LCMS Limited – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Got a letter from LCMS Limited and not sure what to do? You’re in the right place. Each month, over 170,000 people like you visit our website seeking advice on dealing with debt.

In this guide, we’ll:

- Explain who LCMS Limited are.

- Discuss if LCMS Limited can visit your home.

- Talk about how LCMS Limited collects debts and arrears.

- Review the LCMS debt letter.

- Explore options such as writing off some LCMS Limited debt.

Sometimes, a debt letter can come as a surprise, leaving you confused and worried. You might be asking, “Why do I owe this money?” or “What happens if I can’t pay?” These questions are common, and we’re here to help answer them.

Let’s get started.

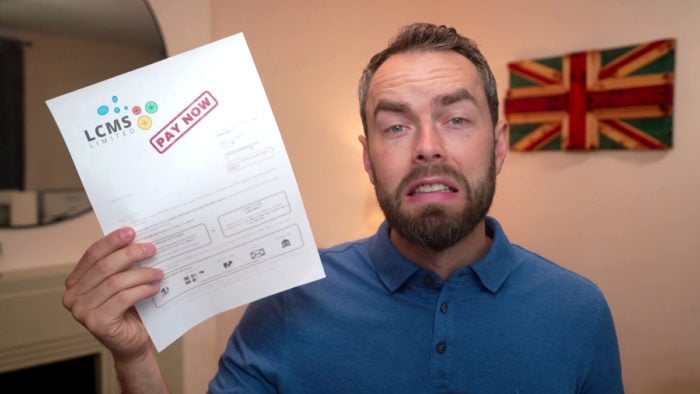

The debt letter

An LCMS debt letter is formally known as a Letter Before Action. These letters simultaneously ask you to pay the debt and make legal threats if you don’t pay within a deadline.

They can be quite intimidating and will certainly get your heart racing. But this is exactly what they’re designed to do. It’s hoped that the threat of litigation will make you pay quickly.

Ask them to prove it

Most people won’t be able to avoid paying because the debt will still be legally enforceable. However, there is still a way to reply to a Letter Before Action which will either:

- Get you some breathing space and time to save

- Make LCMS realise they have the wrong person

- And even stop the real debtor from having to pay at all

You must ask LCMS to prove the debt is yours. They must then send you a copy of a contract or credit agreement that you signed and which you have defaulted on. If they don’t send this documentation, you’re not obligated to pay until they do.

It’s important to keep a copy of your prove-the-debt letter. You can show this to a judge if you’re later taken to court for not paying.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

They sent you evidence – what now?

Consider paying the debt if LCMS do send you proof of the debt. The chance of court action could be high if they’ve gone to this trouble and ignoring them now could be a mistake.

Remember that payment plans are usually available for people who cannot afford the full amount at once. Or you may want to consider making a debt settlement offer!

» TAKE ACTION NOW: Fill out the short debt form

Do you have to pay?

The better news is that there are ways to reply to LCMS Limited which don’t involve opening your chequebook. You don’t have to pay LCMS Limited just because they ask you to. There are boxes that must be ticked before you have to pay, and it’s your job to make sure they tick them.

But before that, there may be a legal loophole that stops you from having to pay at all. What is it? Keep reading!

Should you ignore them?

Because there’s a chance of litigation and further expense, you shouldn’t ignore LCMS Limited or any other debt collection agency. Despite what you may read online, not everyone ignores debt collection groups and gets away with it.

Can they really take you to court?

LCMS Limited might advise their client to take legal action to recover the debt when you have been unwilling to pay. They are allowed to do this, and if the claimant wins in court, a judge will issue an order that states you should pay. This could cause you further expense.

If you were to ignore a judge’s request, the claimant could then be allowed to use debt enforcement action. This could involve different ways to make sure you pay and often comes with additional charges, such as the use of bailiffs.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can they come to your home?

LCMS Limited’s staff members don’t have the same legal powers as bailiffs. If they come to your home you can ask them to leave and they should do so straight away. However, there are no indications online that LCMS actually attend debtors’ homes in any case.

Some debt collection agencies do come to people’s homes and wrongfully suggest they can repossess items if the debtor doesn’t pay. This would be illegal.

Other Debt Collectors to look for on your Credit Report

There are hundreds of debt collectors in the UK and they each collect for different companies.

It’s surprisingly easy to not notice that you’re in a debt collector’s crosshairs.

I’d suggest you spend time checking your credit report. If a debt collector purchases any of your debt, it will appear on your credit report.

Some of the biggest to look out for include Cabot, PRA Group, and Lowell.

So if you see anything relating to their names, then you’ll need to investigate further.

LCMS Limited Contact Information

| Address: | LCMS Limited., W6B Ladytown Business Park, Newhall, Naas, County Kildare |

| Phone: | 045 431143 087 2604625 (Outside business hours) |

| Email: | [email protected] |

| Website: | https://www.lcms.ie/ |

Use our debt info hub for more help

Further support can be accessed via a debt charity like StepChange. And more information can be found by visiting our debt info hub. Make the most of free help and resources to tackle your debts!