Ophelos – Everything You Need to Know

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

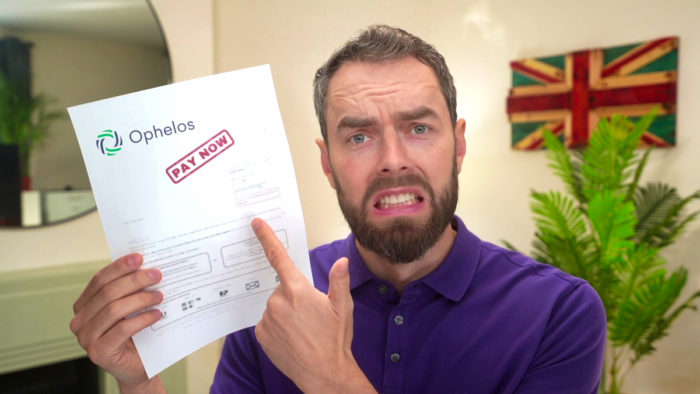

If you’ve received a letter from Ophelos Debt Collectors, it can be worrying, but don’t worry. Over 170,000 people visit our website each month seeking guidance on debt issues, so you’re not the only one.

This article will help you understand:

- Who Ophelos are and what they do.

- How to check if the debt they claim you owe is true.

- What to do if you can’t afford to pay.

- Options to reduce or even write off your Ophelos debt.

- The steps to take if you’ve been contacted by Ophelos.

We’re experts in dealing with debt collectors. Some of us have even been in your shoes and know how stressful it can be. So, we share this advice based on real-life experience.

Let’s help you understand your options and rights when it comes to Ophelos and their debt collection methods.

Have you been contacted by Ophelos?

Ophelos might contact you in different ways, depending on what contact information they hold. They could call, text, email and even write letters asking for a payment or to discuss a payment plan.

Unlike other debt collection agencies, these communications probably won’t be too frequent or harassing. But they are likely to still send a Letter Before Action. This is an intimidating letter that asks you to pay or expect legal action. These letters are designed to make you worry so you give in and pay quicker.

What happens if you ignore Ophelos?

If you ignore Ophelos the situation can go one of two ways:

- Ophelos’ client will take you to court and a judge will order you to pay. You might then have to deal with bailiffs and pay their fees, or face other forms of debt enforcement action.

- Ophelos’ client won’t take legal action and you’ll continue to be contacted or communications may stop.

You never know how the matter will progress, so it’s best to assume you’ll be taken to court if you ignore Ophelos.

» TAKE ACTION NOW: Fill out the short debt form

So, should you pay your Ophelos debt?

To avoid any chance of litigation you can pay your Ophelos debt or agree on a payment plan with Ophelos if the amount owed is too much for you at once.

However, there are also things you can do that might get you out of having to pay Ophelos anything. There are also things you can do to make Ophelos realise that they’re chasing the wrong person.

We discuss these alternative options below!

You can check the debt is enforceable first

Before you pay Ophelos it’s time to check if the debt is still enforceable. Many debts are no longer enforceable after five or six years, also known as statute-barred. If you find out that the debt they’re asking you to pay isn’t legally enforceable anymore, you should let Ophelos know and ask their client to write off the debt.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

You can ask Ophelos to prove the debt too

When the debt is still enforceable, you can ask Ophelos to prove you owe the debt. They state on their website that they provide information about the company they’re working for and the amount owed. But this isn’t enough!

They also have to send you the proof you owe it, which usually means a copy of a credit agreement or contract you signed and then defaulted on. If they cannot provide this information then you’re not obligated to pay.

This is a great option if you need some additional breathing space, although Ophelos seem to offer this already. But it’s an effective reply if you want Ophelos to realise they’re barking up the wrong tree.

If Ophelos don’t send proof but then you get taken to court, you should provide the judge with a copy of your request for proof which went unanswered.

Ophelos proved your debt – should you pay now?

Ophelos might eventually reply to your request for proof with sufficient evidence. This would be a scan of an agreement you signed, which you later defaulted on. If they do this, you should probably consider paying to avoid legal action.

Remember, they welcome payment plans and you may even want to consider a debt settlement offer instead.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Ophelos reviews online

Ophelos currently have 4.5 stars on Trustpilot, which is an exceptional score for a debt collection agency. These types of businesses usually get bombarded with negative reviews from unhappy and frustrated debtors.

That is somewhat still the case as the first review below shows, but most of the reviewers echo the statements of the second review:

“Hassling me for money I don’t owe. These are stressful times for people. These companies should be sure they are chasing money that is actually owed before sending their letters out.”

- Dave (Trustpilot)

“Contacted me recently as a debt been passed on, spoke to Stuart and Shannon via email – although they couldn’t help me further very pleasant to deal with. Wasn’t bombarded with calls and very understanding.”

- Emma L (Trustpilot)

Ophelos Contact Information

| Address: | 9 Appold StLondonEC2A 2APUnited Kingdom |

| Phone: | 020 3318 2823 |

| Email: | [email protected] |

| Website: | https://ophelos.com/ |

Discover more about debt collectors here

More help in dealing with debt collectors can be found on MoneyNerd or by calling debt charities. Further answers to common questions are on our debt info centre.