agreement and a statement of your account.

If they can’t prove the debt is yours, they have no choice but to mark the debt as settled.

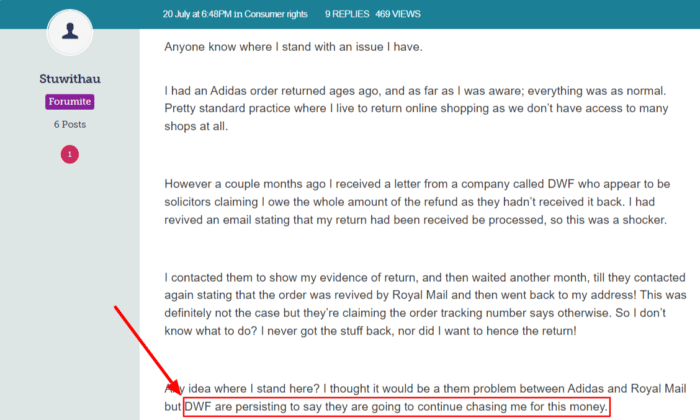

@Stuwithau on Money Saving Expert found himself being chased for money for a refund on an item he says he sent back.

This is where it pays to have as much evidence to support your claim as possible.

If you believe a debt isn’t yours, ask DWF to send you a letter proving the debt.

You may be able to use one of the UK’s debt solutions to manage your debt and stop contact with DWF Solicitors.

What happens if you ignore them?

We always recommend responding to debt collectors – even just to question the debt’s validity.

Remember, you have the right to request proof of the debt. They have to prove it or they can’t charge you.

If you ignore their letters and phone calls DWF could take you to court.

At court, a judge will decide whether you really owe the debt and could issue a court order forcing you to pay. The balance of your debt owed could go up due to fees and interest if you keep ignoring them.

If you get in touch and ask for some time to explore your options, they might pause any debt interest. If you do get a court summons, get advice from your citizens advice

Typical Collection Process

Understanding the debt collection process is crucial to prevent any unwanted situations and manage your finances in the best possible way.

The table below explains the debt collector timeline and provides useful advice. If you’d like to learn more about each of the key stages, please read our specialized guide.

| Stage | Actions | What you should do: |

|---|---|---|

| Missing one or two small payments | Calls and letters from the debt collector asking for payment. They may enquire about reasons for missing payments. | Contact the debt collector and offer to pay what you can. If you are struggling to pay the debt, get in touch with us to explore your options. |

| Missing large or multiple payments | Their contact will become more frequent, urgent, and threatening. | Contact the debt collection agency and offer to pay what you can. You may also make a complaint if you think the letters are a form of harassment. |

| Debt collector visit | After a few months, if the debt is significant (£200+) you will receive notice of a debt collector visit. They have to notify you before arriving. Debt collectors cannot take anything from your home – they may only ask for payment. | If a debt collector shows up at your home, ask them to show proof of the debt and their ID through a window. Do not open your door or let them in. You can arrange a payment plan with the debt collector, but make sure to get a receipt of this. |

| Court | If you still do not pay your debts to the original lender/debt collector agency, they will take you to court and either attempt to: – File a CCJ against you. – File an attachment of earnings order. – File a lawsuit against you. |

You must show up to your court date. From here, you can either dispute the debt, or the judge will likely suggest a manageable repayment plan for you. |

Remember that the easiest way to keep debt collectors from filing a CCJ against you is by contacting them and offering to pay what you can.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How long can they chase you?

For most debts, the time is six years (five for Scotland), although the time limit is longer for mortgage debts.

This is sometimes called the limitation period.

A debt collector may still attempt to pursue you after this time, but they can’t take legal action against you.

This is a statute barred and is why it’s worth looking at how long it’s been since you last paid money (and you technically do still owe it), but they can’t typically take legal action against you.

There’s a few options if you owe debt and don’t feel you have the finances to pay it back.

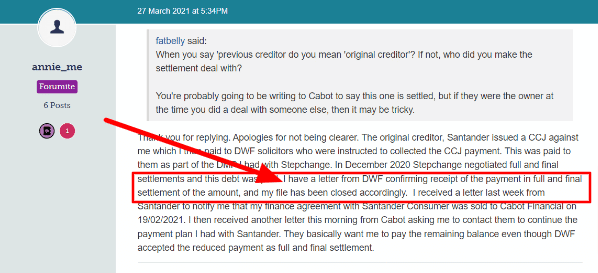

Here @annie_me on Money Saving Expert has owed money to Santander which was taken over by DWF and then solved through Stepchange. At some point it was also sold to Cabot financial.

Annie was issued a CCJ by Santander for her debt and after speaking to Stepchange was able to negotiate final payments. Although it looks like Cabot financial are now involved, she has all the paperwork to prove her files were closed accordingly.

Seeking help through Stepchange or MoneyHelper is a good idea. You should also keep all documentation to contest your debt.

Remember, if you are contacted by a debt collection agency, don’t ignore it.

Check if the debt is actually yours and how much you owe. Then consider which next steps work best for you and your finances. And do consider seeking help from from Step Change or Citizens advice.

» TAKE ACTION NOW: Fill out the short debt form

Is there a way to write off the debt?

If you can prove you’re experiencing financial difficulty and don’t have a viable way to repay, your creditor might agree to write off your debt.

Remember, though, no creditor is forced to write off your debt and will be more inclined to do so in particular circumstances, like if you’re considered a vulnerable adult, pensioner or the amount you owe is small.

You need to simply ask the agent to write off your debt by phone or in writing, supplying the creditor with a monthly budget showing all your monthly income and essential expenses.

There’s also the Statute barred, where the debt becomes legally unenforceable if it’s more than six years old (in England) or five years in Scotland.

After this time, the creditor can’t ask for a CCJ, forcing you to pay.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What about an IVA?

An IVA stands for an Individual Voluntary Arrangement (IVA). It’s a legally binding agreement between you and your creditors which states that you will pay back your debts to your creditors over a certain period of time to which they have agreed to.

Your IVA has to be approved by your creditors, after which it is filed at court and goes into effect.

Then, you’ll have to stick by the proposals presented in your arrangement throughout its entire period for it to be successful.

Only certain debts can be placed in an IVA, which is why you should always get specific advice to find out if an IVA is worth it for you.