How Often Does Clearscore Update & When Exactly?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you puzzled about how often Clearscore updates and when exactly? This article is here to make things clear for you!

Each week, Clearscore updates its records so you can keep track of your credit status. But you might still have questions, right? Don’t worry; we’ve got you covered.

In this article, you’ll learn:

- What Clearscore is and how it works.

- How accurate the Clearscore credit score is.

- Why your Clearscore might not be changing.

- If Clearscore updates daily.

- How to write off some of your debt.

In this guide, we’ll also talk about when Clearscore updates and what to do if your Clearscore account didn’t update this week. We’ll also offer tips on how to improve your credit score and manage your debt.

We know that worrying about your credit score can be hard, but you’re not alone. Every month, over 170,000 people visit our website to understand their credit scores and find ways to deal with their debt.

So, don’t worry. We’re here to guide you on your journey to a better financial future.

Is ClearScore credit score accurate?

ClearScore uses the information held by Experian and can be considered fairly accurate.

It’s possible that your ClearScore account can hold inaccurate or outdated information, due to errors within credit reporting or delays in reporting.

The former might be more common than you think. Which? reports that 20% of people have a credit report error they might not be aware of.

Does ClearScore update daily?

No, ClearScore doesn’t update each day.

Read on to learn how fast ClearScore updates its records below.

When does ClearScore update?

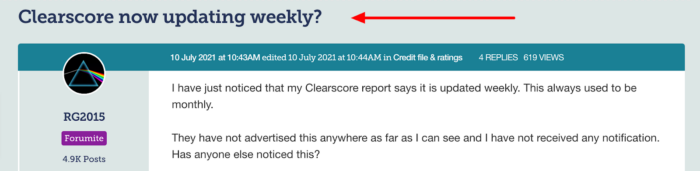

ClearScore now updates its records once per week! It used to only update reports once per month, but made this change in 2021 after high demand.

Previously, it would update each month on the same date that you signed up. For example, if you signed up on the 10th of January, it will update on the 10th of February – and so on.

This change caught a few by surprise:

Source: https://forums.moneysavingexpert.com/discussion/6281987/clearscore-now-updating-weekly

My ClearScore account didn’t update this week – why?

Remember, there could be a delay in companies and lenders reporting to Experian, which means you might not see new updates on your ClearScore report within the next week. And a new event doesn’t necessarily mean there will be a change to your credit score.

You’re only advised to get in touch with Experian or ClearScore if there has been a delay longer than six weeks. In this case, you’ll have to raise a dispute.

But don’t let ClearScore delays worry you if you’re applying for credit. Lenders will use credit reference agencies like Experian. They don’t consult your ClearScore account before making a decision.

So, as long as the information is updated on Experian, the lender will have the most up-to-date credit report on you.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What time does ClearScore update?

ClearScore themselves have published information about when they update records. But they have never publicly stated at what time of the day your records will be updated.

It could be midnight, but we aren’t hanging our hats on it.

» TAKE ACTION NOW: Fill out the short debt form

How long does ClearScore take to update?

ClearScore updates your report each week and this update is made instantly.

If you have any concerns, always contact ClearScore customer service, which has many positive reviews online.

Why is my ClearScore not changing?

Your ClearScore account may not show new information due to:

- A delay in the company reporting to Experian

- A delay in ClearScore extracting the information held by Experian

Companies and lenders may follow different processes and timescales when reporting events to credit reference agencies, which causes a delay in changes to your report. In general, lenders usually report every 30 to 45 days.

Then there is a potential delay between Experian showing new information and this information being collected by ClearScore. We discuss this in detail and answer your FAQs below.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How can you improve your credit score?

A good or excellent credit score can open doors when it comes to applying for credit. If you want a credit card, loan or even a mortgage, you’re going to want to pay attention to your credit report. That’s probably why you joined the ClearScore movement in the first place.

So, how can you update your credit score? The obvious answer is to keep up with your bills, get out of debt and avoid missing repayments. But there are some other tips we can share.

Simply registering on the electoral roll can improve your credit score slightly as it verifies your identity. And if you have a credit card, keeping your credit utilisation ratio below 30% can improve your score as it shows you don’t rely on all the credit you’ve been approved for.

Your credit utilisation ratio is the amount of credit you spend from the amount of credit you’ve been approved for on revolving credit, such as a credit card. For example, spending £300 of your £1,000 credit limit is a 30% credit utilisation ratio.

How often does ClearScore update (Quick recap!)

As of 2021, ClearScore updates your credit report once per week. This is faster than their previous update of once per month.