What Happens if You ignore Debt Collectors?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

When a debt collector sends you a letter, it can be very scary. This is even more true if the debt is not yours, or if you can’t afford to pay it.

In this article, we’ll help you understand what happens if you ignore debt collectors. We’ll answer your worries and questions. Some of these will be:

- How can I check if the debt is really mine?

- Can I ignore debt collectors?

- Is it possible to stop them from chasing me?

- Can I make a plan to pay my debt?

- Is there a way to write off some of my debt?

You’re not alone. In fact, over 170,000 people, just like you, visit our website every month seeking advice on debt problems.

Our team has a lot of knowledge about this; some of us have even had debt collectors chasing us. With our expertise, we’ll help you understand your options.

What Happens If You Owe Money To a Debt Collector?

Debt collectors either act on behalf of your creditor or are working for a company that has purchased your debt. Their role is to try to recover the debt. To do so, they will likely send letters to your address and call you on the phone.

If you are sure that you owe the debt in question, you should respond to the debt collector as soon as possible to discuss a repayment plan. If you don’t, further enforcement action could be taken against you.

However, it is worth noting that debt collection agencies are not bailiffs or High Court Enforcement Officers. As such, they do not have any special legal powers. You don’t have to let them into your home and they are not allowed to harass you.

What Will Happen if I Ignore Debts Collectors?

The impact of ignoring debt collections can leave you with a real headache. There are several things to worry about if you’re refusing to communicate with people trying to collect debt from you. I’ve listed some of them below:

-

It’s very unlikely that debt collectors will stop contacting you. As I’ve mentioned above, debt collection agents are paid handsomely if they are able to get you to pay up. Hence, you can count on them to be very persistent even if you don’t respond.

- If you fail to respond to debt collection agencies, it’s likely that they’ll keep reporting you to the credit bureaus. This will hurt your consumer credit by a significant amount and your inability to pay your debts will be plain to see in your credit file. This will have severely negative credit score implications.

-

Your debt will keep growing. If you refuse to contact your debt collector about the debt, interest will keep adding up and your debt will keep increasing.

- You might be missing an opportunity to write off your debt. It’s very understandable for you to ignore calls by a debt collection agency if you are unable to pay off the debt to your creditor.

» TAKE ACTION NOW: Fill out the short debt form

- However, the important thing that you need to understand is that even if you don’t have the resources to pay off your debt, you have other options to get it settled. You can work with an independent charity to set up a debt payment plan to your creditor that you can afford.

- There are other options as well such as an Individual Voluntary Arrangement (IVA) or a Debt Relief Order (DRO). By ignoring your debt collector, you are robbing yourself of this opportunity.

- There is a chance you may get sued by your creditor. If you keep ignoring letters and calls by debt collection agencies, your creditors have every right to sue you in a court of law.

- If a judgement is passed against you in court, then the debt collection agency may receive the right to seize your possessions or your wages in order to pay for the debt.

- You are missing out on the opportunity to find out if the debt is even valid or not. There are a lot of times when debt collection agencies contact you about a debt that isn’t even yours.

- It’s a very good idea that when this happens that you ask the debt collection agency for information about the debt and find out if it’s even yours or not. A lot of the time, the debt is illegitimate and you can take it up with the Financial Conduct Authority in order to get it cleared.

- You will be unaware of actions that are being taken against you. Hence, you will not be able to prepare for whatever is coming your way. For example, you would be unaware about default notices, court action or a statutory demand from your creditors.

Is There any Advantage at All to Ignoring Debt Collectors?

In short, not really. There are only a couple of advantages to ignoring your debt collector and if I’m being honest, neither of them really seem like advantages at all:

- Ignoring your debt collector may grant you some time to be stress-free. If you don’t attend calls or read letters sent to you by debt collectors then, for a limited time, you may be able to make yourself forget how much trouble you’re in.

However, as you can probably imagine, this will be very short-lived. Your creditors will eventually start taking actions against you that you won’t be able to ignore, e.g., court action.

- There is a chance that if you keep ignoring your creditors and debt collector, they might eventually give up. However, you need to be honest with yourself and ask, “Is that really going to happen?”

If you owe your creditors a considerable sum, they are not going to stop contacting you until they are reimbursed. If they’ve hired an agency for debts collection, then there’s even a lesser chance of this happening.

A debt collection agency usually gets a percentage of the amount they are able to collect from you. Furthermore, the employees of the debt collection agency even get bonuses depending on how much they collect from you.

Hence, these are very motivated individuals and it’s very unlikely that they’re going to stop contacting you just because you’ve decided to bury your head in the sand.

What Should I Do If I’m Contacted by a Debt Collector?

Don’t panic and keep channels open! If you happen to be contacted by a debt collector, then it’s very important that you communicate. It’s alright if you don’t prefer speaking over the phone but it’s important that you maintain contact in some form with the debt collector and be very transparent with your information.

However, before you share any information with the collector, it’s important that you determine whether the debt is legitimate or not. Once you’ve determined that the debt is valid and that you do indeed owe the debt, then you can start worrying about how to pay it off.

Once it’s established that the debt is yours, you have to be as communicative about your situation as possible with your collector so they are more understanding and give you more leeway. If you need help paying off your debt then you can contact an independent charity or a debt management company. They will analyse your situation and help you set up a course of action that will help you pay off your debt.

I recommend that you contact an independent charity such as StepChange or Payplan rather than a private debt management company. This is because private debt management companies usually have their own fees while independent charities will be able to help you free of charge.

Once again, I’ll say that just because you are not able to pay off your debt does not mean it’s the end of the road. You have several options that you can explore which can help you become debt-free.

You just have to be willing to explore these options and be cooperative with your creditors so that they are more understanding and forgiving in regards to your situation.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

How Do I Know If The Debt Is Legit?

Before you make any payments towards a debt, it is essential that you verify the legitimacy of it!

First, check that it is actually your name on the letter. Sometimes mistakes happen, or people forget to update their addresses. If it’s not your name, then you probably don’t owe the debt. You can use my free letter template to explain to the creditor or debt collection agency that you don’t owe the debt.

If it is your name on the letter, you should still ask for proof that you owe the debt before you make a payment. If the company can’t provide evidence that you owe the debt, you don’t have to pay.

This is a good time to check that your debt is not statute-barred.

Statute-barred debts are unenforceable. This means that there is no legal way for you to be forced to pay it. The debt will still technically exist, but you can’t be ordered by a judge to pay.

Debts become statute-barred automatically 6 years (5 in Scotland) after your last payment or the last time you wrote to your creditor about it. But not all debts can become statute-barred!

Secured debts will always be enforceable, as will any debt that already has a County Court Judgement (CCJ) attached to it. Some unsecured debts will remain enforceable for much longer than 5 or 6 years. HMRC debts, for example, will remain enforceable for decades.

If you are not sure if your debt is statute-barred, I recommend speaking to a debt charity. There are several in the UK that offer free and specific advice. I have linked these at the bottom of the page.

Finally, you should make sure that the company is legit before you make a payment. You can do this by looking them up on the Financial Conduct Authority (FCA) register or via their website.

Keep in mind that not all debt collection companies need to be registered with the FCA. But any company trying to collect a debt related to the financial services industry – like loans, insurance policies, or credit cards – must be FCA registered before they can begin collecting.

Talking to Debt Collectors on the Phone is Very Upsetting to Me. Is There Any Other Way For Me to Contact Them?

Yes, there are all sorts of ways. It’s very understandable if you find talking to debt collectors over the phone anxiety-inducing or upsetting. If this is the case then you can inform the agency that you don’t prefer speaking to them over the phone and would like to be contacted in other forms instead. This could be in the form of letters or via e-mail. As per FCA regulations, debt collection agencies are bound to accept your request.

If they continue to contact you over the phone after you have specifically asked them not to then you have every right to report them to the FCA or even sue them in a court of law.

Should I Pay a Debt That Has Gone To Collections?

If you are sure that the debt is yours, and you have the money, paying it off is likely the best route forward. This will prevent your debt from growing and stop any further action from being taken against you.

However, it isn’t your only option. If paying your debt in full will result in financial hardship, you should discuss your repayment options with the debt collector, and with a debt charity.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Can I Get A Debt Solution?

If you have verified that you do owe the debt, you will need to pay it.

Most debt collection agencies and creditors will accept a repayment plan if you ask. But sometimes they’re just not for you. So you may need to look at a debt solution.

There are several debt solutions available in the UK. This means that you can opt for the best option for you and your finances. I recommend speaking to a debt charity. Their advisers will be able to talk you through your options and find what works best for you.

Keep in mind that these debt solutions will only be applied to some types of debt. Generally, debts included in a debt solution are unsecured debts. But any debts from court fines, student loans, child maintenance, and some other types of fines also can’t be included in your debt solution.

Debt Management Plan (DMP)

A DMP is an informal debt solution. This means that it is not a legally binding agreement, so you are not tied to it for a minimum period of time.

During your DMP, you will make a single monthly payment that is shared out among your creditors. You will stay in your DMP until all of your debts are paid.

Individual Voluntary Arrangement (IVA) and Trust Deed

An IVA is a formal debt solution. You make a single monthly payment among your creditors for the duration of the IVA, which is usually 5 or 6 years. After this time, any outstanding debts are written off.

One of the other major benefits is that your creditors can’t contact you during or after your IVA.

To be eligible, you need to owe several thousand pounds to more than one creditor. You also need to show that you have some disposable income every month.

If you are in Scotland, you will need to opt for a Trust Deed, as IVAs are unavailable.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month, and at the end of your Trust Deed term remaining debts may be written off.

Debt Relief Order (DRO)

If you have debts but no assets and a small income, you may be eligible for a DRO.

Once your application is approved, you make no payments towards your debts for 12 months. Your creditors don’t contact you and must freeze your interest during this time.

Your finances are then reassessed. If there is no improvement, your remaining debts may be written off.

Bankruptcy and Sequestration

Bankruptcy – or sequestration in Scotland – can be your only option if you have debts but no real way of paying them off.

It is a serious financial situation that should not be taken lightly, but it may be your only way of getting a financial fresh start.

If you are in Scotland and have few assets and little income, you may be eligible for a minimal asset process bankruptcy (MAP). A MAP is cheaper, quicker, and more straightforward than sequestration and is worth considering.

Will They Give Up Chasing?

After all that you might be wondering whether you can just wait it out and hope they stop chasing you.

Sadly, that’s probably not going to happen. Most debt collectors are persistent.

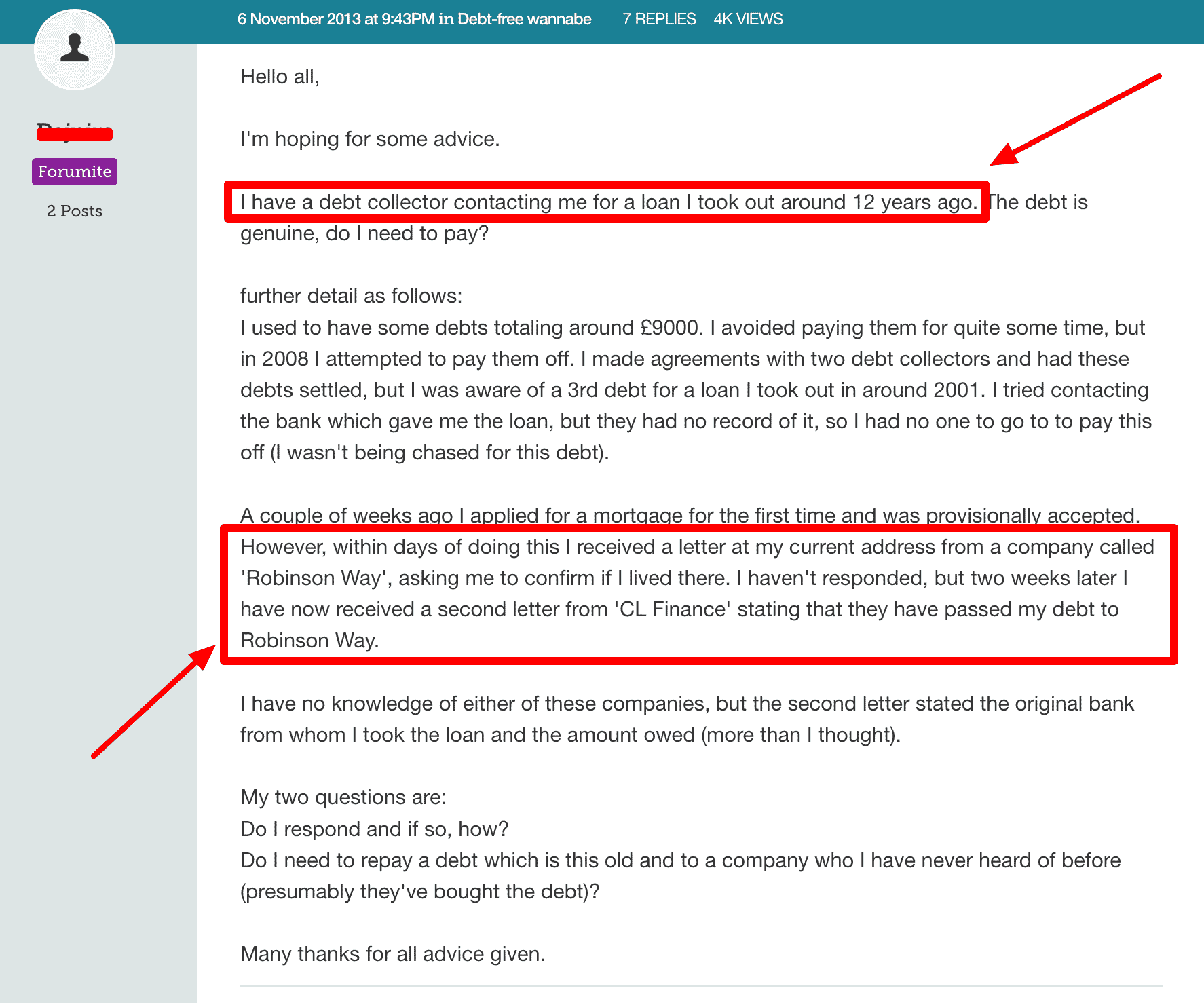

Source: Moneysavingexpert

As you can see Robinson Way starting to chase a debtor mere days after their mortgage application and a full 12 years after the debt was originally chased.

Other agencies like Lowell Group, Portfolio Recovery and Cabot Financial are constantly being accused of buying Statute Barred debts and then chasing people for payment.