How Long can Debt Collectors Try to Collect UK?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you concerned about a sudden letter from a debt collector? You’re in the right spot. Every month, over 170,000 people visit our website seeking advice on debt issues.

In this easy-to-read guide, we’ll help you understand:

- Where the debt might have come from.

- How to check if the debt is real (if it’s not, you don’t need to pay!).

- Steps to question or even ignore the debt collector.

- Your choices to plan payments or even wipe off your debt.

Research shows that 64% of the people in the UK find dealing with debt collectors stressful1. We’ve felt the pressure, and we know it can be scary.

But don’t worry, we’re here to help you understand your options.

Can Your Creditor Chase Your Debt Forever?

According to the Limitations Act 1980, a creditor has six years to pursue their debt from you (or twelve years for certain mortgage shortfalls).

We should reiterate that for these six years to count, you must not have submitted a payment or made an acknowledgement of your debt to your creditor even once.

The limitation period does NOT count in the time during which you have been making payments to your creditor.

It’s also worth noting that if there’s a CCJ against you, there’s no time limit on how long a creditor could chase you for payment.

Plus, there are different rules for certain debts, for example, student loans.

» TAKE ACTION NOW: Fill out the short debt form

What is a Statute-Barred Debt and What Does it Mean for You?

A Statute-Barred debt refers to a debt that has now become unenforceable because the time that is given to a creditor to chase their payment has passed.

Keep in mind that this does not mean that you can ignore your creditors and/or debt collectors for six years and expect your debts to be magically written off.

The ‘limitation period’ starts from the last time you were in contact with your creditors.

This can mean anything from when you last made a payment towards your debt or the acknowledgement of your debt.

Thus, if your creditor is contacting you, ignoring them will not “start” your limitation period. Also, it only counts when your creditor is not attempting to get their payment from you.

The complete outline of how Statute-barred2 debts work is given in the Limitation Act 1980. Please keep in mind not to consider this act an easy way to write off your debts.

If your debt is legitimate and enforceable, then there’s no way you can use the law to get out of paying.

The act is in place to protect debtors from debt collection agencies which attempt to pursue non-enforceable debts. And to set out the legal rights of debtors in the UK.

Your Rights With Debt Collectors

Knowing your rights when dealing with debt collectors could make the situation less stressful.

That’s why we’ve created this simple table that explains what they’re allowed to do. For more information, make sure to check out our detailed guide.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

Keep in mind that if a debt collection agency keeps hounding you about a non-enforceable debt, you can report them to the Financial Conduct Authority (FCA) in the UK.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How Do You Know If Your Debt is Statute-Barred?

Here’s a quick checklist for you to figure out whether or not your debt is statute-barred and may offer a better understanding County Court Judgements (CCJs):

- You do not have a County Court Judgement (CCJ) registered against you by the creditor.

- You have not made a payment to your creditor or any debt collection agency that they may have hired in over six years. Please note that in the case of a different type of debt such as a joint debt, neither you nor your partner must have made a payment in the last six years.

- You (or your partner in the case of a joint debt) have not acknowledged the debt in writing in over six years.

If you meet ALL of these conditions, then that means that the limitation period has passed and your debt is statute-barred.

What Should You Do If You Know Your Debt is Unenforceable?

If your debt has become statute-barred, then that probably means your creditor has not contacted you in over six years.

Chances are that if they have not contacted you in six years, then they will not contact you in the future. If this is the case, then you’re lucky.

You have to do literally nothing at all.

We find it best to know how to handle debt collectors when they contact you after six years regarding your debt.

Here’s what you can do:

- Get a copy of your credit file.

- Write a letter to the creditor that is contacting you and inform them that the debt they are trying to pursue has become unenforceable. Be sure to use a service that confirms when your letter has been delivered so that you have proof that your creditor did indeed receive your letter.

- Keep in mind that you are the one in control. There is no need to panic if you know for a fact that the debt has become statute-barred. Proving that your debt is statute-barred is NOT your burden to bear. In fact, the ball is in your creditor’s court. They are the ones who need to prove that your debt is, in fact, NOT statute-barred.

Once you have sent a ‘prove it’ letter, do not feel as though you owe anything; it is down to the debt collector or credit to provide proof.

You don’t have to pay off a debt that can’t 100% be proven yours.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Does a Debt Being Statute-Barred Mean That It’s Written Off?

A debt being statute-barred means that if, for example, your creditor sues you in a court of law, you can defend yourself effectively.

It also means that your creditor(s) can’t hound you for payments if they have not been in contact with you for six years.

If a creditor persistently keeps trying to contact you AFTER your debt has become unenforceable, YOU can sue them in a court of law or report them to the Financial Conduct Authority (FCA).

You may be asking yourself “If I don’t have to pay the debt, isn’t that the same as the debt being written off?” Well, not exactly.

The debt still exists in your credit file and will continue to impact it negatively. It means you’d have trouble getting a bank loan, credit card or a mortgage until the CCJ expires.

If there’s no court action, debts typically don’t appear on a credit report after six years, which applies to whether a person settles the debt or not.

That said, CCJs remain on a credit report for six years, beginning from the date of a court judgement, regardless of whether a debt is paid.

It’s also worth noting that some debts won’t appear on a credit report, including certain utility debts.

Plus, certain types of debt, even if your debt is statute-barred, your creditor can still legally attempt to ask you to pay up using other actions that don’t involve a court order or judgement.

It can lead to a lot of debt issues that cause you stress and anxiety to say the least!

Is There Anything Your Creditors Can Do Once Your Debt Has Become Unenforceable?

As we mentioned earlier, after a period of six years, your debt becomes statute-barred but it is not necessarily “written off”.

This means that there are certain cases in which your creditors can still pursue you and ask you to make payments towards your debt.

A debt being statute-barred protects you from your creditors in a court of law.

Your creditors cannot get a money judgement or a CCJ against you and they also do not hold the power to make you bankrupt. However, the debt still technically exists.

There are examples of certain types of debt that do not require court action for them to take money from you even if your debt is statute-barred.

This applies to certain cases such as the Department of Work and Pensions (DWP), local authority benefit overpayments and HMRC tax credit overpayments.

The reason for this is that these creditors can easily deduct money from your wages to take care of your debts owed to them without ever having to go to court.

Understanding debt collection laws time limit

It is worth noting that if your creditor registers a County Court Judgement (CCJ) against you then your debt may be enforceable.

To clarify, a CCJ must be registered within the limitation limit for a debt to be statute-barred. It means that should a CCJ be registered after six years; the debt may not be enforceable.

You must also keep in mind that the Limitations Act 1980 does not cover all types of debts.

For example, debts that you owe to the Crown such as income tax are always enforceable. The Limitations Act 1980 prevents court action from being taken against the debtors.

Hence, a lot of debts such as Benefits Overpayments and Council Tax debt use other methods of collecting the debt that don’t involve court action. So, these debts may be able to be collected even if the debt had occurred more than six years ago.

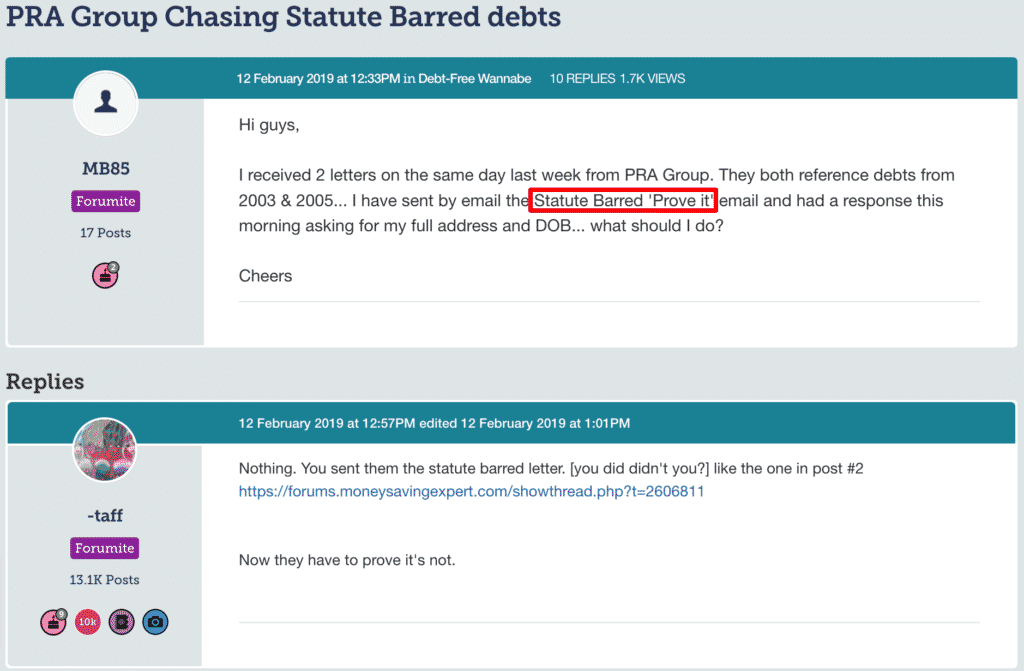

Dealing with Debt Collectors: A Case Study

The case study below illustrates an example of an individual using the actions above to deal with statute-barred debt requests from a debt collector such as PRA group.

Available Options for Repaying Debts

Please bear in mind that this is not the end of the world.

You have lots of affordable options to pay off your debt such as through an Individual Voluntary Arrangement (IVA), a Debt Management Plan (DMP) or a Debt Relief Order (DRO). These are some of the options for repaying debts.

If you aren’t sure about the status of your debt, you can contact a debt charity for some free advice. Their advisors will be able to look at your situation in detail and give you a plan moving forward.

Never feel pressured to paying your creditors even a penny more than you can afford.

And make sure you get the right advice from a debt adviser before you commit to any sort of repayment plan.

Glossary of terms

Creditor – the business/organisation that money is owed to

Debtor – the person who owes money

CCJ – County Court Judgement

FCA – Financial Conduct Authority

FOS – Financial Ombudsman Service