Face to Face Debt Collection Agency – Should You Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Are you feeling troubled because you’ve received a letter from Face to Face Debt Collection Agency? Are you unsure if this debt is yours or if you should pay it? You’re not alone. Each month, more than 170,000 people come to our website for answers to questions just like yours.

In this article, we will:

- Explain who Face to Face Debt Collection Agency are.

- Discuss how to deal with their debt letters.

- Give you options if you can’t afford to pay.

- Talk about what happens if Face to Face workers come to your home.

- Share ways to handle calls from Face to Face.

We know how worrying it can be to get a letter from a debt collector. Some of our team members have been in your shoes. They’ve had debt letters and calls and, luckily, found ways to deal with them. We understand your confusion and worry, which is why we’re here to help you find answers and make a plan.

Let’s start by helping you understand more about Face to Face Debt Collection Agency and what you can do when they contact you.

Face to Face Debt Collection Agency Debt Letters

Knowing how to deal with debt collections in the UK should help take some of the stress out of the situation!

The initial way that Face to Face Debt Collection Agency will contact you is by sending you a debt letter. This is known as a Letter Before Action (LBA) because it requests the money in full of tells you they will take further action.

And further action means legal action.

These debt letters are written to scare you and make you pay instantly. But we will tell you what you can do before reaching for your debit card.

It might even stop you having to pay Face to Face Debt Collection Agency anything at all!

Ask Face to Face Debt Agency to Provide Proof!

Instead of paying the Face to Face Debt Collection Agency debt off straight away, you can use the process to your advantage.

Face to Face Debt Collection Agency must prove that you owe the debt and you can ask for proof, such as a signed agreement you didn’t stick to.

To request proof before paying, you can ask for it by sending them a prove the debt letter.

We have created a prove the debt letter template you can use to save you the trouble of writing one yourself.

Keep in mind that you are under no obligation to pay a debt that Face to Face can’t prove you owe.

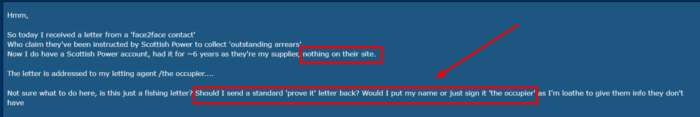

Sometimes they send out letters with minimal information on them! Take a look at this example:

This person’s plan of writing to them without signing his name is probably a good idea – any information that you give them they can use against you!

If you are unsure about your next steps if you’ve received a Face to Face Collections letter, I recommend speaking to a debt charity. I have linked a few below.

Ignoring Face to Face Debt Letters

The best piece of advice you can take from our Face to Face Debt Collection Agency guide is never to ignore their debt letters. The impact of ignoring debt letters can be very severe.

Sometimes their threats of court action are empty (and that is illegal) but not all the time. They could take you to court and have the legal right to do so if you are liable for a debt!

Most debtors will ignore Face to Face Debt Collection Agency because they haven’t got the money to pay. But there is even a way around not being able to pay the full amount.

Further details are found later in our discussion.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Will Face to Face Workers Come to My Home?

Some of the services carried out by Face to Face Debt Collection Agency do require them to visit people at their homes, and that means they do employ “field workers”.

They might come to your home to ask for payment or to negotiate a repayment plan, but they can’t enter your home without your permission. Only a bailiff can enter without permission, and even then they must wait for authorisation from the High Court.

If a Face to Face Debt Collection Agency field worker does any of the following, they are acting illegally:

- Telling you they have the right to enter your home

- Telling you they can or will take your items if you don’t pay

- Repeatedly turning up at your home

- Refusing to leave your premises

When You Never Have to Pay Face to Face Debt Agency

There is one law that can stop you having to pay at all.

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window it will be enforceable for the duration of the CCJ.

If your debt is statute-barred, you can use my free letter template to write to Face to Face and explain the situation.

If you know that your debt is not yet statute-barred, I recommend phoning the debt collection company rather than writing to them. Written communication to the debt collector might look like you are agreeing that you owe the money. This could restart the statute-barred timer.

If you are unsure about the status of your debt, you can contact a debt charity for some advice. Their advisors will be able to look at the debt in question, determine its status, and advise you on your next steps.

How to Halt Those Face to Face Debt Calls

» TAKE ACTION NOW: Fill out the short debt form

If you have started receiving calls from Face to Face Debt Collection Agency, you can’t make them stop completely but you can stop them from calling too frequently.

Send them your communication preferences and they must stick to them. If they don’t, they could be found guilty of harassment and this could land them in hot water with the Financial Ombudsman if you complain.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Face to Face Debt Collection Agency Complaint

If you think that Face to Face has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to Face to Face so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, Face to Face may be fined. You could even be owed compensation.

Face to Face Debt Collection Agency Contact Information

| Website: | http://www.face2faceltd.co.uk/ |

| Phone: | 0208 0806434 |

| Email: | [email protected] |

| Post: | Face To Face Document Services Ltd, Unit 1 Castle Court 2 Castlegate Way, Dudley, West Midlands, DY1 4RH |