How to Deal with Debt Collectors UK – Do You Need to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a letter from a debt collector and not sure what to do? Don’t worry; this article will help you understand what to do. Over 170,000 people come to our website each month for information on matters like this, so you’re not alone.

In this article, we will be looking at:

- Understanding where the debt has come from.

- How to find out if the debt is yours and if you need to pay.

- Ways to stop debt collectors from chasing you too much.

- How to set up payment plans if you can pay or how to write off the debt if you can’t.

- What debt collectors can and can’t do, and what to do if your rights are not respected.

We know how it feels when debt collectors chase you for money, as many of our team members have been in your shoes. We understand your worries and are here to help you make sense of things.

Let’s get started on sorting out your debt issues today.

What to do if I Owe Money and Can Afford to Pay?

According to the guidelines that are authorised and regulated by the Financial Conduct Authority, if you indeed owe money and are able to pay it, it’s definitely in your best interest to just pay up immediately.

Not only is it the right thing to do but it will also save you a lot of hassle in the future from any debt collector that may call you or come knocking on your door. Not to mention that not paying up immediately can even lead to court action as your creditor may become impatient.

One very important thing to keep in mind is that once you’ve paid off your debt, you should ensure that the company now updates your credit file so that it shows that your pending debt is now satisfied.

What to Do if I Owe Money and Cannot Afford to Pay?

If the debt you owe is indeed valid and you are not able to pay your creditor back, then you’ll have to look at other options.

There are many options you can turn to such as a Debt Management Plan, a Debt Relief Order (DRO), an Individual Voluntary Arrangement (IVA) and many others.

You can opt to discuss this with the debt collectors so you can set up a plan that all involved parties can agree with, even if it’s a nominal amount that you’ll pay to your creditor each month.

However, it’s very important to note that before you settle into any kind of agreement over a debt repayment plan with your debt collector, you should seek advice from an independent charity. StepChange and Payplan are examples of such debt charities. You can share your information with them and they will help you decide what the best course of action would be. It’s important to note that all these charities are legally bound to be very discreet with your financial information and they also provide advice related to debt collection free of charge.

Once you have contacted one of these independent charities, you must be given a 30-day grace period by both your creditor as well as your debt collector. During this period, you are expected to get your finances in order so that you can set up your debt repayment plan.

» TAKE ACTION NOW: Fill out the short debt form

Find Out How Much and Who You Owe Money to

Since debt collection agencies are liable to extort an exorbitant amount of money from you, it’s important that you know exactly how much debt you owe and who you owe it to.

When a debt collection agency contacts you, ask them exactly what they want, who they are collecting the debt for, and how much is the amount that they believe you owe. It’s extremely important for you to inquire about this from them before you acknowledge that you owe any debt.

We’ve listed some of the steps that you can take in order to make your life easier when you have to deal with debt collectors below:

- The very first thing you should do is determine whether or not the debt collection agency you’re in contact with is even registered in England or not. This is because oftentimes, debt collection is used as a front for a scam operation. Once you’ve ensured that the debt collection agency is legit and registered in England, then you can start worrying about how much money you owe and who you owe it to.

- You can write to the debt collection agency and ask them to provide a copy of the original credit agreement that was provided to them by the original creditor. Keep in mind that they are legally obligated to provide you with this.

- Ask them that you want to only be contacted via mail. This will stop them from constantly calling you or showing up at your house.

- You can also choose to write a cease-and-desist letter if you want to deal with the original creditor directly. Through this letter, you can clearly inform the collection agency that you wish to deal directly with the creditor and no one else. You can also mention in this letter that any breach of financial conduct in the future will result in legal action from you.

Under current regulatory guidelines, these debt collectors will be legally obligated to stop contacting you. Be sure to keep a copy of this letter in case you need to present it to the Financial Conduct Authority in the future. As long as you have this letter, they will always take your side in the case of any dispute.

Note that a single creditor may send several debt collectors after you and you may have to send cease-and-desist letters to every one of them to get them to stop. However, as long as you’re consistent with this, you will always be in control.

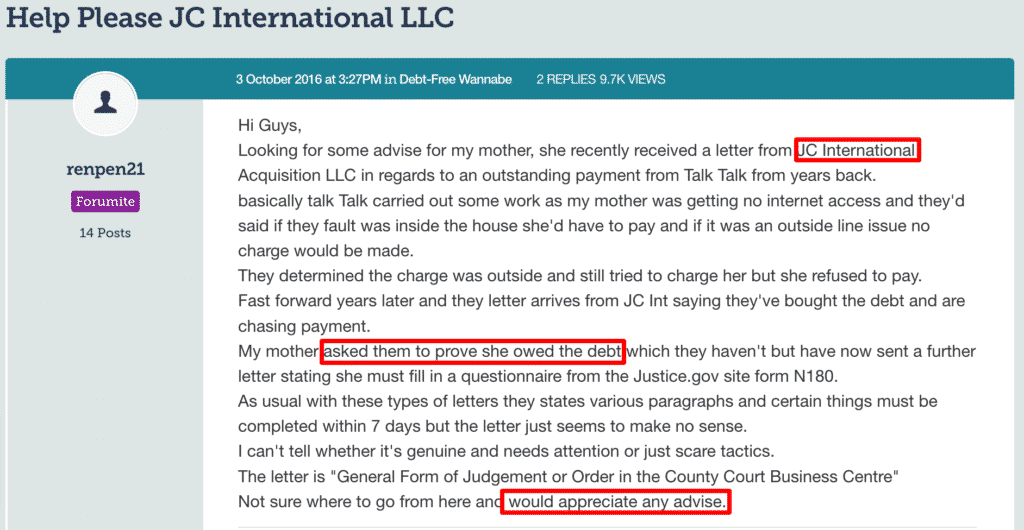

- Share your experiences with specific debt collectors on forums and request help and advice. Forums aren’t designed to give you expert debt advice, yes they can often have experts who can provide sound guidance but the aim of a forum is to give people in debt trouble that they are not alone in dealing with this debt and there are others like them who have come through it.

The case study below illustrates how someone with debt trouble from JC International Acquisition found help on a forum. By just reading some of these stories alongside legitimate guides online you will gain the confidence to deal with debt collectors.

There can even be times when a debt collection agency is legit but the debt collector may be contacting you about a debt that you don’t even owe. In this case, you can tell them that you have no knowledge of this debt and they should stop contacting you.

If they continue to contact you then you can tell them that you will contact Trading Standards if they keep hassling you about it.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

What are Debt Collection Agents Not Allowed to Do?

I’ve listed some of the things you should keep in mind that debt collectors are definitely not allowed to do. If you come across anything like this when a debt collector is contacting you, you should contact the FCA immediately:

- Contact you via social media.

- Contact you at your workplace.

- Mislead you or give you incorrect information regarding your debt.

- Contact you outside of the hours of 8 am – 9 pm on weekdays or at all on weekends.

- Contact your family or friends about your debt situation.

- Threaten to take any sort of illegal action against you.

- Forcibly enter your home. For example, by breaking in or by pushing past you when you open the door for them. Please note that all debt collectors are also legally obligated to leave your property if you ask them to do so. You can also write them a letter to let them know that you would prefer to only communicate via phone, mail or email.

- Take your possessions. They do not have the right to take any of your belongings.

What Should I Do if My Rights are Violated?

Now that I’ve listed some of the actions that collectors are definitely not allowed to do, let’s talk about what you should do when you do encounter something like this. Collectors do have the right to do certain things during debt collection but it’s important that you know when a boundary is being crossed. During debts collection, you may feel that a debt collector’s actions have broken the law or breached FCA guidelines. If that is the case, you can take it up with the FCA.

However, you should keep in mind that you’re going to need evidence of their actions to present to the FCA. This evidence could be in the form of phone calls, video recordings of any visits that any debt collectors made to your home, etc. Furthermore, before going to the FCA, you should clearly state to the debt collection agent that what they have done is in direct violation of FCA guidelines. You should tell them how you would prefer to be contacted in the future. If they still do not back off then you can raise a complaint via the Financial Ombudsman or sue the debt collection agent in court.

Conclusion

In the end, all I have to say is that being in debt can definitely be a scary thing. As your creditor grows impatient, you may have to start dealing with harassment from debt collectors that they may hire.

These collectors can be extremely annoying with their phone calls as well as their occasional visits to your home. It’s important to identify when they are crossing their limits so you can reach out to the concerned authority in order to get them to stop.

Always remember that being in debt does not give debt collectors any kind of authority over you whatsoever. As I’ve reiterated time and time again over the course of this post, if you know your rights, you can definitely save yourself from a ton of stress and trauma that many Brits go through each year.

Other Debt Collectors to look for on your Credit Report

There are hundreds of debt collectors in the UK and they each collect for different companies.

It’s surprisingly easy to not notice that you’re in a debt collector’s crosshairs.

I’d suggest you spend time checking your credit report. If a debt collector purchases any of your debt, it will appear on your credit report.

Some of the biggest to look out for include Cabot, PRA Group, and Lowell.

So if you see anything relating to their names, then you’ll need to investigate further.