Shoosmiths Debt Recovery & Collection – Do You Have to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’ve just got a letter from Shoosmiths Debt Recovery & Collection, you might be feeling concerned.

But don’t worry, we’re here to help! Each month, more than 170,000 people come to our website to learn about debt. You’re not on your own.

In this article, we’ll answer your questions:

- Who is Shoosmiths Debt Recovery?

- Why are they contacting me?

- Do I have to pay them?

- What if I don’t know this debt?

- How can I deal with this?

We know how you feel. Luckily, we’ve got loads of data on Shoosmiths debt recovery. We’ll use this to give you the best advice.

Let’s get started!

Why are they contacting me?

The debt collection industry is booming. Debt collectors like Shoosmiths will purchase debt from a lender for often as little as 20% of the face value of what is owed. They then collect the money that is owed and keeping a profit when the payment is made in full.

Shoosmiths Debt Collection may be getting in touch with you because they have purchased debt that you owe to another lender and now they now manage (and chase payments for) that debt.

But they don’t always buy debt!

Sometimes they are employed by your creditor to chase you on their behalf. In these cases, they don’t purchase your debt at all.

» TAKE ACTION NOW: Fill out the short debt form

What if I don’t recognise the debt?

What happens if you have been contacted by Shoosmiths Debt Collection and you don’t recognise the debt? In this case, you would need to find out where the debt came from.

Don’t just pay the debt if you don’t recognise it, as it could be inaccurate or sent to the wrong person. The value of the debt is likely to be inflated by charges and fees, but if you are not sure if you owe it, ask for confirmation.

There is no reason why Shoosmiths Debt Collection should not be able to provide you with evidence of the debt.

You can write to Shoosmiths Debt Collection and request that they provide you with a copy of the original credit agreements. If they refuse to provide this, or they say they don’t have any evidence, you would be within your rights to withhold payment. You could even be entitled to receive a refund, if you have already made payments to debt you don’t owe.

Follow our ‘prove it’ guide with letter templates and get them to prove that you owe the money.

You can also use this letter to request the original agreement from your creditor. This might be useful if they have employed Shoosmiths rather than transferring your debt to them.

If your debt is old and you haven’t paid anything towards it for a while, you may need to get some advice.

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window it will be enforceable for the duration of the CCJ.

Any of the charities that I have linked at the bottom of this page will be able to help you work out if your debt is enforceable or if it is statute-barred. Speaking to them won’t reset the 5 or 6 year timer on your debt.

Received confirmation? What to do next!

If you have received evidence from Shoosmiths Debt Collection that the debt belongs to you and it is accurate, your best course of action would be to just repay the debt.

If you are unable to do this, you could speak to them and suggest a suitable repayment plan. They will usually be willing to come and go with you, as long as you are willing to repay your debt.

Will They Take Me To Court?

If you refuse to pay or ignore Shoosmiths Solicitors Debt Recovery, you may end up in court. Usually, this will mean that they will get a County Court Judgement (CCJ) against you.

A CCJ is an order from a judge that states you have to pay the debt. This means that the court agrees with your creditor, and you owe the money. But just because you have a letter threatening legal action does not necessarily mean that you will end up in court!

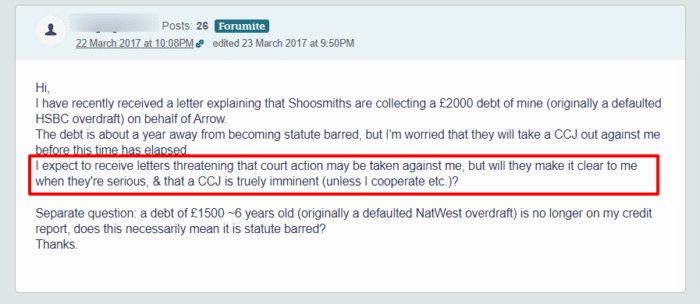

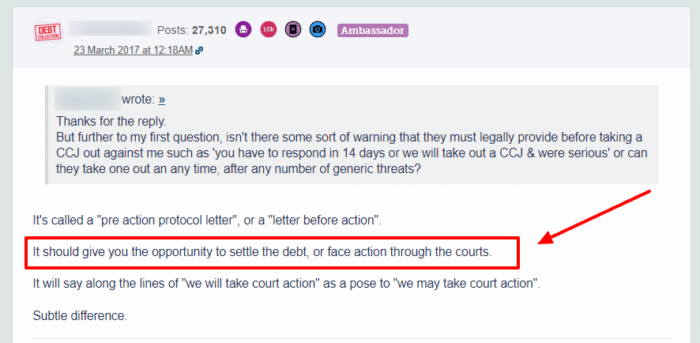

You may find that you get letters hinting at court action unless you pay. You’ll get several of these and different opportunities to pay before they actually begin legal proceedings because court is expensive.

As this reply points out, your final warning before court action will be specific.

If you are facing potential court action, you need to get legal advice. The debt charities that I have linked at the bottom of this page will be able to offer your free and unbiased advice and legal support based on your specific situation.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What else should you know?

If you are going to be able to defend yourself against Shoosmiths Debt Collection, you should know more about them. These are some points you should be clear about when dealing with debt collectors and how they operate.

They may receive a bonus

You should know that Shoosmiths Debt Collection agents will usually receive a bonus for the money they collect. They may have targets to achieve and this is why you will find that they are more than a little persistent when trying to get the funds. This isn’t an excuse for them to bully or harass you into paying though. Regardless of whether they receive a bonus or not, they should treat you fairly at all times, and if they are failing to do this, you would be within your rights to make a complaint.

They could automate their calls

It is relatively common for debtors to just ignore the calls they receive from debt collectors. This just makes your life more difficult though, as they will keep trying to pursue the debt. You may even find that they will use automated technology to try and get hold of you. If your phone is ringing every half an hour for example, it is highly likely that there is automated technology in place, rather than an agent just continuously calling you. The line may even be quiet when you do answer, as it is a form of intimidation. They want to hassle you into paying the debt, regardless of your circumstances.

You should aim to keep track of the calls and when they take place, as they could be breaching the guidelines. In this case, you would have every right to report them and there is the potential that they would lose their license.

When the friendly attitude changes

It is common for debt collectors to start off the conversation by being friendly, but this can soon take a turn when they understand you don’t have the means to pay back the debt. They may be completely unempathetic to your situation, and might even be downright rude to you. This is unacceptable behaviour, and could be deemed as bullying behaviour. They are using these tactics to try and intimidate you and to wear you down. You should keep a calm demeanour despite this treatment, and stand up for yourself, regardless of how difficult that can be at times.

They may discuss your debt with others

Debt collectors are not permitted to discuss your debt with anyone else, but some may try this tactic. They may phone your work and speak to a colleague, or your partner might answer the call and they may just discuss it with them instead. This is not permitted and is illegal behaviour. It is a breach of the guidelines and the privacy laws.

They may lie to you

Some debt collectors may even lie to you about the debt, and they may say that they are a bailiff who plan to visit your home in an attempt to recover the debt. This threatening behaviour is against the legislation, and they are not permitted to tell lies to try and get the payment, but unfortunately, many do this. In some cases, they may even threaten you with criminal prosecution. It is imperative that you deal with your debt, but you should be aware of the potential lies.

You should not feel threatened by the behaviour of debt collectors. If you feel that you are at risk from debt collectors, you should report them to the police.

How Do I Deal With Harassment?

If you feel that Shoosmiths is harassing you or behaving in an inappropriate manner, you can make a complaint. Fortunately, the Shoosmiths Debt Collection complaints procedure is quite straightforward.

Breaching any of the Financial Conduct Authority’s (FCA) guidelines is grounds for a serious complaint.

Make your first complaint to Shoosmiths so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, Shoosmiths Solicitors Debt Recovery may be fined. You could even be owed compensation.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can I Get a Debt Solution to Write Off My Debts?

If you have unsecured debts that you are struggling to pay, you may benefit from a debt solution. You may even be able to write off some of your debts with one of these debt management solutions!

There are several debt solution options in the UK, so I recommend speaking to a debt charity for some free advice. Their advisors will be able to take a detailed look at your finances and make sure that you are opting for the best solution for you. I have linked a few charities that offer these services for free below.

Keep in mind that there are other debt solutions available that don’t write off any debt. These are informal agreements like a Debt Management Plan (DMP) or a more formal debt consolidation agreement. If you would like more information on either of these options, you can speak to a debt charity.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

Checking for Other Debt Collectors

There are a lot of ways to get into debt. In fact, it’s not uncommon to owe money to several companies at once.

Perhaps you have a mortgage, a car loan, a couple credit cards and an item or two you bought on buy-now-pay-later schemes. It’s easy to lose track.

That’s why it’s important to regularly check your credit report and bank statements to make sure you haven’t missed anything.

If a debt collector has purchased your debt, it appears on your credit report.

Some of the debt collectors you’re most likely to come across are PRA Group, Lowell and Cabot Financial.

Shoosmiths Debt Recovery & Collection Contact Details

| Website: | https://www.shoosmiths.co.uk/ |

| Email: | [email protected] |

| Switchboard: | +44 (0) 3700 863 000 |