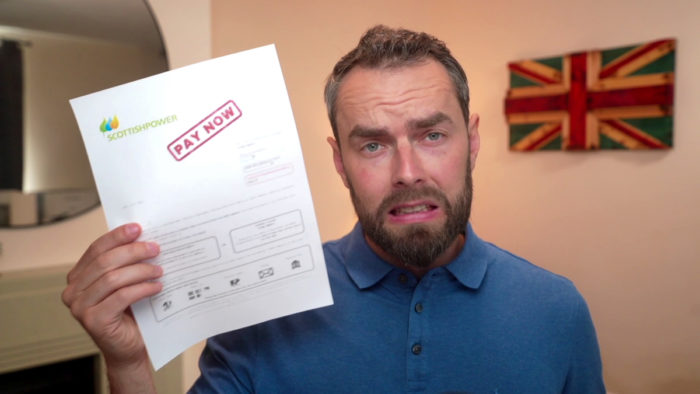

Scottish Power Debt Collectors – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re worried about dealing with Scottish Power debt collectors, you’re in the right spot. Every month, over 170,000 people come to our site for guidance on their debt worries. Citizens Advice reports a record number of people seeking help for energy debts, with almost eight million borrowing money to pay their energy bills in the first half of 2023.1

We know how scary it can be when you can’t pay your energy bills, but don’t fret; we have a lot of handy tips and advice for you.

In this guide, we’ll talk about:

- Who Scottish Power debt collectors are.

- What happens if you don’t pay your Scottish Power bills.

- How you might be able to make some of your Scottish Power debt smaller.

- Ways to be active, gather information, and keep a diary.

- How to deal with debt legally and safely.

We’ll also cover other ways debt collectors might try to get in touch with you and how to find free advice on dealing with your debt. We understand that this is a hard time for you, but remember; you’re not on your own.

Let’s dive in and discuss your options.

Are they legit?

» TAKE ACTION NOW: Fill out the short debt form

Do you owe them?

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What happens if I don’t pay?

Ignoring a debt won’t make debt collectors give up, so by not paying Scottish Power the debt you owe, you can expect to continue receiving correspondence from them. This could include letters, phone calls, or even bailiffs turning up at your door.

While debt collectors have a right to try and retrieve a debt you owe, they do not have the right to harass you in any way. You can take steps to avoid this by:

- Letting the debt collector know when you’d like to be contacted, and specify how (eg, phone, letter, email)

- Keep note of when they are in contact, and if they are aggressive, report them to the Financial Conduct Authority.

Handling debt harassment sooner rather than later will help reduce stress your end too.

Also, having a debt collector chasing you will negatively impact your credit score. This means you will find it much harder to obtain credit.

Your best bet is to get in contact with them to arrange a solution that works for everyone. While a repayment plan or other debt solutions will also affect your credit score, the sooner you sort it, the sooner your credit score can be repaired.

To learn more about potential energy debt solutions, please take a look at the table below.

| Energy Debt Solution | How It Can Help Pay Off Your Energy Bills |

|---|---|

| Installment Plan | Pay in smaller and more manageable monthly amounts until the debt is cleared |

| One-Off Payment | Reduce debt, and possibly get a discount, by paying a lump sum |

| Appealing for a Bill Reduction | Get a reduction by providing evidence of errors in your energy bill or a detailed explanation of your situation |

| Negotiate Contracts | Ask for a temporary reduction in tariffs, a pause on payments, or a longer-term payment plan |

| Switch Providers | If your current energy tariff is too high, consider switching to a cheaper provider |

| Energy Supplier Hardship Funds or Schemes | British Gas Energy Trust EDF Energy Customer Support Fund OVO Energy Fund Scottish Power Hardship Fund npower Energy Fund E.ON Next Energy Fund |

| Government Grants and Schemes | Winter Fuel Payment Warm Home Discount Scheme Cold Weather Payments Local Council Support Child Winter Heating Assistance Breathing Space Scheme |

| Support for Alternative Fuels | If you utilise alternative fuels like oil, LPG, wood, coal, or biomass to heat your home, you may qualify for extra financial help. Speak to an adviser or check with your local council for potential grants or schemes. |

| Seek Advice from Debt Charities | Debt charities offer free advice and practical solutions – they can help you understand your options, negotiate, and set up payment plans with energy providers. |

Are there any other ways of contacting them?

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Next Steps

Follow our ‘prove it’ guide with letter templates and get them to prove that you owe the money.

Be active

Gather information

Keep a diary

If you have a debt repayment plan, make notes of all of your completed payments so you can’t be accused of missing one.

Don’t ignore them

Other Debt Collectors to look for on your Credit Report

There are hundreds of debt collectors in the UK and they each collect for different companies.

It’s surprisingly easy to not notice that you’re in a debt collector’s crosshairs.

I’d suggest you spend time checking your credit report. If a debt collector purchases any of your debt, it will appear on your credit report.

Some of the biggest to look out for include Cabot, PRA Group, and Lowell.

So if you see anything relating to their names, then you’ll need to investigate further.

Scottish Power Contact Information

Free advice on how to deal with them

Dealing with debt collectors can be an overwhelming experience, but there’s plenty of available help out there. In my experience, getting in touch with debt charities like StepChange, Citizen’s Advice and National Debt Line is a great place to start.