Can’t Afford to get to Work – Here’s What You Should Do

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

If you’re finding it hard to afford your travel to work, don’t worry. We’re here to help you out.

Each month, more than 170,000 people visit our website for guidance on issues like this, so you’re definitely not alone.

In this article, we’ll share useful tips on:

- What to do if you can’t afford your commute.

- How to save money on transport costs.

- Ways you might be able to get help with your money woes.

- What debt solutions are available to you.

- How to check your credit report.

Our team knows what it’s like to worry about money, as some of us have had to deal with debt and not having enough for important things like getting to work.

We’re here to guide you to find ways to ease your financial stress. Let’s get started.

What is minimum wage 2023 UK?

As of April 2023, the minimum wage is set to rise.

It means the National Living Wage is due to go up £10.42 , which is an increase of 9.7% or 92 pence.

What is the current minimum wage?

The national hourly minimum wage in the UK varies depending on your age.

I’ve listed the current rates below:

- £9.50 for people aged 23+£9.18 for people aged 21 to 22

- £6.83 for people aged 18 to 20

- £4.81 for people aged 16 to 17

- £4.81 for apprentices under the age of 19, or those who are in their first apprenticeship year

As mentioned the National Living Wage and the National Minimum Wage rates are set to rise as of 1st April 2023. I’ve listed the increases below:

- Workers aged 23 and over (National Living Wage) will increase from £9.50 to £10.42 an hour

- Workers aged 21–22 will increase from £9.18 to £10.18 an hour

- Workers aged 18-20 will increase from £6.83 to £7.49 an hour

- For workers aged 16-17 and apprentice rate will increase from £4.81 to £5.28 an hour

- Accommodation offset will increase from £8.70 to £9.10 an hour

What is a low salary in the UK?

The definition of a low salary in the UK is a wage that causes anxiety and emotional stress. For example, not being able to put food on the table, pay bills and get to work!

When you struggle to meet the cost of actually getting to work, the stress it causes leads to all sorts of issues.

First, your personal circumstances suffer as does your ability to carry out your work as you normally would!

According to the Department for Work and Pension (DWP), low pay is defined as any household where earnings are less than the national median wage which is £31,000 per annum.

The Minimum Income Standard Project believes that households earning less than £19,200 a year should be classed as low-pay households.

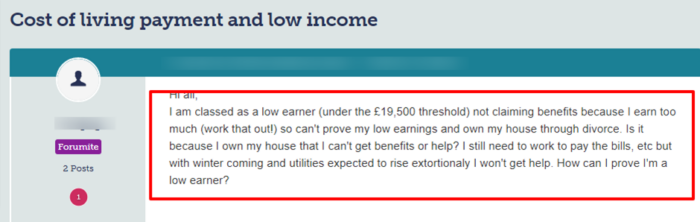

Check out what one person on a low-income posted on a popular forum:

Source: Moneysavingexpert

Can’t afford to get to work?

There are several things you can do to ease your financial dilemma. First, check whether you could receive benefits to help with the rise in the cost of living.

You could be entitled to benefits if you’re on a low income.

You could receive the following benefits:

- Housing benefits

- Working and child tax credits

- Universal Credit

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How You Can Save Money on Transport Costs

If you are really struggling with physically getting into your place of work, here are some tips that could help you:

- Walk or cycle: Not everyone will be able to do it, but walking or riding a bike is one way to get around town without paying for petrol or public transportation. You could look for used bikes if you want to try riding but don’t have one. The Bike to Work scheme can also save you money on the cost of a new bike.

- Check for bus discounts: If you can’t walk or ride a bike, check to see what bus lines are available in your area. People in London who get benefits like Universal Credit can apply for the Bus & Tram Discount photocard, which lets them get 50% off bus and tram tickets.

- Buy a railcard: Railcards make it easy to save money when you take the train. There are nine different kinds, so you should be able to find one that you like. A railcard usually costs £30, but it cuts prices by a third. This could save you a lot of money over the course of a year. Make sure you meet the requirements for each card, and keep in mind that some cards can’t be used for certain trips during weekday rush hours. However, these rules don’t apply on weekends or bank holidays.

- Consider joining a car share scheme: If you drive to work, you might save money on gas by carpooling with a coworker or friend. Your petrol costs could be cut in half if you join a car-sharing programme. If you share with more people, you could save even more.

Could you get Housing Benefits if you can’t afford to get to work?

When you’re on a low income and you can’t afford to get to work, you may be entitled to Housing Benefit.

It’s there to help you pay some or all of your rent. It could take some of the financial pressure off you.

It’s worth noting that Housing Benefit is being replaced by the Housing Element of Universal Credit.

» TAKE ACTION NOW: Fill out the short debt form

Could you be entitled to a Working and Child Tax Credit?

You could be entitled to a Working and Child tax credit. However, you must already be getting Child Tax Credit to claim Working Tax Credit.

If you find you’re not eligible for Working Tax Credit, you may be entitled to Universal Credit.

That said, if you’re State Pension age or older, you may still work to help pay bills. If so, you could apply for Pension Credit.

That said, to apply for Working Tax Credit, you must work for a specific number of hours every week.

What about Universal Credit?

You should also check whether you could receive Universal Credit if you’re on a low income.

You may be entitled to receive the benefit but if you’re already getting other benefits, you may need to move onto Universal Credit.

You’d need to provide the following information when you apply:

- Your rent and housing situation

- What your income is and if you have any savings

- Whether you have a childcare provider

- Your bank details

It’s worth noting that Income Support has been replaced with Universal Credit.

Could you get help with your Council Tax bill?

If you’re struggling financially you could be entitled to a reduction in your Council Tax bill.

Anyone on a low income or who claims benefits could have their bill reduced by as much as 100%.

You’re entitled to apply whether you own your home, or live in a rental property if you’re working or unemployed!

However, how much of a reduction depends on several things which I’ve listed here:

- The area of the country you live in. Every council operates its own scheme

- Your personal circumstances which include your income, benefits, residency status and number of children

- Your household earning which includes pensions, savings and a partner’s income

- Whether your children or other adults live with you

Has a low income resulted in lots of debt?

There are ways you can get back on track if you’re on a low income and have consequently fallen into debt.

However, you should seek advice from an adviser before you choose which debt solution is best for you.

Choosing the wrong solution may just make your financial situation that much worse and harder to resolve.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Are debts written off after 6 years?

You could get out of paying a debt if the following applies:

- The debt is 6+ years old

- You haven’t made contact with the credit in 6 years

- You didn’t make any payments towards settling the debt in 6 years

- You were pressured into signing an agreement or it wasn’t clear

Would an IVA get you out of financial trouble?

There are pros and cons to going down an IVA route to get out of debt which I’ve detailed.

The pros of an IVA

- You get to pay an affordable amount through a payment schedule

- Your assets (if any) are protected

- It stops creditors from harassing you

- The payment you make is fixed

- Interest and other charges are typically frozen

- An IVA is legally binding

- You’re protected from more legal action and bailiffs

The cons of an IVA

- It could have an effect on your employment

- It negatively affects your credit rating

- An IVA is public knowledge

- You’d have to follow a strict budget

- You may have to release equity from your home if you own the property

You’d have to balance the pros and cons. Which answers the question is an IVA worth it?

It’s worth noting that if you go down the IVA route, and you get a pay increase during the IVA, your wages won’t be impacted!

What other debt solutions are there?

There are various ways to write off debts which are open to you when you’re on a low income.

You should contact your creditors and see whether they’d accept a lower payment plan.

You could apply for a Debt Relief Order (DRO) could be an option if your disposable income is less than £75 a month.

It means creditors can’t chase you for payment or take you to court for twelve months. Plus, if your disposal income remains the same by the end of a year, the debt could be written off.

You could ask lenders or creditors to freeze any interest payments on your accounts.

What free debt advice is there in the UK?

There are leading UK charities that provide free debt advice. Plus, there are independent debt management companies that offer advice to people struggling with finances.

However, a debt management company would charge for the advice they provide.

I’ve listed some of the main charities in the table below:

| Name of charity | Links to their websites |

| StepChange | https://www.stepchange.org/ |

| Citizens Advice | https://www.citizensadvice.org.uk/debt-and-money/help-with-debt/ |

| National Debtline | https://nationaldebtline.org/ |

| Prince’s Trust | https://www.princes-trust.org.uk/help-for-young-people/tools-resources/money-management/debt-advice |

Should you check your credit report?

Yes. It’s always a good idea to check your credit report from time to time. Like this, you’ll keep an eye on whether creditors or debt collectors have got a court order against you.

I’ve listed some of the leading debt collection agencies here: