Council Tax Recovery Process – What You Can Expect

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

When it comes to council tax, there are a lot of things that decide who actually pays, as well as how much you pay. In this article, we’ll explain what you can expect if you experience a council tax recovery process.

We’ll address the following questions:

- What happens if you haven’t paid?

- Will the courts be involved?

- Can bailiffs take everything?

- What if you’re a vulnerable person?

- Will anyone else be involved?

Feeling concerned about not being able to pay your council tax is normal, but don’t worry, you’re not alone. Every month, over 170,000 people visit our website seeking advice on debt issues, just like this one.

We’re here to help you figure things out. Let’s dive in!

I Haven’t Paid – Now What?

Being in debt with council tax isn’t great, but depending on why you haven’t paid may alter what you can expect in the recovery process.

If you refuse to pay, or you simply ignore the letter telling you, you have to pay is slightly different from not being able to pay.

If you can’t pay, you’ll want to sort this out as soon as possible. Speaking to your council may help you in this situation. If you’re struggling to pay for your council tax and you live on your own for example on an income that might not be sufficient, you may be entitled, and want to apply for a council tax reduction.

As I’ve said, if this is the case, then sorting this out as quickly as possible will be crucial as council tax is seen as a priority debt, meaning that there are more serious consequences for not paying them.

On the other hand, if you refuse or ignore the payments you can expect a written reminder a week on from the council.

This reminder will inform you that you have seven days to pay your council tax. If you fail to do so, you’ll be required to pay your remaining council tax for the financial year instead. You’ll be sent another reminder if you miss another payment, however, you’ll get two – and only two in the year.

Missing your third payment will be when you’re required to pay the remaining council tax that you owe.

Will the Courts be Involved?

If the council feels it necessary, then they may appeal to the courts. If they go to a magistrate, they may appeal for what’s known as a “Liability Order”. This is a legal demand for payment. In this case, your unpaid council tax.

If this isn’t enough, then bailiffs may be sent around to your house to get the payment. However, it’s important that you know your rights should this happen. For example, with council tax arrears, they aren’t allowed to force entry.

But if the bailiffs come, take what they can and it still isn’t enough to cover the debt, then you may be taken to court over it. Here, the court will consider whether you can afford to pay the debt, or if you have a valid reason not to.

If you’re deemed to have no valid reason to not pay your council tax, and you still refuse to do so, then you could be sent to prison for up to 3 months.

If that wasn’t bad enough, the cost of the courts and bailiffs can all be added onto your already existing debt. Essentially meaning, if the courts get involved, you could end up paying even more.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Can Bailiffs Take Everything?

If bailiffs are involved, you need to be aware of your rights.

There are strict rules on what bailiffs can’t remove from your property, even if they are collecting for priority debts like council tax. These items include:

- Anything that belongs to someone else – this includes things that belong to your children

- Pets or service animals

- Vehicles, tools, or equipment that you need for your job or to study up to £1,350

- A mobility vehicle or any vehicle with a valid Blue Badge

- Anything permanently fitted to your home – kitchen units, etc.

Bailiffs also can’t take things that you need to live. These items can be anything that you use for your ‘basic domestic needs.’ They can take some of these things, but must leave you with:

- A table with enough chairs for everyone in your home

- Beds and bedding for everyone in your home

- A phone or mobile phone

- Any medicine or medical equipment that you need to care for someone

- A washing machine

- A cooker or microwave, and a fridge.

If you think that a bailiff has taken something that they shouldn’t, you need to complain immediately.

You can also contact a debt charity for some advice.

» TAKE ACTION NOW: Fill out the short debt form

What if I am a Vulnerable Person?

Before you start addressing the Notice of Enforcement, you should know that if you:

- Are disabled in any way or extremely ill

- Suffer from any kind of mental illness

- Have children or are pregnant

- Are under the age of 18 or over the age of 65

- Are dealing with a stressful situation such as the death of a loved one or unemployment

- Don’t speak English very well

You are considered a vulnerable person. This means that any bailiffs will have to follow some additional rules to ensure their visit is as easy on you as possible.

Furthermore, if any of these conditions apply to you, you can get more time to deal with the Notice of Enforcement. You can also get more time if the Notice of Enforcement was not sent to you properly by the bailiffs.

If you fall into any of the above categories, you need to either tell the bailiffs yourself or get a relative or carer to do it for you. You can then contact them by phone or by post. I have a free letter template that you can use to explain your situation.

When you speak to the bailiffs, you need to:

- Tell them that you’re vulnerable

- Explain why you would find dealing with bailiffs more difficult than other people in the same situation

- Ask them to stop any visits in the future because it will cause harm and distress to you

- Tell them if a letter or a visit could make your situation worse – this could be the case if you have a mental health problem or a heart condition, for example.

Make a note of what you agree with the bailiffs about future contact. This will make it easier to argue with them if they don’t stick to this new agreement, or if you need to make a complaint.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Will Anyone Else be Involved?

If the council takes you to court, then you may find that other parts of your life are affected by your council tax debt.

The courts have the power to get paid directly from your wages. However, they can also apply to take money from other areas, including:

- Income Support

- Pension Credit

- Universal Credit

- Employment and Support Allowance

- Jobseeker’s allowance

If the payments that are taken from these affect you still, for example, you’re now unable to pay other bills, then you can try to make an arrangement of smaller payments, however, the council do not have to agree to this, but they will usually try to.

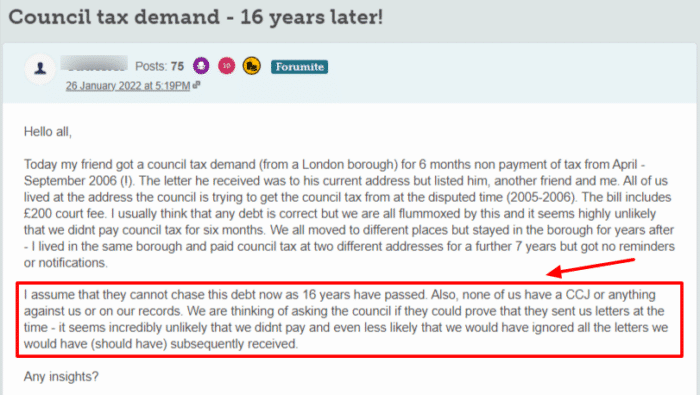

Will I Always be Chased?

A bit of good news, no, you won’t always be chased for council tax debt. And sometimes councils do make mistakes and try to collect council tax areas that are more than a decade old!

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window will be enforceable for the duration of the CCJ.

If your debt is statute-barred, you can use my free letter template to write to the council chasing you and explain the situation.

If you are unsure about the status of your debt, you can contact a debt charity for some advice. Their advisors will be able to look at the debt in question, determine its status, and advise you on your next steps.

The chances of that happening though, are incredibly slim. As mentioned, council tax arrears are seen as a priority debt. As soon as the council realises you’re not paying, they will try to get payment from you, as quickly as possible. And, they won’t hesitate to take it higher to ensure they receive their payment.

So, with a Council Tax Recovery Process – That’s what you can expect.