CCJ Payment Plans – Can You Pay in Instalments?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you keen to know more about County Court Judgement (CCJ) payment plans? Do you wonder if you can pay in instalments?

This guide is here to answer these and many other questions you might have. Every month, over 170,000 people like you visit our website to understand their credit and debt better.

This article will help you:

- Learn what a CCJ is and why creditors might seek one against you.

- Understand what to do if you receive a CCJ.

- Discover how to make payments on your CCJ.

- Find out if you can pay your CCJ in instalments.

- Learn how to change your CCJ payment plan.

We know that dealing with a CCJ and understanding your debt can be tough. But don’t worry; we’re here to help. Our aim is to make sure you feel more clear and confident about your financial situation.

This guide will also touch on how to handle too much debt and how you may be able to write off some of it. Let’s get started!

What To Do if You Receive a CCJ

If you are sent a CCJ, it will come with a form that you need to fill in and return to the creditor within 30 days of the date that the letter was sent to you, not from when you received it.

You can reply stating that you dispute the debt, or that you agree that the debt is owed. If you dispute the debt and it dispute is overturned, or you agree with the debt, then you will then have to negotiate repayment terms.

Don’t just ignore the CCJ, as this will likely result in a more serious problem. Some of the things that might happen if you don’t respond to a CCJ are listed below.

- Seek an attachment of the earnings order, and repayment would be deducted from your wages or salary.

- Send bailiffs or High Court Enforcement officers to your home. They will ask you to pay the debt and may take items from your home to be sold and used to pay off your debt.

- Begin the process of having you declared an involuntary bankrupt.

- Apply for an interim charging order to secure the debt against any equity in your property, and ultimately force you to sell it to pay your debt.

Why Do Creditors Seek a CCJ Against You?

Whether you are being chased by the original creditor or your debt has been handed over to a collection agency such as PRA Group or Cabot Financial, the party collecting the debt might seek a CCJ against you, if they think you will not repay the debt.

Furthermore, having a CCJ issued against you is the precursor for a creditor then applying for an interim charging order, and then a final charging order, to secure the debt on your home. The creditor then has the option of applying for an order for sale, which would force you to sell your home and pay the debt in full.

» TAKE ACTION NOW: Fill out the short debt form

Making a Payment on Your County Court Judgement

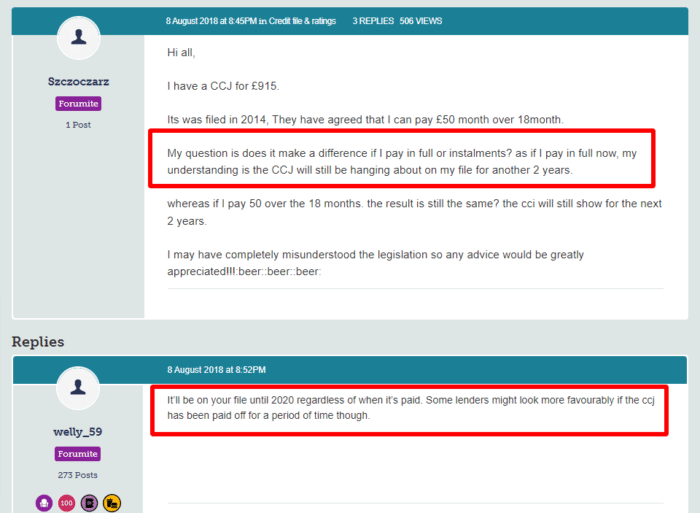

In some cases, you will be asked to pay the debt in full when you are sent a CCJ. Whether an instalment payment option is offered will depend on the court’s decision as to the terms of the CCJ.

If you have to pay the full amount of the debt, this has to be done within the payment timescale that the CCJ will have made clear. If you want to pay a CCJ without having to complete heavy paperwork, can’t afford to pay the debt in full by this date, or have not been offered the chance to pay in instalments, I recommend getting some professional debt advice.

Paying Your County Court Judgement in Instalments

Most commonly, a CCJ will give you the option to either pay the debt in full, or set up a repayment plan with the creditor to pay the debt back in regular instalments. At this stage, you need to negotiate the repayment plan with the creditor.

You might like to speak to a debt counsellor before negotiating the repayment plan, and work out an affordable and sustainable get-out-of-debt plan. The counsellor will be able to help you work out how much income you receive each month, and what your outgoings are. This will help you to find out how much you can realistically ensure that you repay each month.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Changing Your CCJ Payment Plan

If you pay the entire debt within the deadline stated in the CCJ, you can apply to have the CCJ removed, and it will only appear on your credit history for 2 years. If you are going to pay back the debt in instalments, then you have to stick to making regular monthly payments. Otherwise, you face further legal action.

If your circumstances change, and you can no longer make the same level of repayments each month, you will need to renegotiate with the creditor. To work out a fresh repayment plan. Once again, speaking to a debt counsellor could be a good idea here.