Churchill Recovery Debt – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a surprising letter about a debt from Churchill Recovery? Don’t worry, you’re not alone. Each month, over 170,000 people come to our website for advice on debt issues just like this one.

In this guide, we’ll help you understand:

- What Churchill Recovery Solutions Limited is.

- How to check if the debt they say you owe is really yours.

- Ways you can stop Churchill Recovery from reaching out to you too much.

- Options for setting up a plan to pay off your debt or possibly even writing it off.

We know how scary it can be to get letters from debt collectors. Some of us have even been in your shoes before so we understand that you’re feeling worried about where this debt came from or if you’re not sure if you should pay.

Here’s how to deal with your Churchill Recovery debt and take control of the situation.

Have you received a letter?

You’re probably reading this guide because you too have received a Churchill Recovery Solutions debt letter. If you have been contacted by this debt collector, then it’s likely that they have contacted you to collect outstanding debts. This is a letter asking you to pay and threatening legal action if you don’t. The proper name for this letter is a Letter Before Action (LBA) because it is supposed to be the final opportunity to pay before the client takes legal action against you.

However…

There is a chance that some legal threats are empty. They could be trying to scare you into paying when there is no real chance that their client wants to take legal action. But there is also a chance that they will. And for that reason, you should never ignore a Churchill Recovery Solutions debt letter.

Ask for proof that you owe the debt

There may be a chance you don’t owe money at all! Instead of paying straight away, you can ask Churchill Recovery Solutions Debt Collection to provide proof that you owe the debt. This is also beneficial if you think they’ve got the wrong person.

You can use my free ‘prove it’ letter template if you need some guidance or aren’t sure where to start.

The evidence that is sent back to you has to be clear and show that you are liable for a debt with your original creditor. This could be your original credit agreement, but can be other documentation about your debt.

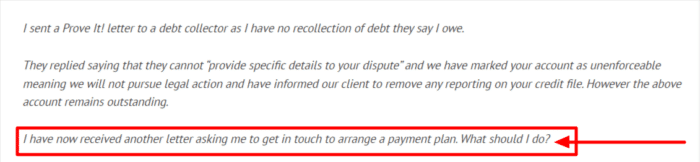

Until they send this proof you don’t have to pay, and if they don’t send anything back, you can ignore their payment requests. Take a look at this example.

Remember that you have no obligation to pay for a debt that can’t be proven to be yours. This forum user should ignore this second letter, but should keep in mind that repeated letters when the debt is unenforceable can be classed as harassment.

Keep copies of your communications so that a judge can see they never responded to your request – in case it goes to court.

» TAKE ACTION NOW: Fill out the short debt form

A legal loophole to avoid paying them

There’s one time when you shouldn’t ask for proof, and that’s when your debt has become too old to go to court. When debts cannot be taken to court, a judge cannot order you to pay and there’s nothing Churchill Solutions can do to enforce the debt.

See if your debt has become too old to be recovered by reading this guide.

Should you pay?

You don’t have to pay Churchill Recovery Solutions straight away after receiving a debt letter. There is something else you can do, which doesn’t mean paying or ignoring them. And it could mean not having to pay. At the very least, it will buy you some extra time if needed.

Of course, if you know about the debt and would prefer to pay it off, there’s no reason not to do so. You can usually get in touch with Churchill and agree on a payment plan if paying it in one go is too much. You might even be able to make a debt settlement offer.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What Happens If I Don’t Pay?

We’ve all wondered – what exactly will happen if you stop paying off your debts? Well, the answer is a whole lot of bother.

- Your creditor will send you reminders and then demands to get you to pay any missed payments

- If you don’t pay, your account will default

- If you still don’t pay your debts, your creditor can choose to sell your debt to a debt collection agency or employ an agency to chase you for the missed payments. This is where Churchill Recovery will come in.

- If you don’t pay the collectors, your creditor or the collection agency might be able to take legal action against you to get their money back. Legal action usually starts with a CCJ.

Are they bailiffs?

No they are not. Bailiffs have different rights do debt collectors and should be treated differently. Despite advertising a doorstep collection service, they are not enforcement agents and have no right to come to your home and demand to enter. They cannot repossess your items to clear the debt.

It is a serious offence for a debt collection company to suggest they are bailiffs when they’re not. Even suggesting they have these powers should be reported. I will walk you through the complaint process below.

Customer reviews

Here is a snapshot of what most reviewers have to say about Churchill Recovery Solutions:

“I spoke to these guys for the first time after receiving a letter. I spoke politely to what can only be described as a “jumped-up aggressive man”. He wouldn’t listen to me and you would think I personally owed him some money or something. Rude, unprofessional and aggressive.”

- Ross H (Google review)

“Completely unprofessional. Shouting at me on the phone telling me they “don’t care” and I’m “not a customer”. Attempting to bully me to acknowledge a debt that may not be mine.”

- Sophie (Google review)

Churchill Recovery Solutions, like all debt collection agencies, is required to act in accordance with rules set out by the Financial Conduct Authority, which means treating customers fairly, giving them time to work out their finances, and helping them reach an ideal debt management plan.

Can I write off my debt?

You can pay off the debt you owed Churchill Recovery Solutions in a number of legal ways. You can consider legal arrangements like a debt relief order, bankruptcy, or an IVA. Through these strategies, people have sometimes written off 100% of their debt.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can I stop them from contacting me?

No, you will not be able to stop all communication with Churchill Recovery Solutions because it is possible that they are required by law to send some letters to you. However, you have the ability to communicate your contact preferences, such as requesting that all communications regarding your debt be conducted in writing rather than over the phone. Your preferences should be followed.

How do I complain?

If you think that Churchill Recovery has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to Churchill Recovery so that they have the chance to sort out the issue themselves. Fortunately, Churchill Recovery have a detailed process on their complaints page on their website. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, Churchill Recovery may be fined. You could even be owed compensation.

Checking for Other Debt Collectors

There are a lot of ways to get into debt. In fact, it’s not uncommon to owe money to several companies at once.

Perhaps you have a mortgage, a car loan, a couple credit cards and an item or two you bought on buy-now-pay-later schemes. It’s easy to lose track.

That’s why it’s important to regularly check your credit report and bank statements to make sure you haven’t missed anything.

If a debt collector has purchased your debt, it appears on your credit report.

Some of the debt collectors you’re most likely to come across are PRA Group, Lowell and Cabot Financial.

How can I contact Churchill Recovery about outstanding debts?

Whether you’re looking to talk about how much debt you have or to adjust your monthly repayments, you can easily contact Churchill Recovery on:

| Address: | Suite 5a, Stanley Grange Business Village, Ormskirk Road, Knowsley Village, Merseyside L34 4AR |

| Trading Address: | C/O Pm+M Waterfold House, Waterfold Business Park, Bury, Lancashire, England, BL9 7BR |

| Contact number: | 0333 320 0748 |

| Email: | [email protected] |

| Registration number: | 04785274 |

| Website: | https://www.churchillrecoverysolutions.co.uk/ |