SSE Debt Collection – Should you Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you anxious about dealing with SSE debt collectors? You’re in the right place to get help. Each month, over 170,000 people come to us for advice on debt problems. We understand being unable to pay energy bills can be very worrying, but don’t fret; we’re here with lots of useful information for you.

In this guide, we’ll explore:

- The way to handle SSE debt collectors.

- What happens if you don’t pay your SSE energy bill on time.

- If you could reduce some of your SSE debt.

- Who the SSE debt collectors are.

- How an outstanding SSE debt might affect your credit score.

We’ll also talk about ways to save energy, help available for your SSE energy bill, and how to legally get rid of too much debt. We know these are hard times, but always remember, you’re not alone, and we’re here to help you through it.

Let’s get started and discuss your options.

What Happens If I Don’t Pay My SSE Energy Bill?

Your energy supply could be disconnected or you could be forced to have a prepayment meter fitted if you don’t pay your SSE energy bill.

If you haven’t paid what you owe, or come to an agreement about how you’re going to pay it, energy companies like SSE have the right to take enforcement action.

There are regulations set out by Ofgem when it comes to disconnecting a person’s energy supply.

That said, there are lots of things that could be improved concerning energy debt and debt recovery. Misconceptions lead to avoidance and fear. But when you know your rights and how to deal with debt collectors, it can make the situation less stressful.

In addition to the measures above, you’ll still have to pay your outstanding debt. The amount you owe will normally be a factor in how SSE chooses to pursue the debt as they have several options available.

If the amount outstanding is relatively low, SSE may opt to add it to the meter and allow you to gradually pay it off. However for larger debts, SSE will want you to either clear it in full, or be paying instalments as part of an agreed plan.

SSE Energy debt management could be an effective way of getting an account back in order.

If you haven’t been in touch with SSE to discuss how you can repay what you owe, your case will probably be referred to their debt collectors.

The debt collectors will then contact you directly to discuss repayment of your SSE energy bill.

Who Are the SSE Debt Collectors?

SSE debt collection isn’t done in-house; they use a company called Advantis Credit Limited. Advantis are one of the biggest debt collection agencies in the country and tend to be very assertive when they are chasing payment from customers.

I’ve talked before about Advantis and their approach, so it’s important that you understand your rights before getting in touch with them. Advantis Debt recovery techniques can be harsh, but they must follow the law when contacting you.

In short, understanding the Advantis and SSE partnership could help resolve your energy debt problem.

Advantis are legitimate SSE debt collectors but they aren’t bailiffs. And owing money to SSE isn’t a criminal offence.

Dealing with debt collectors can be difficult but they are obliged by law to be reasonable, and not to act in an aggressive manner.

You shouldn’t be scared about contacting Advantis even if you can’t pay the full debt. Their goal is to get repayment and working with you to find an affordable repayment plans with SSE debts.

In short, discussing the various solutions with you is their best chance of achieving that.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Do I Have to Pay the Debt Collectors for SSE Energy?

As mentioned, Advantis, the debt collection agency for SSE, aren’t bailiffs so you don’t have a legal obligation to talk to them, or to offer payment. However, they aren’t going to disappear and if you ignore them, the chances are the enforcement action will rapidly escalate.

If you don’t pay your SSE balance and don’t come to an agreement with the debt collectors, the matter could be referred to court. The court has the power to issue a CCJ which opens the possibility of a bailiff visit.

Bailiffs are not the same as debt collectors, and they have the right to remove items from your home to sell. It’s not a good idea to allow your energy debt to proceed as far as bailiff action as your options will be more limited.

To avoid this, contact the debt collectors to discuss how you will repay the SSE debt. Before you speak to them make sure you are clear about what you can afford as this will make it easier to reach an agreement that you’re happy with.

If you’re not sure whether you owe the amount they’re asking you to pay, don’t be afraid to request proof. Our free MoneyNerd template is perfect to use for this purpose. Once you have proof that the debt is genuine, you can proceed with confidence.

Remember, there are debt collection laws UK that debt recovery companies must follow.

» TAKE ACTION NOW: Fill out the short debt form

What Happens If I Can’t Afford to Pay the SSE Debt Collector?

If you can’t afford to pay the SSE debt collector in full you should still contact them anyway. If you ignore them, the matter will escalate to court and enforcement action will probably be taken.

Advantis, or any other SSE debt collection agency, will want to work with you to start the ball rolling on payments. If this is only a small token amount at the moment, they may still be prepared to halt further enforcement action as you’ve shown that you’re willing to repay the debt.

Plus, you could agree to renegotiate the repayments as your finances improve.

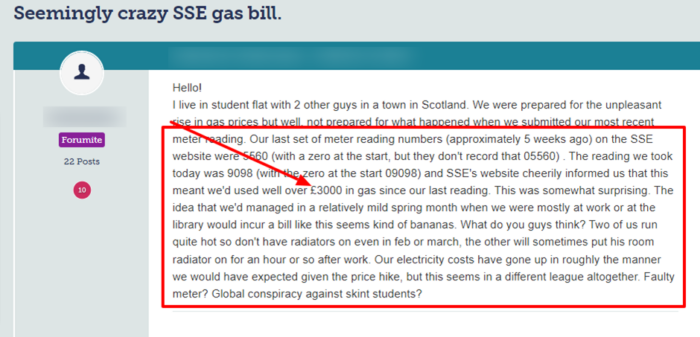

As this message posted on a popular forum shows hefty bills can be scary even if there’s the possibility of an error having been made.

Source: Moneysavingexpert

However, debt collectors are not obliged to accept your offer of repayment. They can refuse a repayment schedule and proceed with court action.

That said, debt collectors want to get the debt paid with as little expense and effort as possible. Going to court and getting bailiffs is time-consuming and costly. This will be a last resort for your SSE debt.

Contacting debt collectors

Before you contact the debt collector, draw up a budget showing your income and outgoings. Sharing this document can help to prove to the debt collector that you are doing your best to repay what you owe.

No matter how bad things are financially, doing nothing is the worst option. The debt won’t disappear if a debt collection agency is involved and you could end up facing bailiff action. It’s far better to work out which UK debt solutions could be best for you.

What other options are there?

If you can’t afford a repayment schedule there are other options which may be suitable for your circumstances. These include an IVO, Debt Relief Order or bankruptcy.

So, let’s delve further into these options. An Individual Voluntary Arrangement (IVO) is an agreement you enter into with creditors. It’s an arrangement to pay off your debts over a set period. The length of an IVO is usually five years.

A Debt Relief Order (DRO) works well if you have low-level debt plus a few assets. Bankruptcy is a last resort and could allow you to start afresh. However, seeking independent expert advice is best before going down this route.

That said, it’s best to contact a debt adviser before choosing a debt solution because entering the wrong one could worsen your situation.

You can get free, impartial advice from debt charities such as National Debtline and StepChange, among others.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

SSE Contact Details

| Phone: | 0345 071 9886 |

| Website: | https://sse.co.uk/ |

Is There Any Help Available for My SSE Energy Bill?

Many households around the country are finding their energy costs hard to meet. They have always been one of the biggest household expenses and prices have been rising. Today, there’s financial aid for energy bills that people can’t afford.

There are several energy grants which are available which can help with energy debt. These regularly change, and you may find that you’re eligible now, even if you didn’t qualify before.

If you speak to the provider, SSE Customer Support should be able to let you know if they have any schemes that could help you. The Citizens Advice Bureau and charities such as National Debtline and StepChange can also provide impartial help.

Here at MoneyNerd, you’ll also find lots of articles about managing your energy costs and other expenses in our Debt Centre.

Energy-saving measures to reduce bills

As well as seeking debt advice, considering energy-saving measures to reduce future bills is worthwhile.

Consider looking at some energy-efficient appliances or improving your home insulation.

You could also switch to a more affordable tariff. Plus, there are several government schemes which include a Green Homes Grant. So, I suggest you check out SSE Energy Tariffs to find one that meets your needs.

Being in debt can leave you feeling overwhelmed. But there’s always help out there whether you discuss a situation with a trusted friend, financial adviser, or a leading UK debt charity.

In short, you shouldn’t hesitate in reaching out to get the support you need to get back on track.