Making Extra Loan Repayments – The Pros and Cons

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you thinking about making extra payments on a loan? Are you wondering if it’s a good idea? This guide is here to help answer those questions. Every month, over 170,000 people turn to our website for advice on handling debt.

In this easy-to-read guide, we’ll explore:

- The good and bad sides of making extra loan repayments.

- How early repayment can affect your credit score.

- Tools to help you plan your debt payoff.

- Possible ways to write off some debt.

We know that having loan debt can be a big worry. You might be scared of not being able to pay it back or of what will happen if you don’t. We understand these fears, and we want to help you find the best way to deal with your debt.

So, sit back and relax. We’re here to guide you through your options and help you make the choice that suits your situation best.

Let’s get started.

So what are the advantages of early repayment?

To begin with, let’s look at why making some early repayments is a good idea.

The first and most obvious point is that you’ll repay the loan faster. This means you won’t worry about loan payments nagging you at the back of your mind for as long. As well as this, you may not have to pay interest on anything you pay back early. The quicker it’s paid back, the less likely you will encounter issues like added interest on your loan or missing a payment.

For most people, paying back a loan quickly seems the most sensible option. Getting a loan paid back ends your business with the loan company.

Real life stories:

I was foolish to take out a bonus loan with this company [Oakam Loans] and have been paying them 45 pound per week for the last 10 weeks. There are another 42 weeks to pay and I am now in a position to repay early.

Phillyg – Consumer Action Group

A loan payoff calculator might be a valuable resource if you have a loan debt in the UK and are struggling to meet repayments or just want to stay on track.

But are there disadvantages to paying back a loan early?

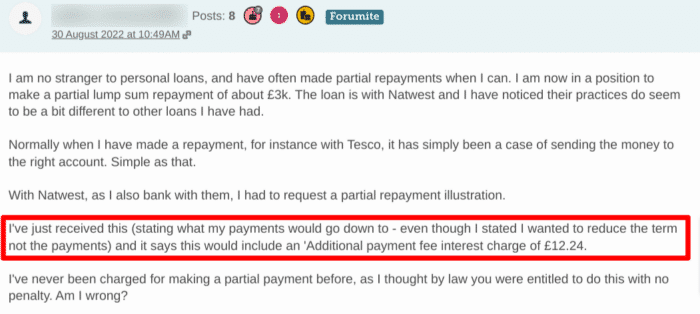

There can, of course, be disadvantages to paying back a loan early. If you have a low APR loan, it might be worth staying in the current payment plan. The biggest issue is when loan companies charge you more for paying early. This may seem strange, but it can be a genuine problem.

Early repayment fees are typical when you try to pay everything back at once. At a basic level, people with personal loans need to pay to clear their debts early. While this may seem very odd, it is a way that loan companies make money. If you stick to your original plan, you must pay interest, which benefits the company.

As you can see, this MoneySavingExpert forum user has tried to make a partial lump sum repayment and was charged an additional payment fee interest charge.

When you make a significant overpayment, it’s called a ‘partial early settlement’.

This means you’re paying off more of your loan than your agreement states. If your loan was given on or after February of 2011, you can pay up to £8000 in overpayment.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Credit score and early repayments

Repaying your loan in a timely manner shows lenders that you are a reliable borrower who can make repayments on time. Therefore, you can improve your credit score if you make timely payments regularly.

On the other hand, paying off your loan early and closing your account means that there is no longer any record of you making payments. In some instances, this means that your credit score could dip. However, the negative impact is often temporary.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

So is paying back early a good idea?

Overall, there are both pros and cons to paying back early. If in doubt, seek professional help from a financial advisor.

The faster you can pay back your loan, the better. However, you need to be careful when paying early. You can be charged money if you try and pay back more than your agreement says. Therefore, you must ensure you’re paying less than the amount stated in a year. This will protect you from fees, and you won’t have to pay interest.

No one wants a loan hanging over their heads, therefore you’ll want to repay quickly. Just make sure you do so in a way that doesn’t rack up more fees.