Reduce Your Monthly Loan Repayments – Here’s How

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Do you have a loan and want to reduce your monthly loan repayments? You’re not alone! Every month, more than 170,000 people visit our site seeking advice on similar matters.

In this article, we’ll cover:

- Tips on contacting your existing lender

- The impact of credit score on loan approval

- Loan rates

- Alternatives to reducing monthly payments without loan switching

We understand that monthly loan repayments can be stressful, some of us have been there too. Don’t worry; we’re here to help you figure things out.

Step#1: Contact Your Existing Lender and Discuss Early Settlement

Always contact your existing lender before doing anything else.

Ask them how much it will cost to pay off your current loan. Some lenders apply early settlement charges (up to 2 months’ interest). Make sure you find out if this applies to you. The full debt, including early settlement charges (if applicable), is called the settlement figure and is what you need to borrow for your new loan.

If you don’t know already, ask exactly what your monthly repayments will be and the loan duration. These two figures are necessary if you want to use the Loan Switching Calculator below or our Loan Total Repayment Amount Calculator.

Be Aware!

Loans taken out before June 2005 often came with hidden penalties for early repayment due to the outdated Rule of 78 interest calculations. This formula uses your money to pay off the interest. Speak to your lender if this applies to you.

Nowadays, when you take out a loan, you can still be hit with an early repayment fee. However, this penalty fee shouldn’t cost you more than two months’ interest. The total amount depends on your loan’s duration and how much of the current debt you are paying off.

Impact of Credit Score on Loan Approval

A person’s credit score lets lenders know how reliable they are with their money. The lower your credit score, the worse your creditworthiness is perceived by creditors. This 3-digit number helps lenders gauge how risky you are as a borrower, and it will impact whether or not they lend you money.

I’ve compiled some useful information about credit scores and how you can improve yours.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

Step #2: Find Out If You Can Save

Once you have all the details from the old and new loans, plug them into the Loan Switching Calculator. Some people find that they can save by getting a new loan and using the cash from it to pay off their old debt.

Note: When using the Loan Switching Calculator, the system will assume the duration of the new loan will be the same as the remaining number of months of your old loan.

Understanding Loan Rates

Annual Percentage Rate (APR) refers to the total annual cost of borrowing. APR includes the standard fees and interest you must pay for the loan.

The representative APR rate is the rate advertised by lenders. This advertised rate is not given to everyone.

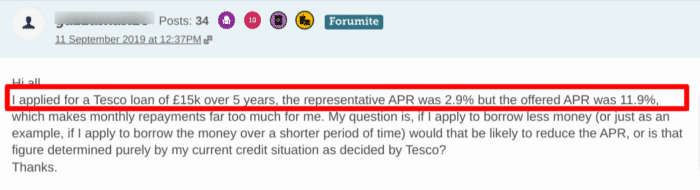

As you can see above, this MoneySavingExpert forum user applied for a loan, hoping to get the representative rate of 2.9%, but was offered an APR rate of 11.9%.

The representative APR rate is given to at least 51% of people accepted for the product, meaning that almost half of those approved for the credit deal may have to pay more.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Alternatives to Reducing Monthly Payments Without Loan Switching

Loan switching to reduce monthly loan repayments isn’t for even themselves falling into a cycle of continual switching while others inadvertently extend their loan term. If you don’t want to go, do negotiate. You can try negotiating new terms with your current lender.

You can also ask if you can make overpayments. Just make sure you don’t get hit with hidden charges for paying more.