Can You Walk Away From a Civil Enforcement Officer?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about a Civil Enforcement Officer (CEO) approaching you because of debt? Don’t fret; you’re in the right place. Each month, over 170,000 people seek advice on debt matters from our website.

In this easy-to-read guide, you’ll find:

- An understanding of what a Civil Enforcement Officer is.

- The legal limits of a CEO’s job.

- How you might deal with a CEO.

- Ways to get help with your debts.

- Tips on how you could possibly reduce some debt.

Our team comprehends the stress of dealing with debt, as some of us have been in similar situations. We understand how important it is for you to know your rights and options when a CEO approaches you.

Let’s learn more about your rights and how to manage your debts effectively.

Why Might a Civil Enforcement Officer Approach You?

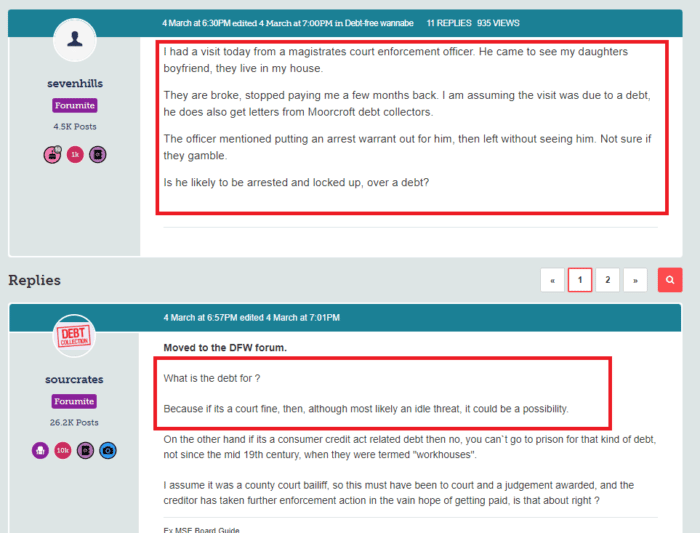

If you have debt problems, you might end up with a collection agency such as PRA Group or Cabot Financial chasing you for payment.

Once these types of collection agencies have exhausted the tools they have at their disposal to try and get you to settle the debt, they may then apply to the court to have a judgment made about the debt.

This is where bailiffs come into the equation. If a court judges that a debt is owed and should be paid, it may, at its discretion, send enforcement officers to collect the debt, or goods to be sold off to cover the debt.

There are a number of reasons why a bailiff might knock on your door, such as the ones below.

- You are being served a court document, and there needs to be proof that you have been given it.

- Because the bailiff has been charged with repossessing an item, such as your car.

- The bailiff is collecting a debt on behalf of the court.

- The goods in your home are being taken to pay a debt.

- You have been served an eviction order but didn’t move out.

What Powers Does a Civil Enforcement Officer Have?

Enforcement officers have a range of powers that are backed up by the law in the UK.

Despite popular belief, in general, these powers do not include breaking into your house.

A bailiff can only enter your home without a warrant if:

- A door has been left unlocked.

- A person over the age of 16 lets them in.

With a warrant, a bailiff can use a certain level of force (e.g. a locksmith) to gain entry to a property. But they cannot physically assault you to break in.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

When an enforcement officer first visits your home, and they are allowed in, they will start listing all of the items that they wish to confiscate against your debt. They may take these items at the same time, or arrange to come back and collect them later.

However, a bailiff can only take consumer goods and similar items – a TV set, a car, a laptop, etc. They cannot take items that are something that is required for a living (furniture or bedding, for example).

Moreover, they cannot take any tools that you need to do your job.

Does a Civil Enforcement Officer Have To Follow a Code of Behaviour?

A bailiff is licensed by the local county court, to carry out their duties. Not just anyone can become an enforcement officer. There are stringent background checks done on applicants.

Furthermore, after receiving training, a bailiff must carry out their duties within the boundaries of the law.

A good example here is if a bailiff pushes you out of the way to gain access to your home. A bailiff may push past you in some circumstances, but they cannot physically harm you in the process.

If you think a bailiff has acted inappropriately, you can report them.

» TAKE ACTION NOW: Fill out the short debt form

Dealing With a Civil Enforcement Officer

If you have received a letter saying an enforcement officer will be visiting, you should check your rights.

When the bailiff arrives, you should deal with them in a specific way, such as outlined below.

- Check their identity, and check that they are on the bailiff register at your local county court.

- Unless the enforcement office is collecting unpaid court fines or tax debt, they cannot force entry into your home.

- They must show you a warrant detailing what they are collecting and why. Check the details on the warrant, they must be accurate.

- Speak to the bailiff through your door, and do not be afraid to close it and walk away if you feel you are being treated unfairly, or the bailiff is acting aggressively.

- If the debt is being challenged, you should inform the enforcement officer of this fact, and they should back off at this stage.

As you can see, in many cases, it is perfectly acceptable for you to close your door and walk away from an enforcement officer.

As they can only force entry into your home in a very narrow range of circumstances. If in doubt, ask the enforcement agent to come back at a later time.