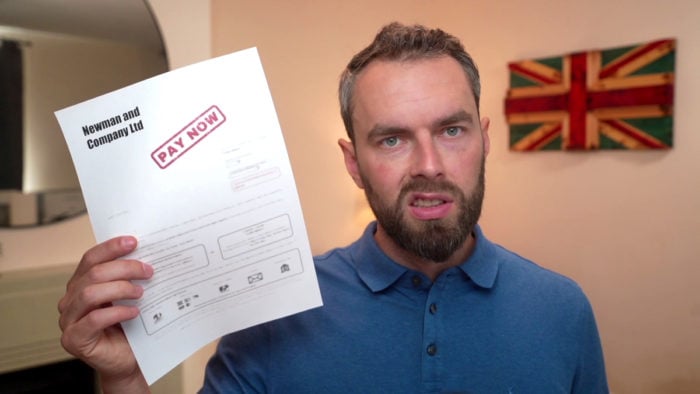

Newman and Company Ltd Debt Collectors – Do You Need to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’ve received a letter from Newman and Company Ltd Debt Collectors, don’t worry. You might be feeling confused, questioning where this debt has come from, or worried about whether you can afford to pay.

You’re not alone in this. Over 170,000 people each month visit our website for advice on matters just like this one.

In this helpful guide, we’ll:

- Explain who Newman and Company Ltd Debt Collectors are.

- Guide you on how to find out if the debt is really yours.

- Determine if it’s possible to ignore or appeal against Newman and Company.

- Show ways to stop them from chasing you too much.

- Explain options for making payment plans or even clearing off your debt.

Some of our team have been in your shoes, dealing with debt collectors, so we understand how scary it can feel. We’re here to help you figure things out.

What are the next steps?

If you are dealing with debt collectors, and wondering what the possibilities are to handle the situation, these are some actions you can take.

The first option is to enter into a debt management plan or an IVA, which will allow you to pay back the debt in a single monthly payment, with the ability to write off some of the debt within a specific period of time. This option is not for everyone though, so it is worth seeking advice before signing up to an IVA.

You may also want to consider a ‘logbook loan’ which is another popular option. This is a loan which you get on your car, you don’t need to give up your car and you get the money too. You get the equity on the car, but you retain it. A great option if you need money, but don’t want to part with your vehicle! To apply for a logbook loan click here.

In addition, you could consider a no credit-check guarantor loan. This is where you get someone else to be a guarantor for the loan, i.e. they take responsibility for it, and your credit rating is not taken into account. The guarantor would usually be a friend or family member. This is ideal if you have a lower credit score, and are concerned that you wouldn’t be able to get it on your score alone. Click on this link for Unsecured Loans, that won’t require a credit check.

You can also try a debt management plan, and we will be able to provide a whole-of-market service, with a wide range of debt management experts available on our panel. Regardless of your circumstances, your application will allow you to source the right plans for you. You won’t need a specific level of debt or income to be able to use this option.

» TAKE ACTION NOW: Fill out the short debt form

Newman and Company Debt Collectors and the Truth About Your Debt

There are a few things you can do to ensure that things are as difficult for them as possible with the various tactics of Newman and Company Ltd. You can bar their phone number permanently, or you could go the other way and record their phone conversations, you can write to them telling them not to call round at your home or any combination of these things (all these template letters can be freely downloaded from the web site).

So ask Newman and Company Ltd for a copy of the original contract when you took out your loan or credit card.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

More Information On Newman and Company Ltd

If you can provide any additional information on Newman and Company Ltd Debt Collectors, we would be more than happy to take a look! You can send us an email, and anything you tell us will be in confidence. We will try and look into the situation and find out more about these debt collectors.

Newman and Company Ltd Contact Details

| Also Known As: | Newman and Company, Newman & Co Debt Collectors, Newman and Company Debt Collection |

| Address: | Newman and Company Ltd, Limewood House, Limewood Way, LEEDS LS14 1AB |

| Telephone: | +44 8453 304800 |

| Fax: | 0113 306 069 |

| Email: | [email protected] |

| Website: | www.newman-dca.com |

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Other Debt Collectors to look for on your Credit Report

There are hundreds of debt collectors in the UK and they each collect for different companies.

It’s surprisingly easy to not notice that you’re in a debt collector’s crosshairs.

I’d suggest you spend time checking your credit report. If a debt collector purchases any of your debt, it will appear on your credit report.

Some of the biggest to look out for include Cabot, PRA Group, and Lowell.

So if you see anything relating to their names, then you’ll need to investigate further.