Stirling Park Debt Collection – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’ve received a surprising letter from Stirling Park Debt Collection, don’t worry -you’re at the right place.

We understand that it can be confusing and perhaps a bit scary, especially since research shows that nearly half of the individuals who deal with debt collection agencies have experienced harassment or aggression1.

You’re not alone! Each month, more than 170,000 people visit our website seeking advice on situations just like this. We’re here to help you.

In this article, we’ll explain:

- How to check if the debt really is yours.

- What to do if Stirling Park contacts you.

- How to find out if their claim can be enforced.

- What your options are if you owe an enforceable debt to Stirling Park.

- How ignoring a debt to Stirling Park might affect you.

We know that dealing with debt collectors can be tough because some of our team have been there too. But with the right information and a bit of guidance, you can manage this situation.

What should I do if they contact me?

First of all, you should verify that it is genuinely Stirling Park who are contacting you. Secondly, you should verify exactly why they are contacting you. Thirdly, you should verify if their claim is enforceable.

Only once you have taken all of these steps should you decide what to do next. This will depend on the exact situation.

Remember, you must take action but it’s important to keep calm when you do. There is always a way forward.

Your Rights

Understanding your rights when Stirling Park contacts you is crucial to prevent unfair treatment, harassment, or any other unwanted situations.

Here’s a quick table that explains what debt collectors can and can’t do. If you want to learn more, make sure to check out our detailed guide.

| Debt Collectors Can | But They Can’t |

|---|---|

| Contact you by phone or mail. | Call you after 9pm or before 8am. |

| Conduct home visits (on rare occasions) and knock on your door. | Forbily enter your home, or stay if you ask them to leave. |

| Threaten to take you to court by suing you for payment on a debt. | Harrass you, including threats of violence, repeated calls and visits, or abusive language. |

| Negotiate a debt settlement. Tip: make sure to get this new arrangement in writing. | Visit your workplace. |

| Access your bank account, but only after a court judgment has been made. | Take anything from your home or threaten to do so. |

| Sell your debt. | Speak to other people about your debt without your permission. |

| Contact you frequently. | Keep doing so if you request that they reduce communications. |

» TAKE ACTION NOW: Fill out the short debt form

Does the debt belong to you?

If you think you are being pursued for a debt which belongs to someone else, or which you have already paid, then the standard course of action is to send what is known as a “prove it letter”. There are various templates you can use for this, but the most basic one is as follows.

Dear Stirling Park,

This letter is a response you your letter dated [dd/mm/yy], reference# (copy attached).

If you think that a debt exists and that the person who owes the money lives at this address, then please prove the debt in writing.

As per FCA regulations, you must stop any collections activity and correspondence until you have done this.

Yours faithfully,

[Your Name]

You can send this by email or letter. If you send it by email, then you may want to think about the email address you use. In fact, you may want to create a specific email address just for dealing with Stirling Park. If you send it by letter, then it’s advisable to use recorded delivery. In either case, it’s usually perfectly reasonable just to supply the reference number, especially if you don’t have a proper scanner and/or printer.

Think very carefully before including your phone number or handing it over if Stirling Park requests it.

Stirling Park should then respond with proof that you do owe the debt. This proof will probably consist of some of the following documents:

- Credit application+Loan Agreement

- Detailed statement of account

- Copy of default notice

- Copy of formal demand

If the debt has been sold, a statement to that effect from the original creditor, plus confirmation that this was permitted under your loan agreement (it usually is).

If Stirling Park does not respond and does not pursue further action, then you can consider the matter closed. It is, however, highly advisable to check your credit record in case the action has triggered an incorrect entry. If it has, you can request the agency/agencies to remove it.

If Stirling Park does not respond but continues to make collection attempts, you should follow up your original letter. Again, there are plenty of online templates you can follow. Here is a suggestion.

Dear Stirling Park,

COMPLAINT

On dd/mm/yy I asked you to prove that I owed a debt to [insert company name].

You have failed to do so, but are continuing to attempt collection. This is against FCA rules. Please cease your collection activities or I shall refer you to the Financial Ombudsman Service.

Please also remove the any incorrect entries from my credit records.

Yours faithfully,

[Your name]

Never send a prove it letter if you have been served court documents

If you have been served court documents then you need to enter a defence within the given time frame. If you fail to do this, you may end up with a County Court Judgement being entered against you. These can be set aside, but it’s better to avoid getting them in the first place. This means that you are unlikely to have time to send a prove it letter. You need to get legal advice immediately.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Is it still enforceable?

If you do recognize the debt, then check if it still qualifies for collection. There are two main reasons why a debt might not qualify for collection. The first is that you have entered into some form of insolvency proceedings.

If a debt is subject to insolvency proceedings, you just need to write and to Stirling Park and inform them of this. Again, there are plenty of online templates. Here is a suggested format.

Dear Stirling Park,

I am writing in response to a letter from you dated [dd/mm/yy], reference#/a copy is attached.

This debt was included as part of [state type of insolvency proceedings]. The [state type of insolvency proceedings] order was made on [date]. As a result, you now have no remedy in respect of this debt. Please cease all collection activity immediately or I shall make a formal complaint to you and if fail to act upon it, I shall refer you to the appropriate regulator or ombudsman.

Yours faithfully,

[Your Name]

The other reason is a statute-barred debt.

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window it will be enforceable for a while.

If you think your debt is statute-barred, then you can use this template for Scotland and this template for the rest of the UK.

When you do owe the debt

When you owe an enforceable debt, you have two options. You can either pay it (or at least part of it) or you can go insolvent. Whichever option you take, you have the right to a certain level of dignity and protection from harassment.

In turn, you must help yourself and do what you can to help others to help you. In other words, you need to keep your head out of the sand and face reality.

If you can afford to pay off the debt in full without compromising on the essentials you need for a basic standard of living, then it usually makes sense to do so. If you can’t, then it is strongly recommended to seek advice from a professional debt advisor.

They will understand both the law and industry practice and will have experience dealing with creditors. As a result, they will usually do a better job of negotiating with Stirling Park than you would yourself. If nothing else, they can act as a shield between you and Stirling Park.

There are two points to remember here. Firstly, it is the job of a debt advisor to help you not to judge you. Secondly, at the end of the day, creditors want as much money as they can get out of you as quickly as they can get it out of you. If you cannot pay the full amount within the requested time-frame, then you can offer to pay a lower amount and/or to pay over a longer period.

If you cannot afford to do that, then you may want to consider a debt solution. There are several debt solutions in the UK, so I recommend seeking specialist advice from a debt charity before you start. Some financial counselling from a professional will help you find out which solution is best for you.

Debt Management Plan (DMP)

A DMP is an informal debt solution that lets you pay off your debts via a single monthly payment.

Because it is informal, it is not legally binding so you are not tied into a DMP for a minimum number of payments.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

When you just ignore it

I always recommend responding to debt collectors – even just to question the debt’s validity. Remember, you have the right to request proof of the debt. They have to prove it or they can’t charge you.

When you just ignore a debt to Stirling Park, they will take enforcement action. This must however, be “reasonable” and stop short of harassment.

For example, Stirling Park can call you, but they can only do so at “reasonable” times. This is not defined but the ICO’s Direct Marketing Guidance suggests 8 AM to 9 PM on weekdays and 9 AM to 9 PM on Saturdays, with no calls on Sundays or bank holidays.

Stirling Park can send letters and representatives to your home, but the latter must behave reasonably. For example, they cannot intimidate, threaten or lie to you, nor can they discuss your debts with anyone else.

That said, they are under no obligation whatsoever to be particularly discreet about their presence. They can also (usually) add charges, interest and penalties to the amount owed. These can quickly add up and can easily become a lot more than the original debt itself.

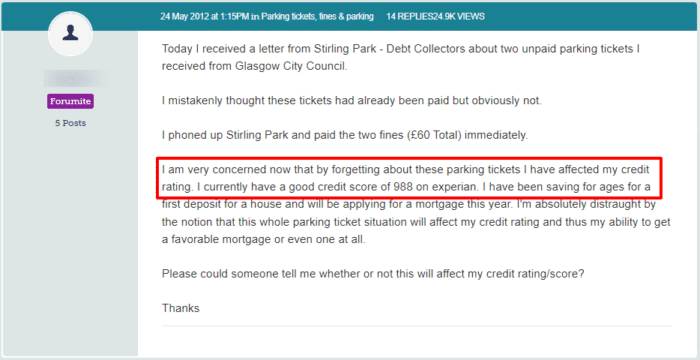

Will it affect my credit score?

If you ignore Stirling Bank, yes, your credit score will be negatively affected.

This is because credit companies use your credit file to see if you are a high-risk customer – someone who might not pay back all of their debts promptly.

Stirling Bank may be able to take legal action against you. A CCJ, for example, will be visible on your credit file for 6 years and will further lower your credit score.

But your credit score won’t be affected if Stirling has sent you letters in error!

This person shouldn’t worry. If they can prove that they have paid the parking tickets to Glasgow Council, Stirling can’t do anything and their credit won’t be affected at all.

Can I Complain?

If you think that Stirling has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to Stirling Park so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, Stirling Park may be fined. You could even be owed compensation.

Stirling Park Contact Details

| Address: | Stirling Park LLP 25 Bank Street Kilmarnock KA1 1HA |

| Telephone: | 01563 546 518 Mon to Thu –8:30am to 6:30pm Fri – 8:30am to 6pm |

| Contact: | Contact Form |

| Website: | stirlingpark.co.uk |

Other Debt Collectors to look for on your Credit Report

There are hundreds of debt collectors in the UK and they each collect for different companies.

It’s surprisingly easy to not notice that you’re in a debt collector’s crosshairs.

I’d suggest you spend time checking your credit report. If a debt collector purchases any of your debt, it will appear on your credit report.

Some of the biggest to look out for include Cabot, PRA Group, and Lowell.

So if you see anything relating to their names, then you’ll need to investigate further.