Utility Warehouse Debt Collectors – Do I Have to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Receiving a letter from Utility Warehouse Debt Collectors can feel confusing and worrying. You might be asking where the debt came from, if it’s real, or if you should pay it.

You’re not alone. Every month, over 170,000 people visit our website seeking advice on debt problems, just like yours.

In this article, we’ll guide you through:

- Understanding what Utility Warehouse is.

- Knowing if the debt letter you received is real.

- Learning what happens if you can’t afford to pay.

- Finding ways to deal with the debt.

- Checking if you can write off some of your debt.

We understand how it feels to get a debt letter; some of our team have been in the same place as you. That’s why we’ve prepared this guide that will help you figure things out.

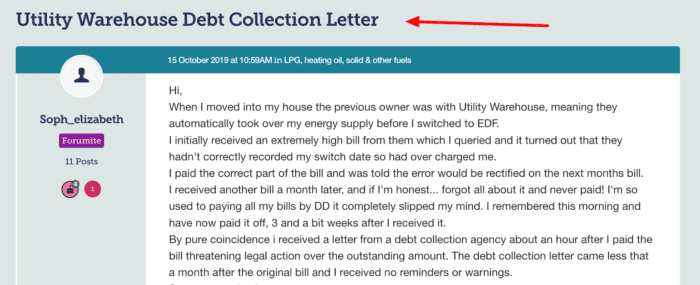

Utility Warehouse debt collection letter

If you miss a payment to utility Warehouse, they’re known to quickly pass on the case to a debt collection agency.

This forum user’s post is evidence of this:

Source: https://forums.moneysavingexpert.com/discussion/6059012/utility-warehouse-debt-collection-letter

The debt collection company is a separate business that specialises in chasing customers for payment on their account arrears. They will threaten legal action if you don’t pay, which is why utility Warehouse debt collector letters can be so scary. They’re this way on purpose to scare you into paying swiftly.

In return for the service provided, the debt collector will take a percentage of the repayment.

Is Utility Warehouse a pyramid scheme?

Utility Warehouse isn’t a pyramid scheme as pyramid schemes are illegal in the UK. The company is a legitimate supplier and is regulated by Ofgem, Ofcom and the Financial Conduct Authority.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Do you have to pay Utility Warehouse debt collectors?

If you do owe the money to Utility Warehouse then you will need to pay the debt off by liaising with Utility Warehouse debt collectors or by speaking directly with Utility Warehouse. This will avoid the potential for legal action and a County Court Judgment (CCJ).

However, before you open your wallet and pay, you might want to consider some alternate legal ways to reply to Utility Warehouse debt collectors…

Ask Utility Warehouse debt collectors to prove the debt

When your debt isn’t statute barred, you can instead choose to ask for proof you owe the debt. Utility Warehouse debt collectors will need to get a copy of the agreement you signed and send it to you.

This is worthwhile if you want to buy yourself time (although fees could still be added) or if you really dispute owing the money. Always keep records of your letter and postage just in case legal action is taken. You could use it to have a CCJ set aside.

To save time, why not use our own prove-the-debt letter template? It’s free to use!

» TAKE ACTION NOW: Fill out the short debt form

Check your Utility Warehouse debt is still enforceable

Older debts cannot be subject to court action to protect the legal system form becoming bogged down in older debt cases.

A debt becomes too old to be enforced (statute barred) after six years of no payments or acknowledgement, or after five years in Scotland. However, there are some exceptions and different timescales for some debts – but not for utility debts.

Always check your debt qualifies as statute-barred first, and if it does, you can reply to Utility Warehouse debt collectors to tell them you won’t be paying for this reason.

What if Utility Warehouse debt collectors send proof?

If you ask for proof and receive a copy of the agreement, it’s time to think about ways to clear the debt. You can discuss all your options with a UK debt charity. They might tell you about solutions you can use you didn’t know about.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

How can I contact Utility Warehouse?

The Utility Warehouse contact number is 0333 777 0777.

The Utility Warehouse debt collection number will depend on the debt collection agency they’ve used to chase you for the payment. Most agencies have a website where you’ll find contact info.

Is Utility Warehouse in trouble?

Utility Warehouse claims to run a healthy business and isn’t at risk of going bust.