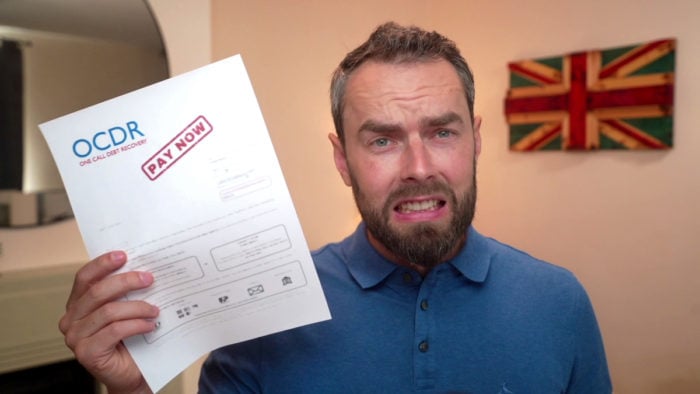

One Call Debt Recovery – Should You Really Have To Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you puzzled about a surprising letter from One Call Debt Recovery? Do you wonder if you really need to pay or if the debt is real? Don’t worry; you’re not the only one. Every month, over 170,000 people come to our website for information about their debt problems.

In this article, we will show you:

- How to find out if the debt is truly yours.

- What to do if One Call Debt Recovery keeps calling.

- How to stop them from coming into your home.

- How to make them prove your debt.

- And how you might be able to write off some of the debt.

Our team knows what it feels like to have debt collectors chasing after you. It’s scary. But we have the tools to help you figure out what your options are.

Let’s dive into how you can deal with One Call Debt Recovery.

Received a Letter?

If you have received a One Call Debt Recovery letter, it is best not to ignore it. Even if you think there has been a mistake, ignoring a One Call Debt Recovery debt letter could make the debt grow because of interest and further financial fees.

If you disagree that you owe them money, you can speak to them directly or use our prove the debt letter.

Make Sure They Prove Your Debt

You might be fully aware of your unpaid debt with One Call Debt Recovery. Even if you are, you are legally allowed to request proof that you owe the debt.

You should do this by writing One Call Debt Recovery a letter asking for proof of the debt.

It is likely that One Call Debt Recovery will send you a signed agreement of your insurance policy. At this point, you should assess your debt solution options.

But requesting proof is good for many reasons:

- It bides you time to think about your next step

- It makes One Call Debt Recovery realise their own mistakes (if applicable)

- It proves admin errors (see above)

- The debt does not have to be paid without proof

Remember, You Have Many Debt Solutions!

Most of the debts with One Call Debt Recovery are not significant because most of their insurance policies only last 12 months. This means you could pay it off in one payment and avoid any additional admin fees or penalties.

But for people who have lost their main source of income, paying the One Call Debt Recovery debt could be an issue. The good news is that One Call Debt Recovery state on their website that they take a personal approach to debts and can help you come up with a way to pay it off over many months.

This is just one of many ways to get out of One Call Debt Recovery debt. Speak with the fantastic UK debt charities to learn more.

» TAKE ACTION NOW: Fill out the short debt form

The #1 Way to Not Pay

Sometimes One Call Debt Recovery may not contact you about an unpaid debt for years. This happens due to clerical errors or because One Call Debt Recovery have had significant problems trying to track you down. You may have been abroad for some time.

If your debt is more than six years old and you haven’t made any payments towards the debt in the previous six years, you might not have to pay.

Statute barred debts are old debts that One Call Debt Recovery and any other collection company cannot ask the courts to look at. Because the courts are too busy with recent cases, they have banned old debt cases from being considered.

It could be the case that your One Call Debt Recovery is statute barred and not legally enforceable. If this is the case, you need to send One Call Debt Recovery a letter to tell them.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Stop the Calls

If One Call Debt Recovery is making repeated calls asking you to pay the money, you can make them stop by providing them with your contact references. One Call Debt Recovery must abide by these contact preferences or they may be committing harassment, which is a criminal offence.

If you are being harassed by One Call Debt Recovery, you can make an official complaint to the Financial Ombudsman. You can rightfully complain even if you owe One Call Debt Recovery money.

Can They Come into My Home?

One Call Debt Recovery are an in-house team trying to get you to pay. It is important to establish the difference between recovery companies and bailiffs. A recovery company is much like an administration business which will track you down and ask for payment.

If they fail to get you to pay, they can apply to the courts for the debt to be legally enforceable. If you continue to not pay after the courts have told you to, One Call Debt Recovery could request bailiffs to come to your home and ask for the money – or repossess your valuable of equal worth.

Bailiffs will try to come inside you home peacefully. This would only happen if you failed to engage with One Call Debt Recovery and discuss your options.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How to Make a Complaint

If you believe that One Call Debt Recovery have treated you unfairly or illegally, either by harassment, pressuring techniques or something else, you can complain.

First, make your complaint directly with One Call Debt Recovery and see how they respond. If you are still unsatisfied, you should complain to the Financial Ombudsman.

One Call Debt Recovery Contact Information

| Post: |

One Call Insurance Services FAO OCDR, First Point, Balby Carr Bank, Doncaster, DN4 5JQ |

| Phone: | 01302 554261 |

| Email: | [email protected] |

| Website: | https://www.onecalldebtrecovery.co.uk/ |

Other Debt Collectors to look for on your Credit Report

There are hundreds of debt collectors in the UK and they each collect for different companies.

It’s surprisingly easy to not notice that you’re in a debt collector’s crosshairs.

I’d suggest you spend time checking your credit report. If a debt collector purchases any of your debt, it will appear on your credit report.

Some of the biggest to look out for include Cabot, PRA Group, and Lowell.

So if you see anything relating to their names, then you’ll need to investigate further.