Capitol Commercial Collections Debt – Do You Have to Pay?

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

For free & impartial money advice you can visit MoneyHelper. We work with The Debt Advice Service who provide information about your options. This isn’t a full fact-find, some debt solutions may not be suitable in all circumstances, ongoing fees might apply & your credit rating may be affected.

Have you received a letter from Capitol Commercial Collections about a debt? Are you unsure if you have to pay it? You have come to the right place. We understand that you may be worried, questioning if this is real and if you can afford to pay.

Each month, over 170,000 people visit our website for advice on situations just like this one, so you’re not alone. In this article, we will cover the following points to help you:

- Understanding who Capitol Commercial Collections are.

- Finding out why you are being contacted by them.

- Exploring if you can write off some of the debt.

- Discussing if you should pay the debt.

- Looking at the effects of not paying the debt.

We have dealt with debt collectors, including Capitol Commercial Collections, so we understand how you may be feeling. This experience helps us to give you the best advice.

Here’s how to handle this debt and hopefully put your mind at ease.

Why are you being contacted by Capitol Commercial Collections Debt Collectors?

There are so many people struggling financially that the debt collection business has become massive. Debt collectors like Capitol Commercial Collections will be found in various forms.

Understanding the debt collection processes should help make the situation less stressful.

Many debt collection agencies work as independent businesses; some could also be a business arm of a creditor such as a credit card company or a bank etc; there are even individual sole trader debt collectors.

The business model rarely differs, as they purchase debt at a small fraction of the face value, often for as little as 20% of the face value, and they make a profit by collecting the debt at (or close to) its full value. There are not many morals involved. They believe that you ran up the debt, so you need to take care of it, regardless of your situation. They care nothing about you and your personal circumstances. Simply put, they tend not to be nice people. The former Office for Fair Trading (OFT, 2010) acknowledged that such poor practices “appear to be widespread”.

» TAKE ACTION NOW: Fill out the short debt form

Should you pay the debt?

The first thing that you need to do is make sure that the debt is actually yours and that you are liable for it. Too many people skip the debt validation process. You don’t want to pay it off and then find out that it wasn’t yours in the first place!

I recommend writing to Capitol Collection and asking for evidence or proof that the debt is yours. You can do this with my free ‘prove it’ letter template. Capitol will then need to provide you with copies of documents that show you are the debtor.

You are under no obligation to pay for a debt that can’t be proven to be yours.

If Capitol has provided you proof that the debt is yours, you now have to pay it. Debt responsibility is like any other contract!

Statute-barred debts

Keep in mind that there are limitations on debt collection, even if the debt is 100% yours.

If it has been 6 years – or 5 years in Scotland – since you last paid towards your unsecured debts and you have not written to your creditor about your debt during this time, it is statute-barred.

This means that the debt is not enforceable. It still technically exists, and you still technically owe the money, but there is no legal way for you to be forced to pay or for the debt to be enforced.

Keep in mind that not all debts become statute-barred!

Any HMRC debts, for example, will stay enforceable for decades. Any debt that had a County Court Judgement (CCJ) attached to it during the 5 or 6-year window it will be enforceable for the duration of the CCJ.

If your debt is statute-barred, you can use my free letter template to write to Capitol Commercial and explain the situation.

If you are unsure about the status of your debt, you can contact a debt charity for some advice. Their advisors will be able to look at the debt in question, determine its status, and advise you on your next steps.

In these situations, I recommend phoning the debt collectors instead of writing as this will not reset the 5 or 6 year timer for your debt.

Are you able to pay and don’t want to?

If this is definitely your debt, then you should repay it, if possible, as this will get them off your back. If you cannot make payments to the debt, or if paying it would stop you from being able to afford your essential bills, including rent or mortgage, and put you in financial hardship, then you should reach an arrangement with Capitol Commercial Collections Debt Collectors.

You may even be able to make a partial payment and close the account.

How a debt solution could help

Some debt solutions can:

- Stop nasty calls from creditors

- Freeze interest and charges

- Reduce your monthly payments

A few debt solutions can even result in writing off some of your debt.

Here’s an example:

Situation

| Monthly income | £2,504 |

| Monthly expenses | £2,345 |

| Total debt | £32,049 |

Monthly debt repayments

| Before | £587 |

| After | £158 |

£429 reduction in monthly payments

If you want to learn what debt solutions are available to you, click the button below to get started.

What if I don’t pay Capitol Commercial?

If the debt is yours, but you still refuse to pay, you may be taken to court.

There are legal consequences of unpaid debt!

From my experience, people often wonder what will happen if they don’t pay because they don’t feel that they owe anything to the debt collectors. This is the wrong attitude to have!

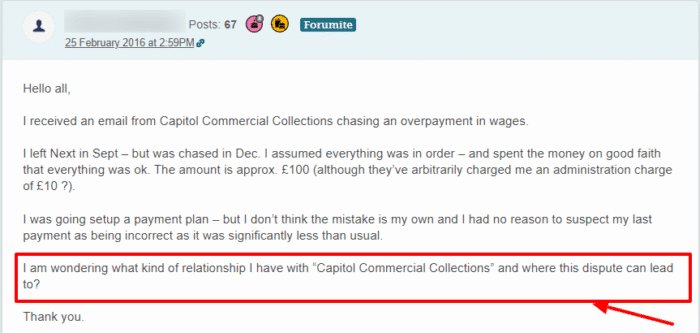

Take a look at this example.

This person’s debt was sold, which means she now owes money to Capitol Collections. This means her relationship with them is contractual – they need to pay. If they continue not to pay, this dispute can end up in court.

A County Court Judgement (CCJ) is an order from a judge that states you have to pay the debt. This means that the court agrees with your creditor, and you owe the money.

Your judgement will include the following:

- How much you owe

- How you should pay

- Who you should pay

- Your deadline to pay.

Unless you pay within one month of the CCJ being issued, it will be recorded in the Register of Judgements, Orders and Fines for 6 years. If you pay off your debt within these 6 years, you can request that your judgement is marked as ‘satisfied’ on the register.

To do this, write to the court with proof that you have paid off the debt in full.

If you manage to pay within one month of the CCJ being issued, the judgement will not be recorded in the register. You will need to write to the court explaining that you have paid and provide proof.

CCJs are also visible on your credit file for 6 years. This will make it almost impossible for you to get credit during this time.

This is because companies use your credit file to see if you are a ‘high-risk’ customer – someone who might have difficulty paying their bills on time. If you have a CCJ, you have had such trouble paying back your debt that someone had to go to court about it.

Understandably, companies are going to be reluctant to give you credit!

After 6 years, it is no longer visible on your credit report and you should find it easier to get credit again.

Can debt collection companies affect my credit score?

Yes, debt collectors can affect your credit score.

Once you have missed a few payments or defaulted on an account with your original creditor – which negatively impacts your credit score too – and your debt is sold to collectors, it will appear as a second collection account on your credit file and the original entry may be marked as ‘sold’ which doesn’t look good!

If they don’t add a second entry to your credit file, the entry for your original debt can be changed to add the debt collection company’s information.

These collection accounts will negatively impact your credit. They are visible for 6 years and will impact your ability to get credit or use some credit products during this time.

This is because companies use your credit file to see if you are a ‘high-risk’ customer – someone who might have difficulty paying their bills on time. If you have a CCJ, you have had such trouble paying back your debt that someone had to go to court about it.

Understandably, companies are going to be reluctant to give you credit!

After 6 years, it is no longer visible on your credit report, and you should find it easier to get credit again.

You also need to be aware that any debt solutions that you use will also be visible on your credit file for 6 years, and your credit score may be affected. However, once these 6 years are over, your debt solution will no longer be visible, and you may find it easier to get credit again.

Is there any way to write off your debt?

Can I get a debt solution?

If you are struggling to manage your unsecured debts or are being chased by Capitol Commercial Collections, you may want to consider a debt solution. Debt solutions can have an impact on your credit score, but the impacts of ignoring debt are much worse!

There are several different debt solutions available in the UK, so I recommend speaking to a debt charity as soon as possible. Their advisors will be able to look at your finances in detail and help you work out which debt solution will work best for you. They will also be able to improve your understanding of debt solutions and make sure that you understand what you are committing to.

I have linked a few charities that offer these advisory services for free above.

Debt Management Plan (DMP)

A DMP is an informal debt solution that lets you pay off your debts via a single monthly payment.

Because it is informal, it is not legally binding so you are not tied into a DMP for a minimum number of payments.

Individual Voluntary Arrangement (IVA)

An IVA is a formal agreement between you and your creditors. You agree to pay a monthly sum that is distributed amongst your debts, and your creditors agree not to contact you during your IVA.

IVAs typically last for 5 or 6 years, and any outstanding debt is wiped off when it ends.

Keep in mind that IVAs are not suitable for everyone. You need to owe several thousand pounds to more than one creditor to be eligible. You also need to demonstrate that you have some disposable income every month.

Trust Deed

IVAs are not available in Scotland. Instead, you will need to opt for a Trust Deed.

Trust Deeds work in the same way as an IVA – you pay an agreed sum each month that is shared amongst your creditors, they can’t contact you, and any leftover debt at the end of your Trust Deed term is written off.

Debt Relief Order (DRO)

A DRO is a good option for those facing financial hardship with no assets and little income.

For 12 months, you make no payments, but your creditors freeze your interest and don’t contact you.

If your finances haven’t improved during this year, you may be able to write off your unsecured debts.

Bankruptcy

If you have debts but no realistic possibility of ever paying them off, you may need to declare bankruptcy.

Bankruptcy has an unfair stigma attached to it as it may be your only way of getting a financial fresh start. That said, it is a serious financial situation that should not be taken lightly.

Sequestration

Sequestration is the Scottish version of bankruptcy.If you have little income and no valuable assets, you may be able to apply for a minimal asset process bankruptcy (MAP). A MAP is a quicker, cheaper, and more straightforward version of sequestration, so worth considering.

Thousands have already tackled their debt

Every day our partners, The Debt Advice Service, help people find out whether they can lower their repayments and finally tackle or write off some of their debt.

Natasha

I’d recommend this firm to anyone struggling with debt – my mind has been put to rest, all is getting sorted.

Reviews shown are for The Debt Advice Service.

Capitol Commercial Collections Contact Details

| Address: | Capitol House St. Mary’s Road, Watford Herts WD18 0RR |

| Website: | https://www.capitol.uk.com/ |

| Telephone: | 01923 253100 |

| Email: | [email protected] |

How do I complain about Capitol Commerical?

If you think that Capitol Commercial Collections has been unreasonable or behaved inappropriately, you can make a complaint. You can also make a complaint if you feel that they have broken any of the Financial Conduct Authority’s (FCA) guidelines.

Make your first complaint to Capitol Commerical so that they have the chance to sort out the issue themselves. If you feel that they have not taken your complaint seriously enough or have not addressed your issue properly, you can escalate matters.

You can make any secondary complaint to the Financial Ombudsman Service (FOS). They will investigate and, if your complaint is upheld, Capitol Commercial may be fined. You could even be owed compensation.

FAQs

Will my debt go away if I ignore debt collectors?

The debt won’t go away if you ignore debt collectors. In fact, the debt collectors may send doorstep agents to your home. It is not a good idea to ignore debt collectors, even if you are unable to repay the debt at that time.

Are Capitol Commercial Collections able to take you to court?

Yes, Capitol Commercial Collections have the ability to take you to court as a result of the debt. If they plan to take you to court, they will issue you with a County Court Judgement – also referred to as a CCJ.

Will you end up in jail for debt collections?

You don’t need to worry about being sent to jail for the debt you owe, this won’t happen!

Will anything happen if I ignore a CCJ?

If you decide to just ignore the CCJ altogether, you may end up with bailiffs being sent to your home. They may end up taking some of your possessions as payment for the debt, if you refuse to pay up.

Are Capitol Commercial Collections able to issue you with a warrant?

Capitol Commercial Collections do not have the legal right to issue you with an arrest warrant. They can, however, request a CCJ against you, and if this is successful, you may end up with bailiffs at your door to take items as payment for the debt.

Do Capitol Commercial Collections also operate as bailiffs?

They may say they are but no,Capitol Commercial Collections are not bailiffs and they cannot act like one! They may request bailiffs to be sent to your door, but they cannot do this of their own accord. If they are planning to do this, warning letters will be sent to you.

Are Capitol Commercial Collections allowed to come to your property?

They could come to your property, but they won’t be able to do anything! They don’t have any legal powers. Therefore, a trip to your home will be a bit of a waste of time on their part! If they do come to your home, you have the right to turn them away.

What if Capitol Commercial Collections force entry?

Capitol Commercial Collections are not permitted to force entry into your property, as they do not have any legal rights. The exception to this would be if they get bailiffs to visit your property.

Are Capitol Commercial Collections likely to give up?

You can be sure of one thing and that is that Capitol Commercial Collections will not give up trying to get this debt from you. They will realistically keep chasing you for 6 years!

Can a debt be too old to collect?

Capitol Commercial Collections won’t give up chasing you for the debt until they’ve exhausted all of their legal options. This usually means being chased for up to 6 years.

What is the expiry on this debt?

According to the the Limitation Act 1980, debt collectors can keep trying to get the debt for 6 years. The 6 years begins from the last time you paid anything towards your account, or in some way acknowledged you have this debt.

Can my debt be written off?

You may be chased for 6 years about the debt and then it would be written off. However, this doesn’t apply if you have a CCJ against you for the debt. In this case, there is no limit. Another way you can get at least some of the debt written off is by signing up to an IVA.

Checking for Other Debt Collectors

There are a lot of ways to get into debt. In fact, it’s not uncommon to owe money to several companies at once.

Perhaps you have a mortgage, a car loan, a couple credit cards and an item or two you bought on buy-now-pay-later schemes. It’s easy to lose track.

That’s why it’s important to regularly check your credit report and bank statements to make sure you haven’t missed anything.

If a debt collector has purchased your debt, it appears on your credit report.

Some of the debt collectors you’re most likely to come across are PRA Group, Lowell and Cabot Financial.

References

CONC 7.9 Contact with customers