Rundles Enforcement Agents Debt – Pay the Bailiffs?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Rundles Enforcement Agents might be contacting you about a debt. If this is happening, don’t worry. Every month, over 170,000 people come to our website seeking guidance on their debt problems. Citizens Advice estimate households have around £18.9 billion in unpaid bills like council tax and utilities1, so you’re not alone.

In this article, we will explain:

- How to find out if the debt Rundles are asking about is really yours.

- Who Rundles Bailiffs are and why they want to talk to you.

- Ways to stop Rundles & Co bailiffs from bothering you.

- How to deal with a visit from Rundles Bailiffs.

- Steps to take if Rundles take your things.

Being in debt can be scary, especially when people like Rundles Enforcement Agents are asking for money. We know how this feels because some of us have been in your shoes before. We want to help you find a way out of this hard situation.

Let’s dive in to explore your options and find the best course of action.

Why Do They Want to Speak to You?

If you are being contacted by Rundles & Co bailiffs, you might be wondering why they want to speak to you.

As a legitimate organisation, you should not ignore contact from them. Instead, you should find out what they want, as there are various reasons why they might be getting in touch with you. These include:

The way it works is the organisation, company, or person you owe the debt to will hand it to Rundles & Co bailiffs to take care of, usually because you have not been in touch with them to sort out the debt.

This may go a long way to helping you understand why you might not recognise them. These are some companies they will chase you on behalf of, and you might recognise one of these names:

Companies like Rundles & Co bailiffs will purchase the debt from these companies, and often this is bought in bulk. They buy the debt for a fraction of the value of the debt, and they only start making money when they collect the payments. This is why they can be quite persistent in their attempt to get you to pay back the debt you owe.

But other times, they are paid to chase the debt by their clients – your original creditor. You may find that they are less likely to accept low offers in these circumstances.

So, Rundles Enforcement is a legitimate company. If you hear from them, you might need to check your finances for any outstanding balances.

How to Deal with Contact

If you are contacted by Rundles Bailiffs and you are not sure what to do, these are some things to bear in mind:

Speak to them

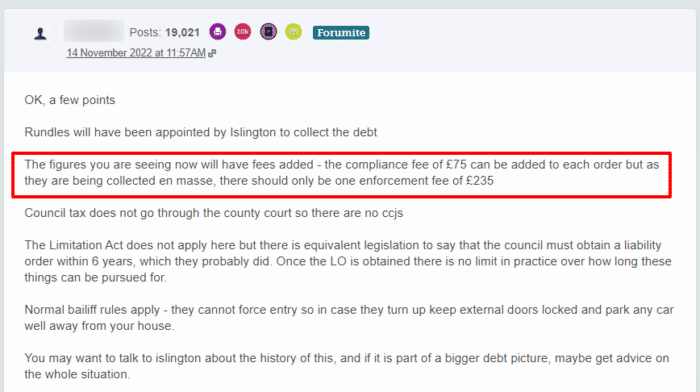

It may seem tempting to just ignore the contact from Rundles Bailiffs in the hope that they will just disappear. This is not the case, they won’t just disappear, so there is no point in ignoring them. As they are enforcement agents, they may charge you an extra fee as they need to deal with the debt. These fees include:

You should always respond to any contact from Rundles Bailiffs, even if the debt doesn’t belong to you. If you speak to them, they’ll be less likely to take action and visit your home. Speak to them and find out what the debt is, and make sure it is yours.

Our financial expert, Janine Marsh, advises on letting a bailiff into your home: ‘It’s crucial you check who they are before you open your door. Ask for their certificate through the letterbox or a window.’

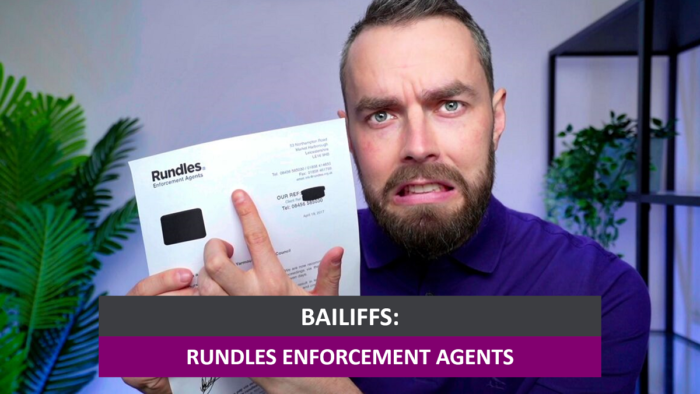

There are lots of examples of debts having fees added online, including debts being chased by Rundles Enforcement.

This forum user has kindly responded to a query and broken down the possible fees that have been added to the debt. They also offer very good advice at the bottom – speaking to a debt charity for some advice is always a good idea.

Is it your debt?

The first step, if you are sent a letter which states that you owe the money, is to make sure it is correct. Debt verification is a step that too many people skip.

If you don’t recognise it, it could belong to someone who lived at your address prior to you moving in, or there could be an error with the name. Alternatively, you may have already cleared the debt.

You can use my free ‘prove it’ letter template to write to Rundles Enforcement and ask for proof that you are liable.

Remember that you are in no obligation to pay for a debt that can’t be proven to be yours.

Is it enforceable?

For older debts, you might need to be aware of the statute of limitations.

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window it will be enforceable for the duration of the CCJ.

If your debt is statute-barred, you can use my free letter template to write to Rundles Enforcement and explain the situation.If you are unsure about the status of your debt, you can contact a debt charity for some advice. Their advisors will be able to look at the debt in question, determine its status, and advise you on your next steps.

Pay it back

If you receive confirmation that the debt belongs to you, and there is evidence of this, you should pay the debt back. If you pay the debt off, Rundles Bailiffs will stop contacting you and if you can’t pay it, you should set up a repayment plan. This will not only get them off your back, and save you a lot of stress, it will also save you from getting a visit from them. Always ensure you get receipts for any payments you make to the company.

Whatever you do, it is always best to speak to Rundles Bailiffs and be honest about your financial situation. If you set up a repayment plan, and for any reason, you are unable to make a payment, you should give them plenty of notice to let them know.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How to Deal with a Visit

You do not need to let the bailiffs into your home, despite what they might tell you. It is only in extreme cases they can actually enter your home, such as if you have criminal charges you have not paid, or you have tax debts.

They should also have paperwork to back this up, and if they don’t have this, you should not let them in. In extreme cases, they may go to the trouble of getting a locksmith to enter your property, but they do not have permission to break the door.

If Rundles Bailiffs turn up at your home, you should always ensure you ask them for identification. This will prove that they are authorised to enter your premises. These are some types of identification:

If you are worried about answering the door to get this information, you can just ask them to pass it through the letterbox or under the door. You should inspect them closely, including ensuring they are not out of date, and that all the information is accurate.

StepChange found that 90% of people who have been visited by a bailiff in the last 2 years identify as vulnerable. With over 50% reporting depression and more reporting stress and anxiety2.

» TAKE ACTION NOW: Fill out the short debt form

If there is no proof that they can enter your home, you have the right to demand that they leave, and you should agree to contact the Rundles Bailiffs head office to make a payment or to get a plan in place. If the debt isn’t in your name, you should ask them to leave, and you can contact the head office.

If you do owe the debt, you can be assured that Rundles Bailiffs will continue to try and contact you to get payments from you. It is not worth ignoring the debt.

If you are unsure of the rights and responsibilities that Rundles Enforcement have, you should contact a debt charity for some free and specific professional advice.

Do They Have Any Powers?

As they are an authorised enforcement agent, Rundles Bailiffs do have legal powers with regards to your debt. You have certain rights as well, it’s not all about them, and you should know what they can and can’t do.

Unfortunately, bailiffs like Rundles Bailiffs can visit your home and demand that you pay the debt you owe. They may have the right to enter your home and take assets to sell, if you are unable to pay back the debt. It is not advisable to refuse to pay them and tell them they can’t enter your home, as in these circumstances, they might end up removing your car, or other assets from outwith your home.

If Rundles Bailiffs do visit your home, and enter the premises, they might take some of your prized possessions, including your games consoles, expensive jewellery, and TV’s etc. – f you have failed to pay criminal fines, or your income tax, you may find that bailiffs will force the entry to your home. There are certain things that bailiffs cannot do when it comes to entering your home, and these include:

Please check out the following table to learn more about what bailiffs can and can’t do.

| Bailiffs Can | But They Can’t |

|---|---|

| Call and visit your home multiple times, any day of the week. | Visit your workplace (if you are not self-employed) |

| Take items from your home. These items have to be considered ‘luxury’. | Take essential items from your home. This includes beds, clothing, and work equipment. |

| Use ANPR technology and DVLA information to locate your car and take it. | Enter your home without permission unless they have a warrant to force entry for a CCJ. |

| Peacefully enter your property. | Harass or threaten you. |

| Issue notices to those who owe a debt. | Take items that belong to someone else. However, they may be able to seize jointly owned property. |

| Offer to conduct a Virtual Controlled Goods Agreement (rather than in-person). This will typically be offered to vulnerable people. | Sell goods they have seized at auction until seven clear days have passed. |

If you have any queries or concerns about Rundles and your own circumstances, you can contact a debt charity for some free debt and legal advice. The following organisations offer these services for free:

How to Cope if They Take Your Belongings

If you have allowed Rundles Bailiffs to enter your home and they have taken some of your belongings to cover the debt you owe, don’t worry, as all is not lost. Asset retrieval is possible – you can still get your things back.

You can recover your goods by paying the debt quickly, but you need to make sure you do this before they get sold off. If you can’t afford to do this, you may be able to set up a repayment plan to pay it off, or buy the items back.

It is important to be aware of the legal procedure which Rundles Bailiffs must follow, and if you find that they have failed to do this, you may be able to get the belongings back. You may want to contact Citizens Advice to for some free advice on how to deal with this.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Is There Any Way of Stopping Them?

The agents from Rundles & Co bailiffs may be extremely persistent in their quest to get payment. This is quite common among these types of companies. They will usually send letters and make calls to get your attention, and in more extreme circumstances, they might even turn up at your home.

It can be tempting to just ignore them, but this won’t help. It is better to deal with the issue and speak to them. As they are bailiffs, Rundles & Co bailiffs will often show up at your home with court documents or to give notices or summons.

They cannot just turn up though, they must give you notice and this should be at least 7 days. If you want to avoid this kind of situation, it is best just to pay off your debt, as this is ultimately what they want you to do.

There are things that Rundles & Co bailiffs can’t do, and these include:

If you wish to contact Rundles, you can check the letters they have sent or take a look at the company’s website to get the details you require.

If you contact them, it will help to increase your ability to resolve the matter and save yourself a lot of time and stress, as well as saving yourself from the costs of them visiting your home.

You may be in a situation where the debt isn’t even yours. In this case, you may request that they provide proof and give confirmation of the debt. The Financial Conduct Authority’s guidelines have more information on this below.

How do I Complain?

If in doubt, you might want to check out the Trustpilot reviews of Rundles, as you will see that the reviews are less than favourable. You will find words such as ‘bullies,’ ‘threatening,’ and ‘mistreated.’

If you think that Rundles Enforcement has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to Rundles Enforcement so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, Rundles Enforcement may be fined. You could even be owed compensation.

You can also make secondary complaints to the Civil Enforcement Association (CIVEA) if you think that Rundles has broken any of their rules.

Rundles Bailiffs Contact Number

References

- Citizens Advice – Debt Statistics and Bailiff Issues

- StepChange – Creditor and Debt Collector Conduct

Schedule 12, Tribunals, Courts and Enforcements Act, 2007

Part 1, Regulation 10, Certification of enforcement agents, 2014.