Kearns Solicitors Debt – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

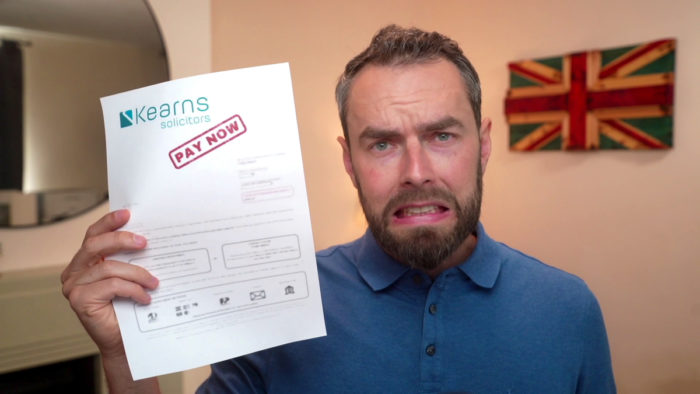

Did you get a letter from Kearns Solicitors about debt? Are you unsure if you should pay? You’re in the right place. Many people visit our website for help with debt questions.

In this article, we’ll help you understand:

- Who Kearns Solicitors are.

- How to deal with Kearns Solicitors debt collectors.

- How to know if the debt is really yours.

- What to do if you can’t afford to pay.

- How to stop Kearns Solicitors from chasing you.

Research shows that 64% of UK adults find interactions with current debt collectors stressful1. So we understand how you feel.

Don’t worry! Our team has lots of experience dealing with debt collectors. So, we’re here to provide helpful advice.

Let’s get started!

Have you received a Kearns Solicitors letter?

Kearns Solicitors’ debt letters are formally known as a Letter Before Action (LBA)2. The letter is a necessary step in the process of taking you to court. They give you an opportunity to pay the debt or agree to a payment plan if you cannot afford to pay the whole amount at once.

It will also threaten that the company you owe may take you to court if you don’t do anything. Debt collection companies use this as a way to scare many people into paying quickly despite having no intention of taking the debtor to court.

However, there is still a chance Kearns Solicitors could help their client take you to court over the arrears.

So, your first question is probably…

Should you pay?

Despite the threat of court action, you shouldn’t just give in and pay Kearns Solicitors straight away, unless you know about the debt and wish to pay it anyway.

You can reply to their Letter Before Action which continues the process without having to pay straight away.

It might buy you some extra time to come up with the money. And it may even get you out of having to pay at all. This step is also useful if you think they have the wrong person.

Your Rights With Debt Collectors

Kearns Solicitors and other debt collection agencies will try to intimidate you to make you pay. However, it’s crucial to keep in mind that they cannot harass you.

Here’s a quick table that explains what debt collectors can and can’t do. If you want to learn more about your rights, make sure to check out our detailed guide.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

Janine, our financial expert, explained that while debt collectors can visit your home for payments, they cannot come to your workplace, act threateningly, force payment, or discuss your finances with others. If they violate these rules, you can complain.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Ask them to prove your debt

You should reply to Kearns Solicitors Debt Recovery asking them to prove you owe the debt they state you do. The only time you shouldn’t do this is when:

- They already sent proof with the LBA

- Your debt is too old to be collected anyway (see the section below)

Kearns is obligated to show you evidence that you owe the money before you have to pay. This evidence should be a signed agreement or contract when relevant. For example, if they’re chasing a credit card debt, they should provide you with the credit agreement that you defaulted on.

You don’t need to pay until they supply this, and if they ignore your request you can ignore their future letters until they supply proof. If the matter was to go to court, you should then show the judge you asked for proof which wasn’t acknowledged. This means you should keep a copy of your prove the debt letter.

» TAKE ACTION NOW: Fill out the short debt form

Or tell them your debt is statute-barred

Alternatively, you should tell them that the debt is too old to be collected if that’s true. Many UK debts cannot be collected because they cannot be taken to court after six years. This is called a statute barred debt.

You should check to see if your debt qualifies as statute-barred by reading our detailed guide, and getting a second opinion from a debt charity. And then tell Kearns if it has become too old to be collected.

The debt was proved – should I pay?

If Kearns Solicitors prove you owe the debt then you should probably pay. Not doing so could end in legal action and further expense for you.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Other Debt Collectors to look for on your Credit Report

There are hundreds of debt collectors in the UK and they each collect for different companies.

It’s surprisingly easy to not notice that you’re in a debt collector’s crosshairs.

I’d suggest you spend time checking your credit report. If a debt collector purchases any of your debt, it will appear on your credit report.

Some of the biggest to look out for include Cabot, PRA Group, and Lowell.

So if you see anything relating to their names, then you’ll need to investigate further.

Kearns Solicitors Debt Recovery reviews

Upon reading the Kearns Solicitors reviews online, you’ll get mixed messages. But the reviews also suggest that Kearns Solicitors will sometimes work with their client to escalate the debt collection process to the courts.

This means that any legal threats are not always made to simply scare you into paying. Take a look at this review:

“Well, they have taken action against me so I may well be a little bit biased. Not a massive fan. However, I have had a couple of communications with them and have found them fairly responsive.”

- The Fuzzy Scrapper (Google review)

Kearns Solicitors may advise their client to escalate the debt collection process to court. This is more likely if the debt is a significant amount. The court could then ask you to pay (if you do owe the debt) and you’ll be issued with an order to do so. You must then pay the debt or agree on a payment plan. Otherwise, you might have to deal with bailiffs and more costs.

But this is a long way down the process. Let’s get back to those initial Kearns debt letters…

Kearns Solicitors Contact Details

| Address: | Kearns Solicitors, Brecon House,3 Caerphilly Business Park, Caerphilly, CF83 3GQ |

| Telephone: | 02920808668 |

| Fax: | 02920 808667 |

| Email: | [email protected] |

| Website: | https://www.kearns.co.uk/ |