Severn Trent Water Debt Collection – Do I Really Have to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Getting a surprise letter from Severn Trent Water Debt Collection can be a shock. You might be asking, “Do I really have to pay?” You’re not on your own. Each month, over 170,000 people come to our website for help with questions about debt. In this article, we will explain:

- Who Severn Trent Water Debt Collection is.

- How to know if their claim is real.

- The right way to answer a debt letter.

- Steps to deal with debt collectors.

- What might happen if you don’t pay.

We know this can be a tough time. Some of our team have had to deal with debt collectors too. We’re here to help you understand what to do next. With our guidance, you can find out if you need to pay this debt and how to handle it if you do. Stay with us to learn more.

Why did I get a Letter from Severn Trent Water Debt Collection?

The most likely reason that you received a letter is that you are behind on payments with them.

They explain on their website that after a certain number of payments have been missed, and a lack of contact from you, they may move the debt to a debt collection agency.

This depends on the payment plan you are on.

How do you respond to a debt letter?

There are a few ways to deal with debt collectors. One of them is to not respond straight away.

Give yourself time to think, look at what options you have available and respond once you are fully informed on the subject.

What is a Prove the Debt Letter?

If you think that the letter has been sent to you by accident, then you can dispute it by asking them to prove that you are the person in debt.

At this stage, they then need to prove it. There’s a chance you may be the wrong person, and they would then allocate it to the person it should have been sent to in the first place. If you don’t believe the debt is yours, don’t pay anything until they have proved your debt.

Should I Pay the Severn Trent Debt Collection Letter?

Whether or not you should pay depends on your personal details, and whether the debt is yours. If you know the debt is yours, then you should make every effort to pay. If you’re struggling to pay the amount in full, debt collection companies are normally more than willing to set up a payment plan with you.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How to Deal with Debt Collectors

Some argue that the best way to deal with them is to respond as quickly as possible. This way, you can gauge the situation, and get as much information out of them as possible.

The free Government Debt Scheme might be useful at this stage for those who want more personalised assistance.

What Happens if I Ignore Severn Trent Water Debt Collection?

This is unlikely to make it go away. They will start attempting to make contact. If they are unsuccessful, after a period of time (that depends on your payment plan) of not paying, they may hand it over to a Debt collection agency.

This might be a good time to learn about whether a debt is written off after 6 years.

Do Unpaid Debts Ever Disappear in the UK?

This depends on the situation. It changes for everyone. This might be a good opportunity to learn two related points around this subject:

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Severn Trent Water Debt Collection Review

Over on Trustpilot, Severn Trent water debt collection currently has mixed reviews.

Their customer service has been rated highly with many 5-star reviews. Whereas their payment plans and details relating to payments have received between 1 to 2 stars.

This would suggest that they are reasonable communicators. So, if you feel you need to get in touch with them they are likely to handle the situation reasonably well.

How do I make a Complaint about Severn Trent Water?

In their PDF, they explain that the following steps should be taken to make a complaint:

- Firstly, you can try contacting Severn Trent Water directly either by

- Email at [email protected]

- Write a letter to Severn Trent Water, Customer Care Team, PO Box 409, Darlington, DL1 9WF

- If you are still not happy after direct contact, you can request them to review it and they will get back to you within 10 working days. They have a “Guaranteed Standards Scheme” for when they don’t get back to you in that time frame. This means that you might be able to get some money from them. This is in section 9 of their Guaranteed Standards Scheme

- After this, if they still haven’t helped. You can contact

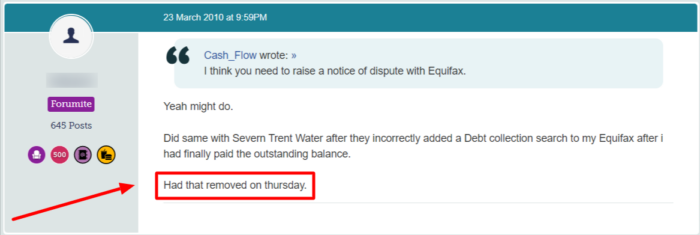

When the author of this comment wrote, this company has made mistakes in the past.

But, in support of the review earlier, their customer service amended this mistake quite promptly.

This shows that rather than ignoring things in the hope that they go away, tackling them head-on can resolve things faster than you might think.

Image src: The Money Saving Expert Forum

Information on debt collectors and some details on how you might deal with them could be helpful here.

Conclusion

We hope that you are now more informed about what choices are available to you. This is a difficult situation, but don’t give up hope yet!

Here are a few of the options we covered that might be worth further exploration:

- Declaring yourself Bankrupt

- Arranging an Individual Voluntary Arrangement

- Approaching a Debt Charity if you want help with anything

- Finding a professional who can help you on a personal basis

- Looking into the free government debt scheme might help too

Whatever direction you choose, we wish you the best. Thank you for reading, and be sure to check out some of the related links below.