EDF Debt Collectors – Should you Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you puzzled by a letter from Fulmar Services about EDF debt? Are you unsure about where the debt came from, if you should pay, or even if it’s real? Don’t worry, you’re not alone, and you’re in the right place for help.

Every month, more than 170,000 people come to our website for advice on debt issues similar to this. We’re here to help you understand:

- Who EDF Energy Debt Collectors are.

- How to ask for proof of your debt.

- Ways to possibly write off some EDF debt.

- How to pay EDF Energy if you can.

- What to do if you can’t afford your EDF energy bills.

Research shows that 64% of UK adults find interactions with current debt collectors stressful1. So, we know it can be scary when you get a letter about debt.

But remember, just because you’ve got a letter doesn’t mean you have to pay. We’re here to guide you through your options and help you decide what to do next.

Let’s get started.

Ask for proof of debt.

How can you pay EDF Energy?

Remember that if you’ve missed a payment, EDF Energy will call and send letters. The easiest way to stop them from contacting you is by talking to them and offering to pay what you can.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What to do if you can’t afford your energy bills.

In 2022, arrears on household bills increased by 68% from £1,739 to £2,9202. So, it’s common for people to struggle to pay. If that’s your case, and you can’t pay your energy bills, don’t worry. There are several actions you can take.

As aforementioned, you should seek out alternative payment plans with your supplier.

This can make payments more manageable and stop you from falling behind – this is something offered by EDF Energy.

In some cases, energy suppliers may try to force you to install a prepayment meter. This is an arrangement that means you pay for energy before actually using it. This only happens in exceptional circumstances when an agreement can’t be reached or you continually fall behind on payment plans.

The Daily Record recently featured our comments on dealing with debt collectors who attempt to forcibly install a pre-payment meter.

This insight may provide you with additional information on how to navigate these challenges effectively.

It may also be possible to apply for grants or schemes offered by certain energy companies that essentially mean you don’t have to pay the full amount of your bill over a period of time. Charitable schemes are also in place for those who are in serious need of help with their energy bills.

» TAKE ACTION NOW: Fill out the short debt form

Typical Debt Collection Process

Understanding the debt collection process is crucial when dealing with EDF Energy or any debt collection company. That’s why we’ve put together this table that explains the key stages and actions involved. If you’d like to learn more, please read our specialized guide.

| Stage | Actions | What you should do: |

|---|---|---|

| Missing one or two small payments | Calls and letters from the debt collector asking for payment. They may enquire about reasons for missing payments. | Contact the debt collector and offer to pay what you can. If you are struggling to pay the debt, get in touch with us to explore your options. |

| Missing large or multiple payments | Their contact will become more frequent, urgent, and threatening. | Contact the debt collection agency and offer to pay what you can. You may also make a complaint if you think the letters are a form of harassment. |

| Debt collector visit | After a few months, if the debt is significant (£200+) you will receive notice of a debt collector visit. They have to notify you before arriving. Debt collectors cannot take anything from your home – they may only ask for payment. | If a debt collector shows up at your home, ask them to show proof of the debt and their ID through a window. Do not open your door or let them in. You can arrange a payment plan with the debt collector, but make sure to get a receipt of this. |

| Court | If you still do not pay your debts to the original lender/debt collector agency, they will take you to court and either attempt to: – File a CCJ against you. – File an attachment of earnings order. – File a lawsuit against you. |

You must show up to your court date. From here, you can either dispute the debt, or the judge will likely suggest a manageable repayment plan for you. |

Can you get your energy debt written off?

As one of the biggest outgoings for any household, energy bills can easily become too much. It is possible to dispute energy debt and potentially get it written off.

You shouldn’t bank on this however, it is important to understand exactly what your situation is and whether this may be an option for you.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Staying On Top Of Your Debts

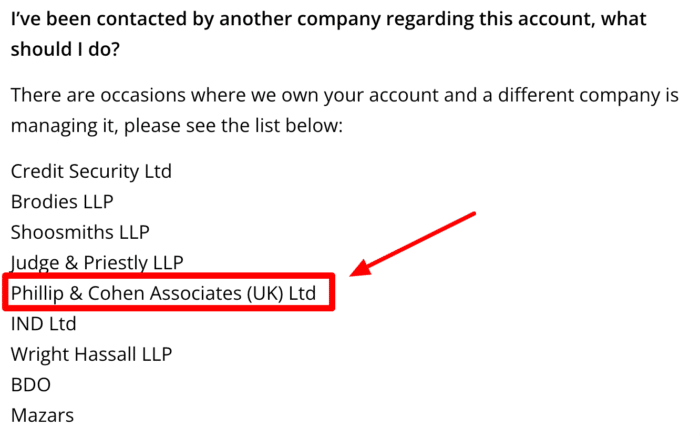

One of the hardest parts about being in debt is that the industry isn’t at all transparent.

One common tactic used by Debt Collectors is contacting you under multiple names and addresses.

Sometimes, it’s for practical reasons, but even then it can be confusing and intimidating. So it’s important to try to keep a level head and research what’s going on.

Some of the biggest debt collectors in the UK operate under multiple names.

- Robinson Way will sometimes contact you under the name Hoist Finance.

- Cabot Financial Group recently bought Wescot Credit Services

- Credit Style communicate as both Credit Style and CST Law.

- Lowell Financial also owns Overdales and collects debts under both names.

In fact, in the case of PRA Group, they’ve been known to use multiple company names. As you can see in the image below.

If you’ve been contacted by a debt collector recently, it’s worth going through your post and emails to check that you haven’t missed anything, just in case they’ve started writing to you under a different name.

EDF Debt Collectors Contact Details

| Phone: | 0333 200 5100 |

| Phone for hearing disabilities: | 0800 096 2929 |

| Opening hours: | Weekdays – 8 am to 6 pm Saturday – 8am to 2pm |

| Website: | https://www.edfenergy.com/ |