Henriksen Limited – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

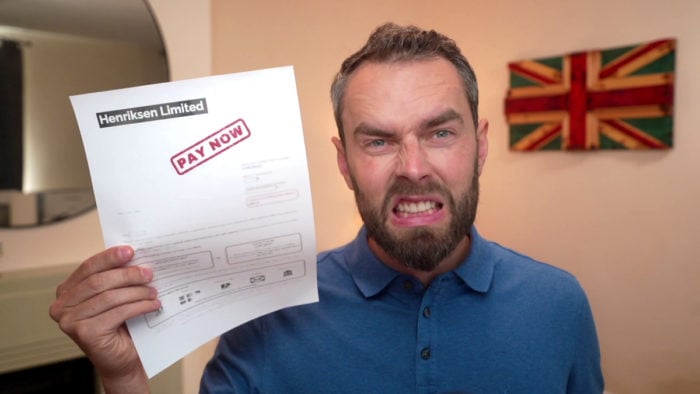

If you’ve received a letter from Henriksen Limited and you’re unsure what to do, we’re here to help. This article is meant to answer your questions and ease your worries.

We understand how you might be feeling. You might be wondering where this debt came from or if you really should pay it. It can be a bit scary, but remember, you’re not alone. Each month, over 170,000 people come to our website for advice on their debt problems.

In this article, we will help you understand:

- Who Henriksen Limited are and what they do.

- How to check if the debt they say you owe is really yours.

- What to do if you can’t afford to pay.

- What happens if you ignore Henriksen Limited.

- How you can stop them from bothering you.

We’re experts in dealing with debt collectors, as some of us have even been in your shoes. We know how it feels to face a situation like this. Let’s work together to figure out your best next steps in dealing with Henriksen Limited.

Debt recovery letters

Henriksen’s debt collection process will start by sending you a communication to let you know they are chasing the debt and to ask for payment. This communication has to be in writing. The letter will state the debt you owe and how to pay it. It will probably threaten legal action if you don’t pay by a certain date.

You’ll probably be given the option to discuss a payment plan to repay if you have financial difficulty. Or you could consider other debt solutions.

Request for Proof

If your debt isn’t statute-barred, you might still be able to get out of having to pay. You should reply to their letter with a request for proof you owe the debt. This can be easily done by using our free prove the debt letter template. Simply download the template, add your details and send it off.

Henriksen Limited must provide solid evidence that you owe the money they’re asking for. This usually means they have to show you a contract or credit agreement you’ve signed. If they’ve made a mistake by sending you a letter, they’ll realise this themselves after you have requested proof of the debt.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens if you ignore them?

If you don’t pay the debt then you might be taken to court. This will be a decision made by the company you owe, rather than Henriksen. The matter could escalate to court, or legal threats may just be a scare tactic to get you to pay.

If the matter does go to court and you lose, you’ll have to pay the debt or you could face debt enforcement action, such as a bailiff. Going to court and facing bailiffs will cause the debt to grow.

But before you decide to pay, there may be a way to avoid having to pay at all. Read on!

» TAKE ACTION NOW: Fill out the short debt form

Is your debt too old to be collected?

You’re only forced to pay a debt in the UK when the court orders you to do so. But some older debts cannot be taken to court to prevent clogging up the legal system. If your debt is older than six years and you haven’t made a payment or acknowledged the debt in writing in the last six years, your debt may be too old to be collected.

The proper term for this is a statute-barred debt. We’ve put together a complete guide on statute-barred debts so you can work out if your debt has become legally unenforceable. If it has, notify Henriksen and tell them you won’t be paying.

Should you pay them?

You don’t have to pay Henriksen Limited if your debt has become statute-barred. Depending on how they responded to your prove the debt letter, you may or may not have to pay them to avoid potential court action.

They proved I owe the money

If Henriksen proves you owe the debt, you should consider paying in full or agree on a payment plan. Alternatively, you might want to explore other debt solutions by speaking with a charity.

Ignoring payment requests after they provided evidence could lead to (expensive) legal action and even bailiffs.

They never proved the debt

If Henriksen failed to provide the correct evidence, you don’t have to pay until they do. Keep in mind that if it takes them a long time, your debt could become statute-barred.

If you’re taken to court over the debt, you can show the judge that you requested proof of the debt but it wasn’t provided. Keep copies of your letters. This can help you to win in court because Henriksen won’t have followed the correct process.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Online reviews

Henriksen Limited reviews online are split. Many businesses that use their services to get money from unpaying customers are happy with their work:

“I have been using Henriksen for my business for well over 3 years now. They have successfully reclaimed money owed to me 95% of the time. I have been very satisfied with the company and will continue to use them!”

- Deb the Web (Google Review)

Whereas those that receive payment requests from Henriksen are less pleased, often calling them a scam. But it’s important to remember that Henriksen Limited is a legal business, even if you don’t like what they do.

Other Debt Collectors

You should check for more outstanding debts that you may have with other companies or debt collectors. Here are four steps you could take:

- Check your credit report for other defaults

- Check your email and post for reminders or overdue notices

- Check the court records for CCJs against you

- Check your bank statements for the names of other debt collectors

There are hundreds of debt collectors in the UK and each works with different companies to collect debts.

For example, Cabot Financial have been known to collect for the DVLA while Lowell Financial and PRA Group buy debts from various credit card companies like Barclaycard.

If you see a name on your bank statement that you don’t recognise then you can search MoneyNerd to see if they’re a debt collector.

Henriksen Limited Contact Details

| Address: | Newlands House, Thornburgh Road, Eastfield, Scarborough., YO11 3YT |

| Phone: | 0344 411 3201 |

| Email: | [email protected] |

| Website: | https://hcollect.com/ |