Does Clearpay Affect Credit Score? Does it Help or Destroy?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you wondering if Clearpay affects your credit score?

You’ve come to the right place for answers! Each month, over 170,000 people visit our website looking for help to understand their credit scores and deal with their debt.

In this article, we’ll:

- Explain what Clearpay is and how it works.

- Discuss the importance of a credit score and how it’s worked out.

- Look at how using Clearpay can change your credit score.

- Explore if you can write off some debt.

- Share tips on what to do if your debt is too big to handle.

In 2022, arrears on household bills increased by 68% from £1,739 to £2,9201. So, it’s quite common to feel concerned about debt.

Don’t worry, we’re here to help. Learning about your credit scores and how to manage your debt are big steps towards being in control of your money.

How Does Clearpay Work?

You need to be a resident of the UK, and 18 years or older to use Clearpay.

If you are not a UK resident and don’t have a UK billing address, you won’t be able to use Clearpay, even if you hold a British passport.

The process of using Clearpay is very straightforward, it follows the steps below.

- Find a merchant that accepts Clearpay online.

- Purchase goods, and select Chearpay at the checkout.

- Clearpay pays the vendor.

- You pay Clearpay back in 4 equal instalments.

You don’t have to wait to pay the money back in 4 instalments, you can pay up early if you wish, and there is no fee applied when you do this.

Something to keep in mind, is that Clearpay doesn’t rely on your credit score to decide if they will extend you credit. The decision is purely based on how long you have been using Clearpay, and whether you have kept up with payments.

When you first sign up for Clearpay, you will be asked to add and verify a payment card, and once this is done, Clearpay will give you an initial credit limit.

For most people, this will be around £450 at first. This credit limit will be raised the longer you use Clearpay, as long as you don’t miss any payments.

» TAKE ACTION NOW: Fill out the short debt form

Does Using Clearpay Impact Your Credit Score?

Before we answer this question, let’s take a look at what happens if you miss a Clearpay payment.

Clearpay has a very clear process for people who miss payments, as shown below.

- If you miss a payment, Clearpay will block your ability to spend any more through the service.

- You will be given until 1ppm the next day to may the payment. If you do this, you will incur a late payment fee of £6.

- If you don’t make the payment within the first 7 days after it was due, you will be levied an additional £6 late payment fee.

- If you still don’t make the payment, you may find that Clearpay passes the debt over to a debt collection agency such as Cabot Financial or PRA Group.

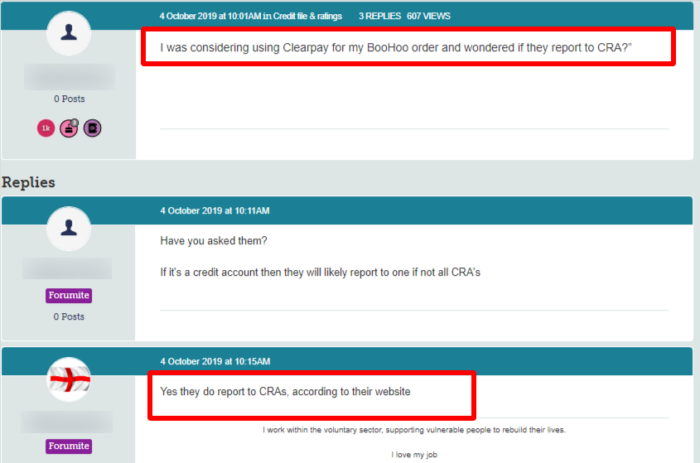

From step 3 onwards, these transactions would be recorded on your credit file, and have an impact on your credit score.

Missed payments to Clearpay will be recorded on your credit file, as will any legal actions taken against you by a debt collection agency.

Therefore, it is vital that you make sure you make your payments to Clearpay. Buy now pay later credit can be very dangerous.

It is generally very easy to get this kind of credit. And this means you could easily rack up a level of debt you simply cannot meet. Make sure to curb your spending once you realise you are accruing a level of debt that could soon become a problem.

Budget Advice

If you’re having trouble keeping up with payments to Clearpay, taking a look at your budget can help identify areas where you can cut back on expenses.

I’ve put together this table that provides ten budgeting tips.

| Budgeting Advice | How You Can Lower Your Expenses |

|---|---|

| Arrange a Debt Repayment Plan | To negotiate, contact your creditors via phone, email, or letter to explain your financial situation, and offer to pay an amount you can afford. |

| Save on Utility Bills | Compare energy providers to find a cheaper deal. Use energy-efficient appliances. Reduce water usage with low-flow fixtures. |

| Save on Groceries | Shop with a list to avoid impulse buys. Buy store brands instead of name brands. Look for sales and use coupons. |

| Cut Back on Non-Essentials | This includes dining out, entertainment, subscriptions, and luxury items. Look for free or low-cost entertainment options and cook meals at home. |

| Transportation Costs | If possible, use public transportation, carpool, or consider biking to work. If you own a car, maintain it regularly to avoid costly repairs. |

| Negotiate Bills | Contact service providers (like phone, internet, and cable) to negotiate a lower rate or switch to a cheaper plan. |

| Consolidate Debts | If you have multiple debts, consider a debt consolidation loan or a balance transfer credit card (with caution) to lower interest rates. |

| Sell a Financed Car | When you sell a financed vehicle, the proceeds can be used to pay off the remaining loan balance. |

| Use Cash Instead of Credit | To avoid accumulating more debt, use cash or a debit card for your purchases. |

| Seek Professional Advice | If you’re struggling, consider contacting a debt advice service like StepChange or National Debtline. They offer free, confidential advice. |

What To Do if You Are in Debt

If you get yourself into financial trouble using Clearpay, or any other buy now pay later lender, you need to take action to stop the situation resulting in legal proceedings.

The Citizens Advice Bureau (CAB) should be your first port of call.

The staff can offer you advice on how to reduce your debts, and help you work out a plan to clear your debts completely.