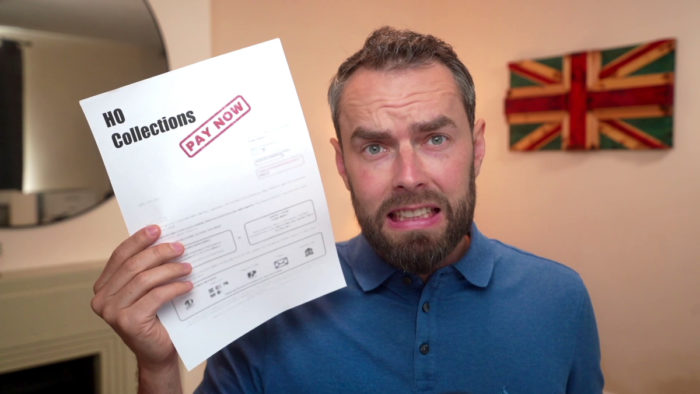

HO Collections Account Debt – Do You Need to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about an unexpected letter from HO Collections? You’re in the right place. Our site is visited by over 170,000 people every month for guidance on debt matters.

This article will help you understand:

- Who HO Collections Debt Collectors are.

- How you might beat HO Collections.

- Your possible choices to deal with this debt.

- The truth about your debt with HO Collections.

- How much debt is too much, and ways to legally write off your debt.

We know getting a letter from a debt collector can be scary. Our team has loads of knowledge about debt and some of us have even been in your shoes. But don’t worry, we’re here to help you.

Let’s take a closer look at your situation with HO Collections and explore your options together.

The Truth About Your Debt

What options do I have?

» TAKE ACTION NOW: Fill out the short debt form

More Data

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Checking for Other Debt Collectors

There are a lot of ways to get into debt. In fact, it’s not uncommon to owe money to several companies at once.

Perhaps you have a mortgage, a car loan, a couple credit cards and an item or two you bought on buy-now-pay-later schemes. It’s easy to lose track.

That’s why it’s important to regularly check your credit report and bank statements to make sure you haven’t missed anything.

If a debt collector has purchased your debt, it appears on your credit report.

Some of the debt collectors you’re most likely to come across are PRA Group, Lowell and Cabot Financial.