Here’s Whether You Should Pay Judge & Priestley Debt

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a letter from Judge and Priestley Debt Collection? Are you unsure if it’s real or if you must pay it in 2023? Don’t worry, we’re here to help.

Every month, over 170,000 people come to our website for advice on debt matters. We understand how confusing and scary it can be to get a debt letter.

In this easy-to-understand article, we will tell you:

- How to find out if the debt is really yours.

- Why Judge and Priestley Debt Collectors may be contacting you.

- If you can ignore them or need to pay.

- How they might change the way they deal with you.

- Ways to stop them from bothering you too much.

Our team knows a lot about debt because some of us have had debt letters too. We understand how you feel, and we’re here to guide you.

Read on to find out more about Judge and Priestley Debt Collection and how to handle them.

Why you are being contacted?

You may not realise this fact, but debt is a major problem in our society. Debt collectors, such as Judge And Priestley Debt Collectors come in a variety of forms; many debt collectors are independent, some work together as part of the company you have the original debt with, such as credit card companies (sometimes hiding their real identity – see below), and believe it or not, there are even debt collectors who work independently. All debt collectors have the same end goal in mind, and that is to get you to pay up!

The way they all work is pretty similar. They buy up the debt from the company you have taken out the credit with, and they get a good bargain with it. They could end up paying only £1,000 for a debt worth £5,000! This is why it is such big business, they can make a tidy profit, if they manage to collect the payments. There is no real care or concern about your situation, but there is a desperation to get the money. If they don’t get payments, they lose money in the end, which is why they can be so eager to get hold of you. Even if you are in a dire situation, they don’t particularly care, the only concern is that they get the payments.

» TAKE ACTION NOW: Fill out the short debt form

Is this really your debt?

You could be wondering whether this debt is really yours. In which case, you should take steps to establish the origin of the debt, together with an understanding of the total costs of the debt. It is probably that the debt, if this does exist, is much higher than you remember, due to the various charges and interest. It could be so inflated that a seemingly small debt, has became quite large!

If you want to ensure that the debt is correct, and the cost is accurate, you may want to write to Judge And Priestley Debt Collectors and request to see the credit agreement. If they tell you they won’t be able to give you this, you would not be required to pay the debt.

Follow our ‘prove it’ guide with letter templates and get them to prove that you owe the money.

Should you pay?

As long as you have received confirmation that you owe the money, you should take steps to pay it back. If you can afford to, it is best to clear the debt, but if that is not possible, then set up a repayment plan. Judge And Priestley Debt Collectors should be willing to work with you, and your individual circumstances to develop an appropriate repayment structure.

Entering into an IVA

You may be able to write off some of your debt, if you enter into an Individual Voluntary Arrangement (IVA). With an IVA, you sign up to an agreement which means you are committed to paying a set amount each month towards your debt. Any remaining debt is written off, after around five years.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

The legislation

The Office for Fair Trading (OFT, 2012) put guidelines in place, in response to the escalating debt problems. These are some of the rules that Judge And Priestley Debt Collectors and other debt collectors must not adhere to:

- They have a responsibility to ensure they treat debtors fairly. This includes refraining from using aggressive practice, or any unfair/improper behaviour.

- They must ensure transparency and clarity in all information they provide to borrowers. They must not attempt to mislead anyone.

- They are responsible for showing consideration to debtors, who may be in a difficult financial situation.

- They must take the debtors’ circumstances into account, before determining appropriate action.

If you believe that Judge And Priestley Debt Collectors are trying to intimidate, hassle or abuse you, or they are just failing to follow the necessary guidelines, you would have a case for reporting them to the OFT.

It is easy to make a complaint about Judge And Priestley Debt Collectors, you can complete the details on this online complaint form.

Always make sure you know who Judge And Priestley Debt Collectors, as some debt collectors are known for lying to customers. They may say they are working externally to the company you have the debt with, when they are actually working with them.

Will They Give Up Chasing?

After all that you might be wondering whether you can just wait it out and hope they stop chasing you.

Sadly, that’s probably not going to happen. Most debt collectors are persistent.

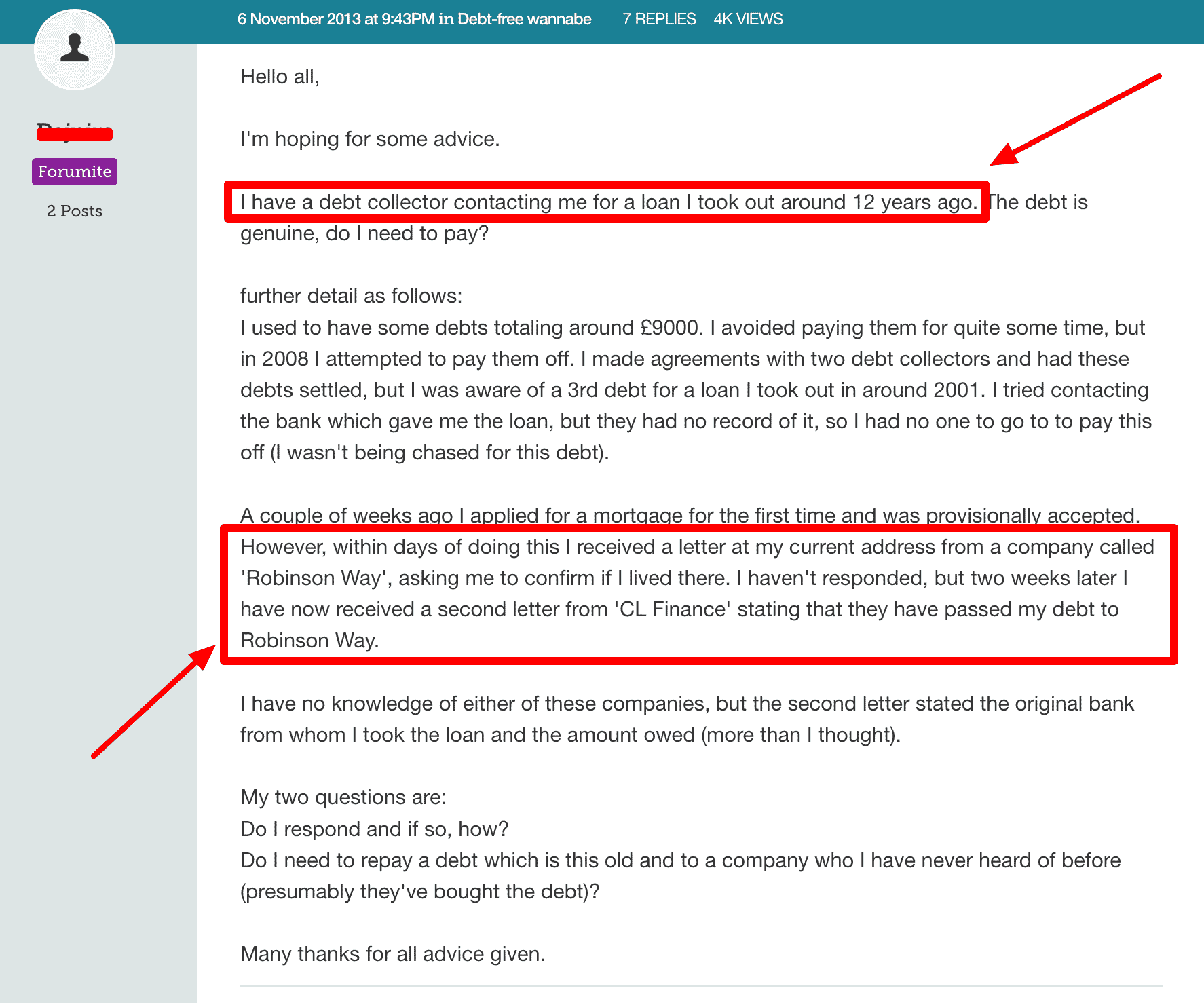

Source: Moneysavingexpert

As you can see Robinson Way starting to chase a debtor mere days after their mortgage application and a full 12 years after the debt was originally chased.

Other agencies like Lowell Group, Portfolio Recovery and Cabot Financial are constantly being accused of buying Statute Barred debts and then chasing people for payment.

Judge & Priestley Contact Details

| Phone: | 020 8290 0333 |

| Fax: | 020 8464 3332 |

| Address: | Justin House, 6 West Street, Bromley, Kent BR1 1JN, DX 117600 BROMLEY 7 |

| Email: | [email protected] |

| Website: | https://www.judge-priestley.co.uk/ |

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Summary

When it comes to Judge and Priestley, debt collection is another part of their business. Rather than being their sole business. They are legal experts, which can make the debt recovery process for the debtor that little bit harder to go through. With clients that are largely borough councils, it comes as no surprise that many of the people that they are chasing are in debt with their rent or council tax and perhaps come from an area that is already struggling financially. Which can make the job all the harder too.