Are You Owed Money – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

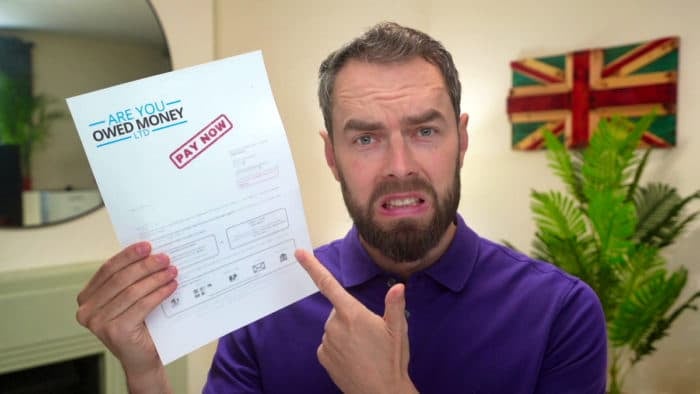

Have you received a letter from Are You Owed Money Ltd? You may be feeling confused about where this debt has come from or if it’s real. You may also be worried about if you should pay or what happens if you can’t. Don’t worry, you’re not alone, and we’re here to help.

Every month, over 170,000 people visit our website to find answers to their debt questions. We can guide you too. In this article, we will share easy steps on how to:

- Understand who Are You Owed Money Ltd are.

- Check if the debt is real and if it is owed by you.

- Learn what happens if you don’t pay.

- Find out ways to deal with the debt, even if you can’t afford to pay it.

- Discover how to stop them from chasing you.

Our team has lots of experience with debt collectors, including Are You Owed Money Ltd. We know how worrying it can be when they contact you. We’ll share our knowledge with you, so you can feel more calm and in control.

Let’s dive in and explore your options.

Have you received a letter?

Are You Owed Money Ltd will try to wear you down so you agree to pay or ask for a payment plan. They do this by contacting you frequently. One way they’re likely to make contact is in writing by sending a Letter Before Action (LBA).

An LBA is a letter that must be sent to give you an opportunity to come to an agreement before court action can be taken. So this is a serious letter.

How do I Verify the Debt?

If you have received debt letters from Are You Owed Money, but aren’t sure if they’re legit, what do you do?

From my experience, the best thing to do is ask for proof that the debt is yours. I have a free ‘prove it’ letter template that you can use to help you write to Are You Owed Money and request evidence that you are liable for the debt that they are chasing.

You are under no obligation to pay for a debt that can’t be proven to be yours.

It is crucial that you respond to legitimate debt collectors quickly. Responding quickly will help you avoid any extra charges or fees. Not ignoring debt collectors also means that you are less likely to face legal action, such as a CCJ.

Should you pay?

Not ignoring Are You Owed Money Ltd and paying them are two completely different things. Although you shouldn’t ignore them, you don’t have to pay them straight away. There are things you can do instead, depending on your situation.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What can you do instead?

Before paying Are You Owed Money Ltd, you should check that the debt is still enforceable and ask them to prove the debt. Here are the details:

#1: Check if the debt is still enforceable

Statute barred debts are those debts that can no longer be taken to court and the debtor cannot be forced to pay. As per The Limitations Act, many debts become too old for court after six years. You should check if your debt is statute barred before making any moves.

#2: Ask them to prove it

If your debt is young enough for litigation, you can instead ask Are You Owed Money to prove you owe the debt. You should do this in writing and keep a copy of the request. You don’t have to pay until they send evidence, which usually means a copy of a signed agreement.

If they do prove your debt you should consider paying in full, a payment plan, a settlement offer, or even a debt solution.

Can you ignore them?

You shouldn’t ignore communications from Are You Owed Money Ltd, and you certainly shouldn’t ignore a Letter Before Action. If you ignore them their client could take you to court and a CCJ will be issued if you don’t defend yourself. The CCJ opens the door for the claimant to use debt enforcement action, including bailiffs.

You might hear stories of people ignoring debt collection agencies and getting away without having to pay. Although this is a possibility, it’s a risky strategy.

Are they bailiffs?

No, Are You Owed Money Ltd is not a bailiff company and shouldn’t be coming to visit you at home. They only work at the start of the debt collection process to try and recover payment. But according to their service list, they can help put clients in touch with enforcement agents when required.

Can they take you to court?

Are You Owed Money Ltd won’t take you to court themselves, but they can advise their client to take legal action against you if you ignore the payment requests. The client will then have to decide if they want to use litigation or not.

Even when the client has no desire to take you to court, Are You Owed Money Ltd might still threaten legal action. This is because debt collection agencies often use the threat of court action as a scare tactic. Many people worry about the possibility of going to court and decide to pay to get rid of them.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Are they a Scam?

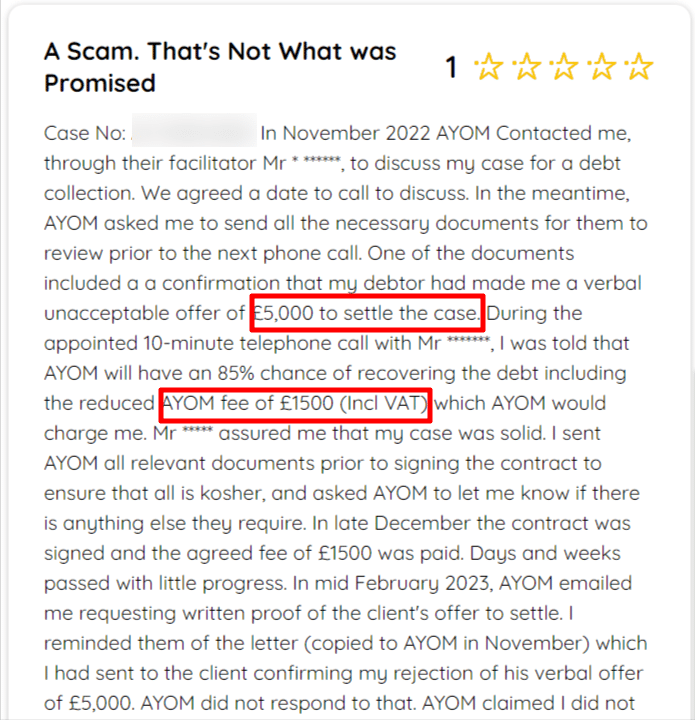

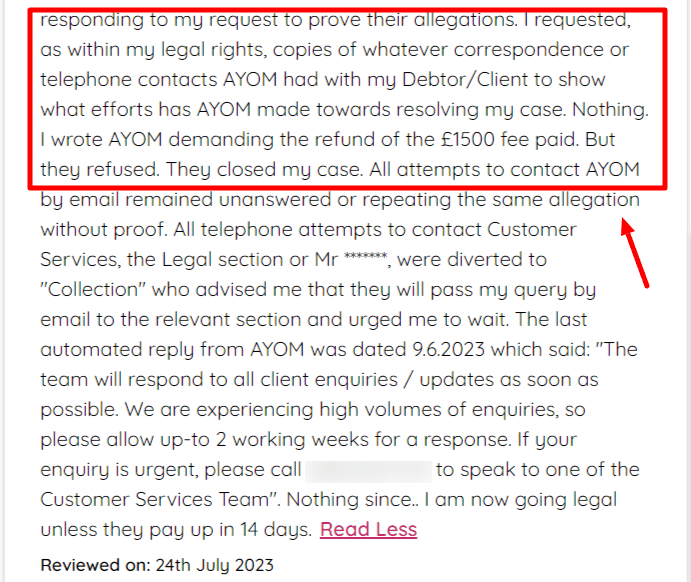

It has come to my attention that Are You Owed Money Ltd might be involved in an Advance Fee Payment scam.

In these types of fraud cases, a company gets customers to pay up front for goods or services but then doesn’t deliver. In these cases, it is common for the fraudsters to stop contact or ignore the victims once money has been received.

Take a look at some snippets of this review:

As you can see, they apparently dropped their fee from £5,000 to £1,500, which is quite a lot and already quite suspicious!

In my opinion, this reviewer is describing textbook advance fee payment fraud. If you are dealing with this company, I encourage you to be as cautious as possible and seek advice if you ever feel unsure or uneasy.

Other reviews, which I discuss below, also suggest that this company is not 100% legitimate.

If you are worried that you have been caught out by this scam or similar, I recommend speaking to a debt charity for some advice. There are several debt charities that offer free advisory services for debt-related issues:

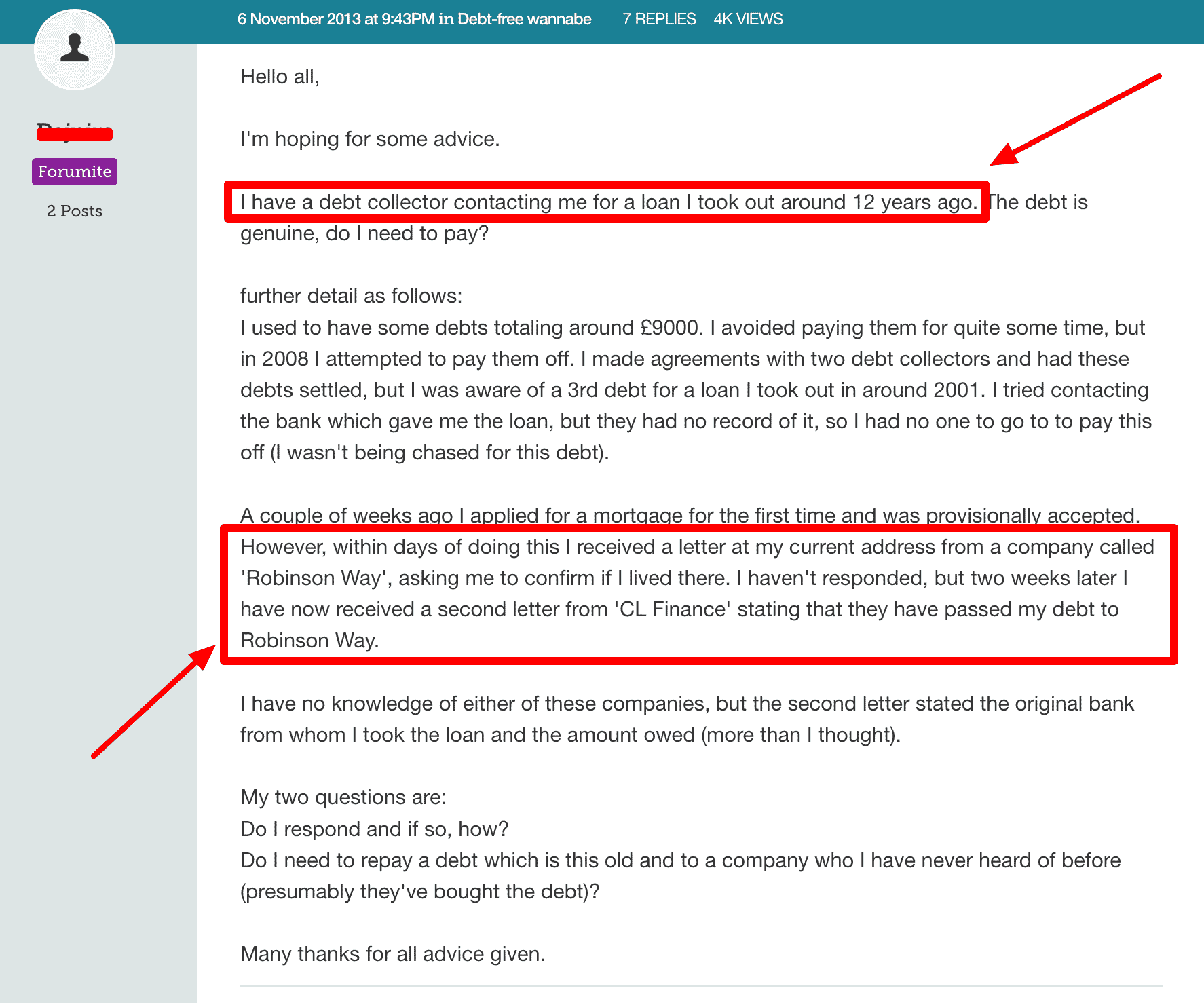

Will They Give Up Chasing?

After all that you might be wondering whether you can just wait it out and hope they stop chasing you.

Sadly, that’s probably not going to happen. Most debt collectors are persistent.

Source: Moneysavingexpert

As you can see Robinson Way starting to chase a debtor mere days after their mortgage application and a full 12 years after the debt was originally chased.

Other agencies like Lowell Group, Portfolio Recovery and Cabot Financial are constantly being accused of buying Statute Barred debts and then chasing people for payment.