Is Clearscore Accurate & Could My Score be Wrong?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you curious about Clearscore and how accurate it is? You’re in the right place! Every month, over 170,000 people come to our website seeking debt advice.

In this article, we’ll explain:

- What Clearscore is and how it works.

- Why credit scores are important and how they’re worked out.

- What you should look for in your credit score.

- Why Clearscore and Experian might show different scores.

- Useful tips to help improve your credit score.

Navigating financial difficulties can be challenging, and it’s common to feel unsure about seeking help. In fact, Citizens Advice revealed that 60% of adults facing financial difficulties hesitate to seek assistance.1

If that’s your case, don’t worry — you’re not alone. We’ll help you understand your scores and know how to deal with debt.

Is ClearScore accurate?

ClearScore should be as accurate, considering your ClearScore information is pulled from Experian.

Thus, ClearScore is considered as accurate as any credit reference agency.

Can ClearScore be wrong?

It’s possible to have incorrect information recorded on your ClearScore account.

If incorrect information was reported to Experian by a company or lender, then the same incorrect information would appear on your ClearScore account.

» TAKE ACTION NOW: Fill out the short debt form

One study reported by Which? found that around one in five people have a credit score error they may not be aware of.

With that in mind, ClearScore is as accurate as the most trusted credit reference agencies, but mistakes and errors are quite common.

It’s important to search your credit score for errors and request they be removed. Even errors can stop you from securing credit or a mortgage.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

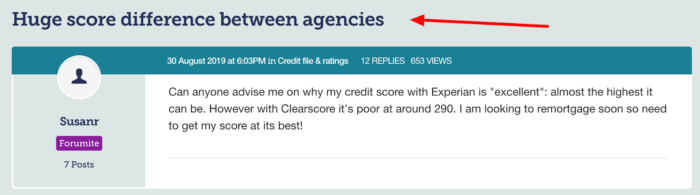

Why is my ClearScore so different to Experian?

Even though ClearScore uses the data held by Experian, it’s possible to have different credit scores on each platform.

This is because credit reference agencies, including Experian and ClearScore, use different score bands to categorise your score into “poor”, “good”, “excellent” etc.

We’ve already written a guide explaining the meaning behind each of ClearScore’s score bands. Check it out now if you want to know what your ClearScore credit score really means.

However, if there is a big difference between the ClearScore report and the Experian report, something else could be going on. This isn’t impossible as this forum user has experienced:

Source: https://forums.moneysavingexpert.com/discussion/comment/76217564#Comment_76217564

We cannot say exactly what was going on for this forum user, but it could be a delay between an event recorded on Experian which has yet to be pulled up by ClearScore.

If this happens to you, it’s best to see what is reducing your score on one platform and not the other, then contact either company to discuss.

The good news is that ClearScore has some sublime reviews online, with many people referencing their great customer service and quick response times to fixing credit report errors. So fear not!

Debt Solutions Comparison

If you’re struggling with debt and are concerned about your credit score, don’t worry. There are different debt solutions that can help you manage your finances effectively.

These are:

| Debt Solution | Description | Formality | Debt Type | Debt Range | Legally Binding | Impact on Credit Score | Asset Risk | Monthly Payment | Duration | Creditor Agreement Required |

|---|---|---|---|---|---|---|---|---|---|---|

| Debt Management Plan (DMP) | Agreement to pay back non-priority debts in one monthly payment. | Informal | Non-priority debts | Any amount |

No | Yes | No | Varies | Varies (until debt is paid) | No (but creditors must be informed) |

| Individual Voluntary Arrangement (IVA) | Agreement to pay back all or part of your debts over a set period. | Formal | All or part of debts | Usually over £10,000 | Yes | Yes | Possible | Fixed | Fixed period, usually 5-6 years | Yes (75% by debt value must agree) |

| Debt Relief Order (DRO) | Freezes debt for a year and be potentially written off. | Formal | Non-priority debts | <£20,000 debt | Yes | Yes | No | None during freeze | 12 months | No (court approval needed) |

| Bankruptcy | Legal status for those who cannot repay debts, potentially writes off debts. | Formal | Unmanageable debts | Any amount, typically high debt | Yes | Yes | High | None during bankruptcy | Usually 12 months, then discharge | No (court process) |

| Consolidation Loan | Taking out a new loan to pay off all existing debts. | – | Multiple debts | Based on loan amount | Varies | Yes | Depends on loan type | Fixed | Depends on loan terms | No |

| Payment Holiday | Temporary relief or reduced payments offered by creditors. | – |

short-term financial difficulties | Any | No | Yes | Low | Reduced or paused payments | Break of up to 6 or 12 months, depending on circumstances, payment history, and creditor’s policy. | No |

| Informal Negotiation | Direct negotiation with creditors for reduced payments or extended terms. | – | All debts | Any | No | Possible | No | Negotiable | Until agreement terms are met | No |

| Statutory Debt Repayment Plan (SDRP) | Plan to repay debts over a reasonable time, with protections from creditor action. | Formal | All debts | Varies | Yes | Yes | No | Fixed | Varies, based on ability to pay | Yes |

| Equity Release | Homeowners release equity from their home to pay off debts. | – |

Debts of homeowners, typically older individuals aged 55+ | Varies and depends on property value | Yes | Yes | Asset (home) is used as collateral | Varies | 8-10 weeks timeframe from application to fund disbursement. Lifetime; repaid on house sale/death. | No |

Is ClearScore free?

Yes, ClearScore is free for life.

Some credit reference agencies had a bad reputation for allowing people to check their credit score for free within so many days but then charge them if they forgot to cancel.

The free trial period would revert to a paid subscription if the user forgot to cancel their subscription during the free trial. This caused many people to get stung by unexpected costs later.

The good news is that ClearScore is currently free for life, but of course, that may change in the future.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Do lenders use ClearScore?

No, lenders aren’t known for checking your ClearScore account.

However, lenders do look at your Experian credit history. As ClearScore data is supposed to reflect the information held by Experian, the lender should find the same information when they look on Experian, as if they were checking your ClearScore account.

How effective is ClearScore?

ClearScore is effective at what it does.

It provides credit scores and information to improve your credit score for free. It’s worthwhile using ClearScore if you’re preparing to ask a lender for credit, especially before you apply for a mortgage.

Is Clear Score accurate (UK)? – Quick recap

ClearScore is as accurate as Experian.

This is because ClearScore gets its information from Experian. It’s possible to have Experian credit history errors, and it’s therefore possible to have errors on your ClearScore account.