Universal Credit Overpayment Not My Fault – How to Dispute

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you worried about an overpayment of universal credit that wasn’t your fault? You’re not alone. Every month, more than 170,000 people visit our website for guidance on such issues.

In this easy-to-understand article, we’ll guide you on:

- What universal credit is and how it works.

- Steps to take if you’ve received an overpayment letter.

- Who oversees universal credit and how overpayments occur.

- The possibility of writing off some of your debt.

- What happens if you don’t repay universal credit overpayments.

We know how stressful it can be to deal with a debt you didn’t cause, which is why we’re here to help. We’ll explain your options, whether you can write off some of your debt, and what happens if you can’t repay the overpayment. We’ll also talk about the people who oversee universal credit and how to get more help with your debt.

Let’s get started.

What Is Universal Credit?

Universal credit is an all-in-one benefit payment, designed to replace a number of different types of benefit payments. It is paid to people on a low income (or with no income) to help them meet their living costs. It is paid monthly (bi-weekly in Scotland).

Universal credit has replaced the following benefits:

- Working Tax Credit

- Child Tax Credit

- income-related Employment and Support Allowance (ESA)

- Housing Benefit

- income-based Jobseeker’s Allowance (JSA)

- Income Support

In order to qualify for universal credit, you would need to prove that you have a low income, and are struggling to make ends meet. Meaning that you must be:

- Unemployed.

- Working but on a low income. This includes part-time workers and self-employed people.

- Unable to work due to health problems.

- At least 18 years old (with some exceptions for younger people).

- Not be collecting your state pension.

- Have under £16,001 in investments and savings.

Don’t worry, here’s what to do!

There are several debt solutions in the UK, choosing the right one for you could write off some of your unaffordable debt, but the wrong one may be expensive and drawn out.

Fill out the 5 step form to find out more.

Who Oversees Universal Credit?

It is the Department for Work and Pensions (DWP) that administers universal credit payments. The DWP handles all state benefits, including the state pension, apart from tax credits. However, your local council is also involved in helping you to get universal credit if you are eligible. But this is as far as the involvement with the local authority goes. Once you have been referred to your local DWP benefits office, it will be the DWP you deal with from then on.

How Do Universal Credit Overpayments Happen?

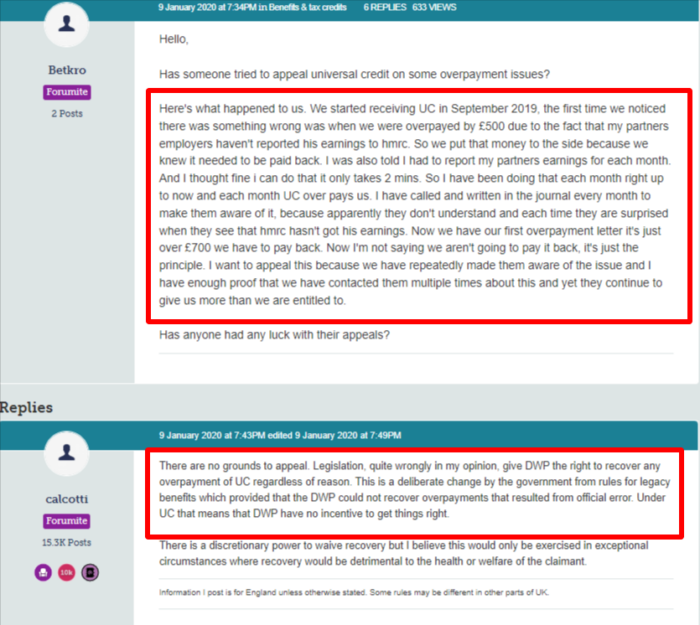

You may have received a letter from your local benefits office, telling you that you have been overpaid for universal credit. There are three reasons why this will happen.

- It was the DWP that made a mistake when calculating how much universal credit you are entitled to.

- You failed to inform the DWP about a change in your circumstances that would have an impact on how much universal credit you should get.

- You gave fraudulent information to the DWP in order to try and get more universal credit than you are entitled to.

If you have been contacted about an overpayment by the DWP, it doesn’t automatically mean that they suspect you of trying to commit benefits fraud. In many instances, it is the DWP itself that has made a mistake that leads to the overpayment. Either way though, the DWP is going to want to collect the overpayment from you.

If you did do something that resulted in the overpayment, you may face a civil penalty. This would happen if you purposefully gave the wrong information to the DWP, or lied through omission by not telling them about a change in your circumstances on purpose.

If you are found guilty of such actions, and this resulted in you being overpaid universal credit, you will need to pay the overpayment back, and you may be prosecuted for fraud.

Will You Be Investigated by the DWP?

If you have been overpaid universal credit, the DWP might sanction a compliance officer to interview you. This would initially take the form of a telephone interview. This doesn’t mean that the DWP thinks you have committed benefit fraud, it means they need more information to work out why the overpayment happened.

However, if during the telephone call the compliance officer comes to suspect that you have not been entirely honest, this will trigger an actual home visit. At this stage, it is likely that the DWP will trigger a full investigation into your means, and your financial situation to work out whether you have been fraudulent or not.

What Happens if You Don’t Repay Universal Credit Overpayments?

An unpaid debt for a benefit overpayment will mean that the DWP will take action to recover the money from you. Initially, your universal credit payments will be reduced until the deficit has been made up. However, if you become employed before the overpayment has been collected in this way, you still need to repay the remainder. If you don’t, there are a number of things that could happen, such as the ones listed below.

- The DWP will ask your employer to deduct repayments from your wages/salary.

- Your debt might be passed on to a debt collection agency such as Lowell Financial.

- You may find that the DWP asks the local county court to issue a County Court Judgement (CCJ) against the debt.

- The county court may send bailiffs to your home to collect the debt.

It should be noted that the DWP is quite strict when it comes to collecting debts. Furthermore, it has legislation on its side. Specific laws that were put in place to help the government collect money that is owed by people who have been overpaid benefits. You can’t just ignore a debt to the DWP and expect it to go away. You will be forced to pay it in one way or another.

How To Find More Help With Debt

If you want some help and advice about reducing your debt, you can visit your local Citizens Advice Bureau (CAB). The staff help people with debt every day. They can help you work out how much you can afford to repay the DWP each month, and help you contact them to work out a repayment plan. They can also advise you on more advanced debt recovery schemes such as an Individual Voluntary Agreement (IVA).